The Clean Energy Tax Debate: Shaping America's Economic Future

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

The Clean Energy Tax Debate: Shaping America's Economic Future

The debate surrounding clean energy tax credits and incentives is heating up, shaping not only America's environmental trajectory but also its economic future. This isn't just about solar panels and wind turbines; it's a complex discussion with far-reaching consequences for jobs, investment, and national competitiveness. Understanding the nuances of this debate is crucial for anyone interested in the future of the American economy.

The Current Landscape: A Patchwork of Incentives

Currently, the US employs a variety of tax credits and incentives to promote clean energy development. These range from the Investment Tax Credit (ITC) for solar, wind, and other renewable energy technologies, to production tax credits for renewable energy sources like wind and geothermal. These incentives have played a significant role in the growth of the renewable energy sector, driving down costs and creating jobs. However, the current system is often criticized for being fragmented and inconsistent, leading to uncertainty for investors and hindering long-term planning.

Arguments for Expanding Clean Energy Tax Credits:

Proponents of expanding clean energy tax incentives argue that they are essential for achieving climate goals and fostering economic growth. They highlight the following key benefits:

-

Job Creation: The clean energy sector is a significant job creator, offering opportunities in manufacturing, installation, maintenance, and research. Expanding tax credits would accelerate job growth in this burgeoning sector. A recent report by the [link to credible report, e.g., E2 or SEIA] highlighted the substantial job creation potential in renewable energy.

-

Technological Advancement: Incentives drive innovation by encouraging investment in research and development of new clean energy technologies. This leads to greater efficiency, lower costs, and a wider range of options for consumers.

-

Energy Independence: Reducing reliance on fossil fuels through increased clean energy adoption enhances national energy security and reduces vulnerability to global price fluctuations.

-

Economic Competitiveness: Investing in clean energy positions the US as a leader in a rapidly growing global market, attracting investment and creating high-skilled jobs.

Arguments Against Expanding Clean Energy Tax Credits:

Opponents of expanding clean energy tax incentives raise concerns about:

-

Cost to Taxpayers: Providing substantial tax credits can be expensive, potentially adding to the national debt or requiring cuts in other areas of the budget. This argument often focuses on the allocation of scarce public resources.

-

Market Distortion: Some argue that tax incentives distort the market, unfairly favoring certain technologies over others and potentially hindering free market competition.

-

Inefficiency: Critics sometimes question the efficiency of government intervention, suggesting that the market could drive clean energy adoption without excessive subsidies. This perspective often champions a laissez-faire approach.

The Way Forward: Finding a Balanced Approach

The debate over clean energy tax incentives isn't about choosing between environmental protection and economic growth; it's about finding the right balance. A well-designed system of tax incentives could stimulate economic growth while advancing climate goals. This requires careful consideration of:

-

Targeted Incentives: Focusing incentives on specific technologies or sectors that offer the greatest potential for job creation and emissions reduction.

-

Phased Reductions: Gradually reducing the level of incentives as technologies mature and become more cost-competitive.

-

Transparency and Accountability: Ensuring that tax credits are used effectively and transparently, with mechanisms in place to prevent fraud and abuse.

Conclusion: A Critical Investment in America's Future

The clean energy tax debate is a crucial discussion shaping America's economic future. Finding a balanced and effective approach to tax incentives is vital for fostering innovation, creating jobs, and ensuring a sustainable and prosperous future for all Americans. The conversation needs to move beyond partisan divides and focus on evidence-based policymaking that promotes both economic competitiveness and environmental stewardship. The time to act is now, as continued inaction risks jeopardizing America's leadership in the global clean energy market.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on The Clean Energy Tax Debate: Shaping America's Economic Future. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Birthright Citizenship On Trial Supreme Court Hears Key Case On Federal Jurisdiction

May 17, 2025

Birthright Citizenship On Trial Supreme Court Hears Key Case On Federal Jurisdiction

May 17, 2025 -

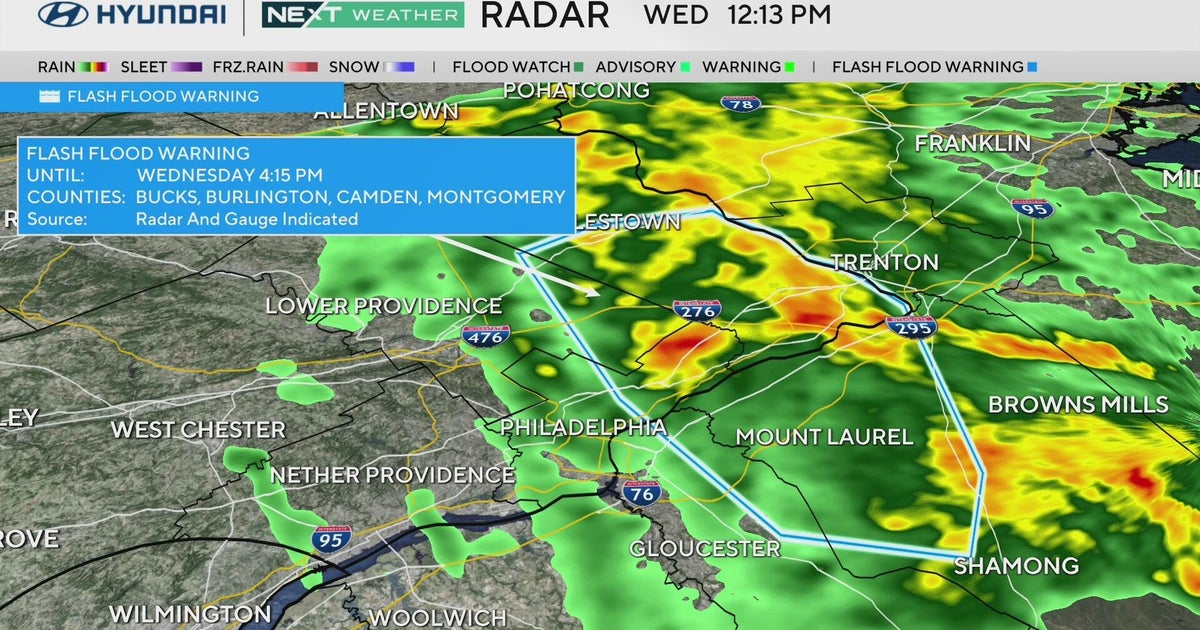

New Jersey And Pennsylvania Flash Flood Warning Heavy Rain Causes Emergency

May 17, 2025

New Jersey And Pennsylvania Flash Flood Warning Heavy Rain Causes Emergency

May 17, 2025 -

Ambiente Em Alvalade E Alcochete Novas Revelacoes Da Operacao Cnn

May 17, 2025

Ambiente Em Alvalade E Alcochete Novas Revelacoes Da Operacao Cnn

May 17, 2025 -

2025 Wnba How To Watch Liberty Vs Aces Without Cable

May 17, 2025

2025 Wnba How To Watch Liberty Vs Aces Without Cable

May 17, 2025 -

Was Peace Possible Examining Putins Missed Chance For Negotiation

May 17, 2025

Was Peace Possible Examining Putins Missed Chance For Negotiation

May 17, 2025