The Clean Energy Tax Debate: How Will It Reshape America's Economic Landscape?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

The Clean Energy Tax Debate: How Will it Reshape America's Economic Landscape?

The Inflation Reduction Act (IRA), signed into law in 2022, has injected billions of dollars into clean energy initiatives, sparking a vigorous debate about its impact on America's economic future. While proponents hail it as a crucial step towards a sustainable economy and energy independence, critics raise concerns about its potential downsides. This article delves into the heart of this contentious issue, examining the potential economic ramifications of the IRA's clean energy tax provisions.

H2: A Boon for Green Jobs and Innovation?

The IRA offers significant tax credits and incentives for renewable energy projects, including solar, wind, and geothermal. This has already led to a surge in investment and job creation within the clean energy sector. Companies are expanding operations, building new manufacturing facilities, and hiring skilled workers to meet the growing demand.

- Increased manufacturing: The incentives are driving the domestic production of solar panels, wind turbines, and batteries, reducing reliance on foreign imports and boosting American manufacturing.

- Job growth: From installation technicians to engineers and researchers, the clean energy sector is experiencing a rapid expansion of employment opportunities, particularly in previously underserved communities.

- Technological advancements: The influx of funding is fueling research and development, leading to innovations in battery technology, energy storage, and other crucial areas. This could place the US at the forefront of global clean energy technology.

H2: Concerns about Inflation and Economic Competitiveness

Despite the optimistic outlook, concerns remain. Critics argue that the substantial government spending could exacerbate inflation, potentially negating some of the positive economic impacts. Furthermore, some worry that the tax incentives might disproportionately benefit larger corporations, potentially hindering the growth of smaller, innovative companies.

- Inflationary pressures: The massive investment could lead to increased demand for resources and labor, potentially driving up prices. Careful monitoring and economic management are crucial to mitigate this risk.

- Competitiveness Concerns: Some argue that the tax incentives could disadvantage American companies competing in the global marketplace, particularly if other countries don't implement similar policies. A level playing field is essential for sustained economic growth.

- Equity and Access: Ensuring equitable access to clean energy benefits for all communities is a key challenge. Targeted programs and policies are needed to prevent exacerbating existing inequalities.

H2: Long-Term Economic Impacts: A Balancing Act

The long-term economic effects of the clean energy tax debate are complex and uncertain. The transition to a cleaner energy system will undoubtedly disrupt certain industries, leading to job losses in sectors reliant on fossil fuels. However, the creation of new, high-paying jobs in the renewable energy sector could offset these losses, creating a net positive effect on employment.

The success of the IRA's clean energy initiatives depends on several factors, including:

- Effective policy implementation: Clear guidelines and efficient administrative processes are essential to ensure the funds are used effectively.

- Technological advancements: Continuous innovation and improvements in clean energy technology are crucial for reducing costs and increasing efficiency.

- Global cooperation: International collaboration is necessary to address climate change and ensure a fair and competitive global energy market.

H2: The Road Ahead: Navigating Uncertainty

The clean energy tax debate is far from over. Ongoing analysis and evaluation of the IRA's impact are crucial to inform future policy decisions. Striking a balance between environmental sustainability and economic prosperity is a complex challenge requiring careful consideration of various economic factors and potential risks. The coming years will be critical in determining whether the IRA will truly reshape America's economic landscape for the better, fostering a sustainable and prosperous future. This requires ongoing public dialogue and engagement from all stakeholders. Learn more about the Inflation Reduction Act and its implications by visiting the (link to relevant section).

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on The Clean Energy Tax Debate: How Will It Reshape America's Economic Landscape?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

