The Clean Energy Tax Debate: Jobs, Growth, And The Future Of American Energy

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

The Clean Energy Tax Debate: Jobs, Growth, and the Future of American Energy

The future of American energy is a hot topic, and at the heart of the debate lies the question of clean energy tax credits and incentives. Are they a vital engine for job creation and economic growth, or a costly government overreach hindering true market forces? This article delves into the complexities of this contentious issue, examining both sides of the argument and exploring the potential impact on the American economy and environment.

The Case for Clean Energy Tax Incentives:

Proponents argue that investing in clean energy through tax credits and incentives is crucial for several reasons:

-

Job Creation: The clean energy sector is a significant job creator. Tax incentives can accelerate growth in this sector, leading to the development of solar panel manufacturing plants, wind turbine assembly facilities, and numerous related businesses. A recent study by the National Renewable Energy Laboratory (NREL) [link to NREL study] highlights the substantial employment potential of the renewable energy industry.

-

Economic Growth: Investing in clean energy technologies fosters innovation and creates new markets. This stimulates economic growth, not just in the energy sector, but across related industries like manufacturing, construction, and technology. Furthermore, reducing reliance on fossil fuels enhances energy security, minimizing vulnerability to global price fluctuations.

-

Environmental Benefits: The most compelling argument centers around environmental sustainability. Transitioning to cleaner energy sources is essential to mitigating climate change and improving air quality. Tax incentives are seen as a necessary catalyst to accelerate this transition. The Environmental Protection Agency (EPA) [link to EPA page on climate change] provides comprehensive data on the environmental impacts of various energy sources.

The Counterarguments: Concerns and Criticisms

Opponents of expansive clean energy tax incentives raise several concerns:

-

Government Overreach: Some argue that government intervention distorts the market, picking winners and losers rather than allowing free market forces to determine the most efficient and cost-effective energy solutions. They suggest that subsidies create an unfair advantage for certain technologies, hindering innovation in potentially superior alternatives.

-

Cost to Taxpayers: The financial burden of these tax incentives is a significant concern. Critics question the long-term value for taxpayers, especially considering the potential for inefficiencies and waste in government spending. A thorough cost-benefit analysis is crucial to determine the true economic impact.

-

Potential for Inefficiency: The complexity of some tax credit programs can lead to inefficiencies and potential for fraud. Ensuring accountability and transparency is essential to maximize the effectiveness of these incentives and minimize waste.

Finding a Balance: Navigating the Path Forward

The debate over clean energy tax incentives is multifaceted and requires a nuanced approach. Finding a balance between promoting sustainable energy development and responsible fiscal policy is crucial. Several potential solutions are being explored:

-

Targeted Incentives: Focusing incentives on specific technologies with high growth potential and demonstrable environmental benefits can improve efficiency and minimize costs.

-

Streamlined Processes: Simplifying the application and approval processes for tax credits can reduce administrative burdens and improve transparency.

-

Independent Audits and Evaluations: Regular, independent audits and evaluations are necessary to assess the effectiveness of clean energy tax programs and identify areas for improvement.

Conclusion: A Critical Investment in the Future

The clean energy tax debate is not merely a discussion about dollars and cents; it's a debate about the future of American energy independence, economic competitiveness, and environmental stewardship. While valid concerns exist regarding cost and potential inefficiencies, the potential benefits of a robust clean energy sector – in terms of job creation, economic growth, and environmental protection – are undeniable. A carefully crafted, targeted approach to clean energy tax incentives is vital to ensuring a sustainable and prosperous future for the United States. The conversation must continue, focusing on finding pragmatic solutions that balance economic realities with the urgent need for a cleaner energy future.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on The Clean Energy Tax Debate: Jobs, Growth, And The Future Of American Energy. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

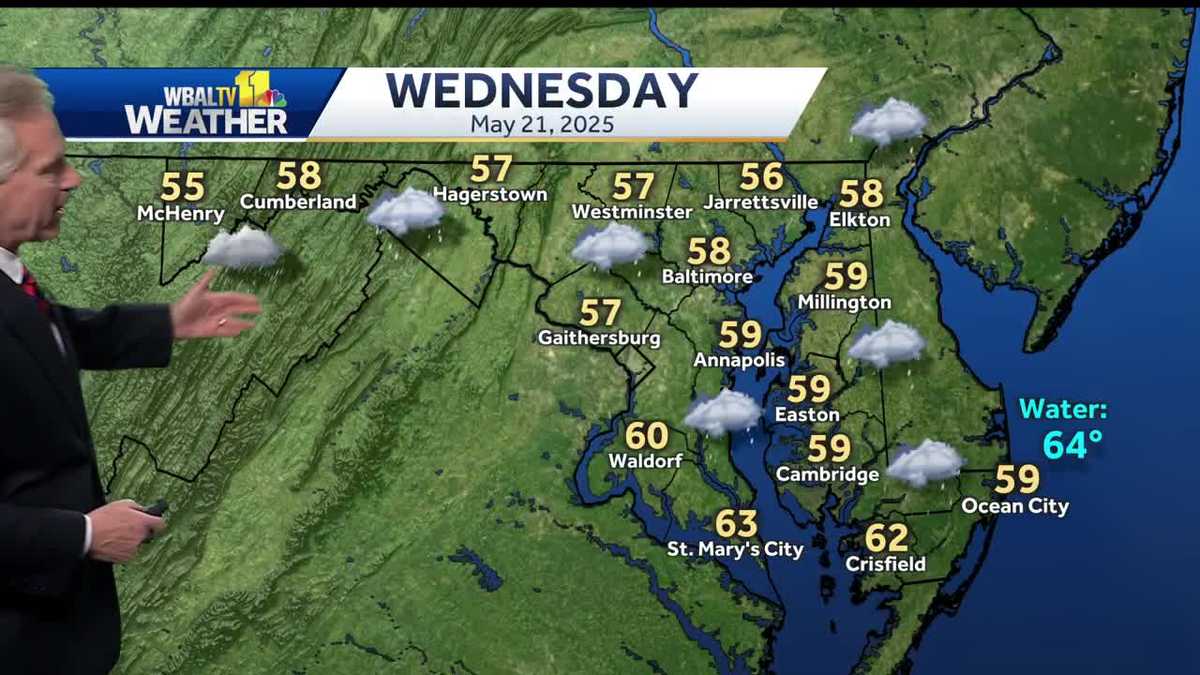

Rain And Chilly Temperatures Sweep Across Region Wednesday

May 21, 2025

Rain And Chilly Temperatures Sweep Across Region Wednesday

May 21, 2025 -

Heartbreak To Homecoming Ellen De Generes Moving Social Media Comeback

May 21, 2025

Heartbreak To Homecoming Ellen De Generes Moving Social Media Comeback

May 21, 2025 -

Helldivers 2 May 15th Master Of Ceremony Warbond Drop Incoming

May 21, 2025

Helldivers 2 May 15th Master Of Ceremony Warbond Drop Incoming

May 21, 2025 -

Bitcoin Etf Investment Surge Over 5 Billion Inflows Driven By Directional Bets

May 21, 2025

Bitcoin Etf Investment Surge Over 5 Billion Inflows Driven By Directional Bets

May 21, 2025 -

Taylor Jenkins Reid A Deep Dive Into Her Publishing Empire

May 21, 2025

Taylor Jenkins Reid A Deep Dive Into Her Publishing Empire

May 21, 2025