The Clean Energy Tax Debate: Shaping America's Economic Landscape

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

The Clean Energy Tax Debate: Shaping America's Economic Landscape

America stands at a crossroads. The urgent need to combat climate change clashes with economic realities, sparking a fiery debate surrounding clean energy tax policies. These policies, intended to accelerate the transition to a sustainable future, are shaping the nation's economic landscape in profound ways, impacting jobs, investment, and the overall competitiveness of the US economy.

The Core of the Controversy: Tax Credits, Incentives, and their Impact

The heart of the debate lies in the effectiveness and fairness of various tax incentives designed to boost clean energy development. These include tax credits for renewable energy projects like solar and wind farms, investments in energy efficiency upgrades, and the production of electric vehicles (EVs).

Proponents argue these tax credits are crucial for jumpstarting a green economy. They cite studies showing significant job creation potential in sectors like solar panel manufacturing, wind turbine installation, and the broader EV supply chain. The argument is that these incentives level the playing field, making clean energy technologies more competitive with fossil fuels, which historically have benefited from substantial government subsidies. Furthermore, they highlight the long-term economic benefits of reducing carbon emissions, including mitigating the costs associated with climate change impacts like extreme weather events and rising sea levels.

Concerns and Counterarguments: Economic Burden and Potential Drawbacks

Critics, however, raise concerns about the economic burden of these tax incentives. They question the cost-effectiveness of certain programs, arguing that some subsidies disproportionately benefit wealthy landowners or corporations, rather than genuinely promoting widespread adoption of clean energy. Concerns also exist about the potential for market distortions, where tax credits might artificially inflate prices or create an overreliance on government support rather than fostering genuine market-driven innovation. Some opponents also point to potential job losses in the traditional fossil fuel sector, demanding a just transition plan to protect workers and communities affected by the shift away from fossil fuels.

H2: Navigating the Political Landscape: Bipartisan Efforts and Divisions

The debate isn't confined to economic arguments; it's deeply intertwined with political ideology. While there's growing bipartisan support for addressing climate change, significant disagreements persist on the best approach. Some Republicans advocate for market-based solutions like carbon pricing, while many Democrats favor more direct government intervention through tax credits and regulations. This partisan divide often leads to legislative gridlock, hindering the implementation of comprehensive and effective clean energy policies.

H3: The Future of Clean Energy Tax Policy in America

The future of clean energy tax policy will likely involve a delicate balancing act. Finding policies that are both economically sound and environmentally effective will require careful consideration of several factors:

- Targeting Efficiency: Designing tax incentives that specifically target the most impactful clean energy technologies and avoid unnecessary subsidies.

- Fairness and Equity: Ensuring that the benefits of clean energy policies are distributed fairly across different income groups and communities.

- International Competitiveness: Avoiding policies that put American businesses at a disadvantage compared to their global competitors.

- Technological Innovation: Supporting research and development to drive innovation in clean energy technologies.

- Just Transition Initiatives: Providing support for workers and communities affected by the transition away from fossil fuels.

Conclusion: A Path Forward

The clean energy tax debate is far from over. However, finding common ground and crafting effective policies is crucial for both environmental sustainability and economic prosperity. Open dialogue, data-driven analysis, and a commitment to finding equitable solutions are vital to navigating this complex challenge and shaping a brighter, more sustainable future for America. Further research and public discourse are needed to ensure that future policies balance environmental goals with economic realities, creating a truly sustainable and prosperous energy future for all Americans. Learning more about the specific proposals currently being debated is a crucial step in engaging with this critical issue. [Link to relevant government website or policy resource].

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on The Clean Energy Tax Debate: Shaping America's Economic Landscape. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

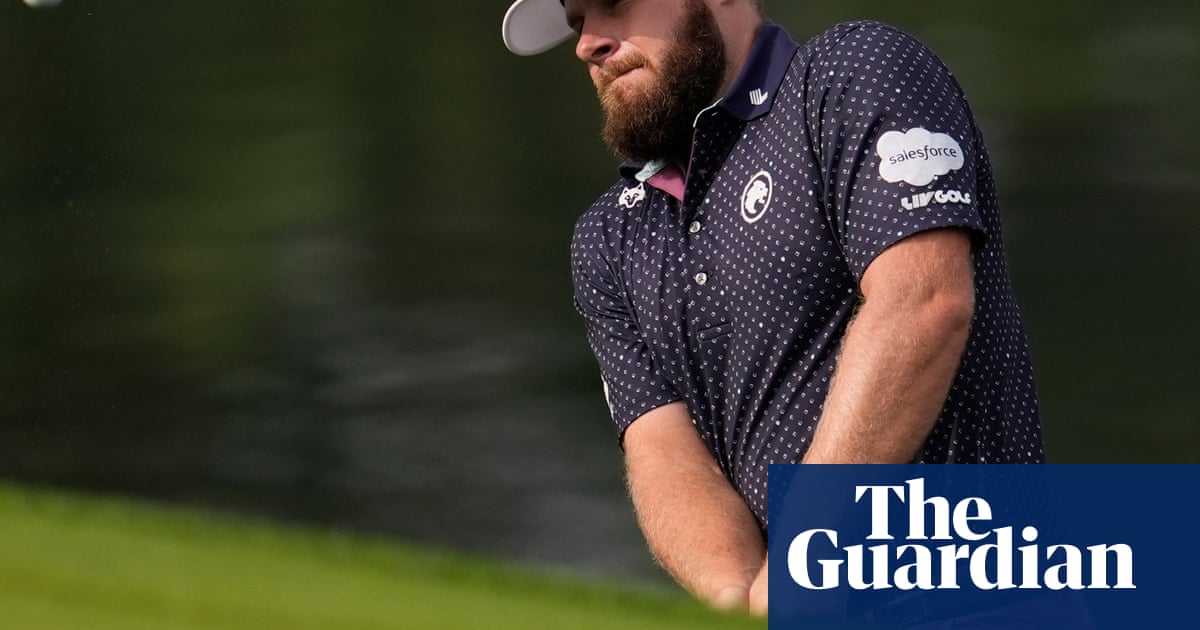

From Forgotten Star To 63 Million Liv Golfs Top Earners Incredible Comeback

May 17, 2025

From Forgotten Star To 63 Million Liv Golfs Top Earners Incredible Comeback

May 17, 2025 -

Can Sam English Lead Syracuse Mens Lacrosse To A Second Final Four Appearance

May 17, 2025

Can Sam English Lead Syracuse Mens Lacrosse To A Second Final Four Appearance

May 17, 2025 -

Us Pga Hattons Outburst Could Result In Significant Fine

May 17, 2025

Us Pga Hattons Outburst Could Result In Significant Fine

May 17, 2025 -

Rising Temperatures Rising Risks The Impact Of Climate Change On Pregnancy

May 17, 2025

Rising Temperatures Rising Risks The Impact Of Climate Change On Pregnancy

May 17, 2025 -

Pga Championship 2024 Jon Rahms Path To Potential Win

May 17, 2025

Pga Championship 2024 Jon Rahms Path To Potential Win

May 17, 2025