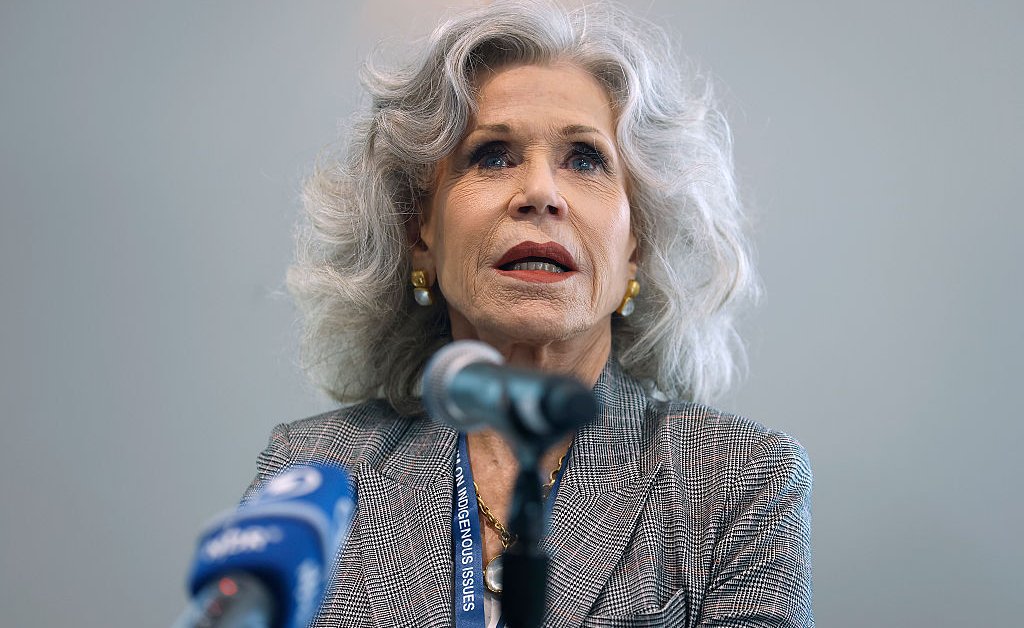

Ecuadors Rainforest Under Threat Jane Fondas Urgent Plea For Action

May 17, 2025

Ecuadors Rainforest Under Threat Jane Fondas Urgent Plea For Action

May 17, 2025 -

Iga Swiatek Overtaken Coco Gauffs Rise To A New Career High Ranking

May 17, 2025

Iga Swiatek Overtaken Coco Gauffs Rise To A New Career High Ranking

May 17, 2025 -

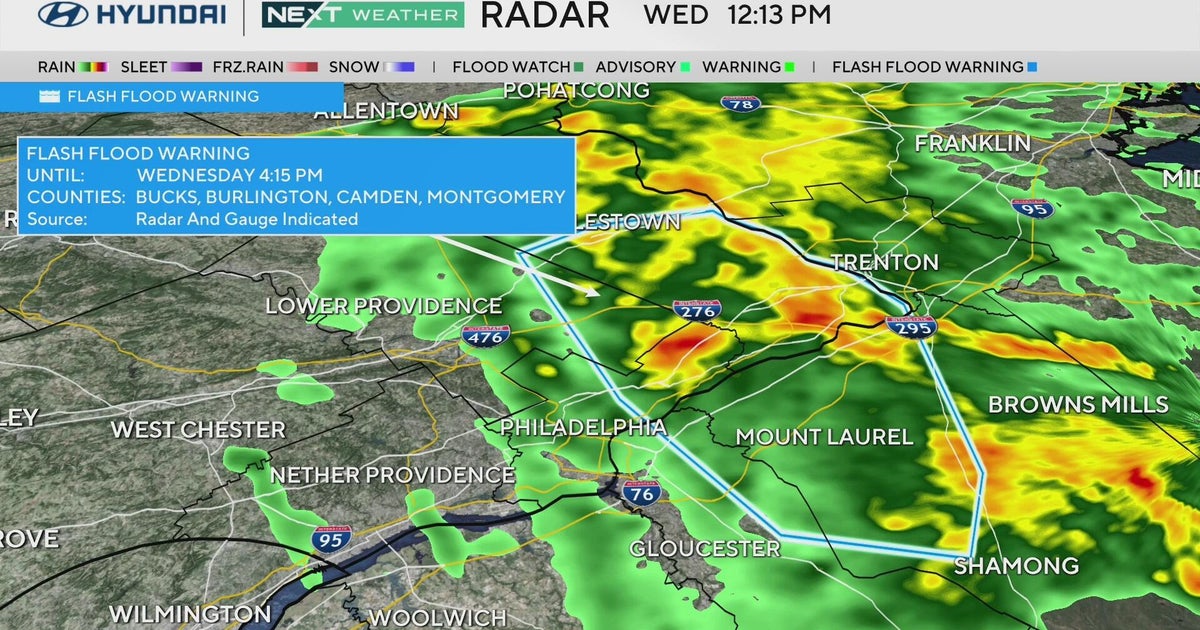

Heavy Rain Unleashes Flash Flood Warning Across New Jersey And Pennsylvania

May 17, 2025

Heavy Rain Unleashes Flash Flood Warning Across New Jersey And Pennsylvania

May 17, 2025 -

Last Chance Prime Tee Times Still Available For Booking

May 17, 2025

Last Chance Prime Tee Times Still Available For Booking

May 17, 2025 -

House Gop Hardliners Defy Trump Party In Key Vote

May 17, 2025

House Gop Hardliners Defy Trump Party In Key Vote

May 17, 2025