The Clean Energy Tax Debate: Economic Winners And Losers In The US

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

The Clean Energy Tax Debate: Economic Winners and Losers in the US

The Inflation Reduction Act (IRA), a landmark piece of legislation passed in 2022, has injected billions of dollars into the US clean energy sector. While hailed by proponents as a crucial step towards combating climate change and boosting economic growth, the IRA's impact is far from uniform, sparking a heated debate about its economic winners and losers. This article delves into the complexities of this debate, examining the sectors and regions poised to benefit, as well as those facing potential challenges.

Winners: The Green Energy Boom

The most obvious beneficiaries are companies involved in renewable energy production and deployment. The IRA offers substantial tax credits and incentives for:

- Solar power: Manufacturers of solar panels, installers, and developers are experiencing a surge in demand, leading to job creation and investment in domestic manufacturing. This is particularly true in states like California and Nevada, already strong players in the solar industry.

- Wind energy: Similar to solar, the wind energy sector is receiving a significant boost from tax credits, fostering expansion of wind farms and related infrastructure projects across the country. States with abundant wind resources, such as Texas and Iowa, are prime beneficiaries.

- Battery storage: With the increasing reliance on intermittent renewable energy sources, battery storage technology is critical. The IRA incentivizes the development and deployment of battery storage solutions, creating opportunities for both established and emerging companies.

- Electric vehicles (EVs): Tax credits for EV purchases and the expansion of charging infrastructure are driving growth in the electric vehicle market, creating jobs in manufacturing, sales, and servicing. This is a significant boost to states like Michigan and Tennessee, which are major automotive production hubs.

- Green manufacturing: The IRA promotes domestic manufacturing of clean energy technologies, creating jobs and reducing reliance on foreign imports. This includes components for solar panels, wind turbines, and batteries.

Losers: The Fossil Fuel Transition

While the clean energy sector thrives, the transition away from fossil fuels presents significant challenges for certain industries and regions:

- Coal and oil industries: The shift towards renewable energy inevitably reduces the demand for coal and oil, potentially leading to job losses in these sectors, particularly in states heavily reliant on fossil fuel production, like West Virginia and Wyoming. These regions face the daunting task of economic diversification and workforce retraining.

- Fossil fuel-related jobs: Beyond direct production, the decline in fossil fuel usage impacts related industries such as mining, transportation, and refining, potentially causing job displacement and economic hardship.

- Regions dependent on fossil fuels: Entire communities built around the fossil fuel industry face significant economic challenges. This requires proactive government support for retraining programs, infrastructure investments, and diversification initiatives.

The Economic Debate: Beyond the Numbers

The economic implications extend beyond immediate job creation and loss. The debate centers around several key aspects:

- Long-term economic growth: Proponents argue the IRA fosters long-term economic growth by creating high-paying jobs in a rapidly expanding sector and promoting technological innovation. Critics, however, point to the potential short-term economic disruptions and the costs associated with the transition.

- Regional disparities: The economic benefits are not evenly distributed across the country, creating concerns about widening regional inequalities. Targeted policies and investments are crucial to address these disparities.

- Global competitiveness: The IRA aims to strengthen US competitiveness in the global clean energy market. However, concerns remain about the potential impact on international trade relations and the risk of carbon leakage, where emissions are simply relocated to countries with less stringent environmental regulations.

Conclusion: Navigating a Complex Transition

The clean energy tax debate is multifaceted and complex. While the IRA promises significant economic benefits in the long run, careful management is necessary to mitigate the challenges faced by affected communities and industries. This requires a strategic approach that combines investment in clean energy technologies, workforce retraining programs, and support for regions undergoing economic transition. The success of the IRA hinges on navigating this complex landscape effectively, ensuring a just and equitable transition to a cleaner energy future for all Americans.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on The Clean Energy Tax Debate: Economic Winners And Losers In The US. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

High Stakes Matchup Big Red And Spiders Vie For Final Four Bid

May 17, 2025

High Stakes Matchup Big Red And Spiders Vie For Final Four Bid

May 17, 2025 -

Manchester United To Beat Chelsea Premier League Odds And Best Bets Analyzed

May 17, 2025

Manchester United To Beat Chelsea Premier League Odds And Best Bets Analyzed

May 17, 2025 -

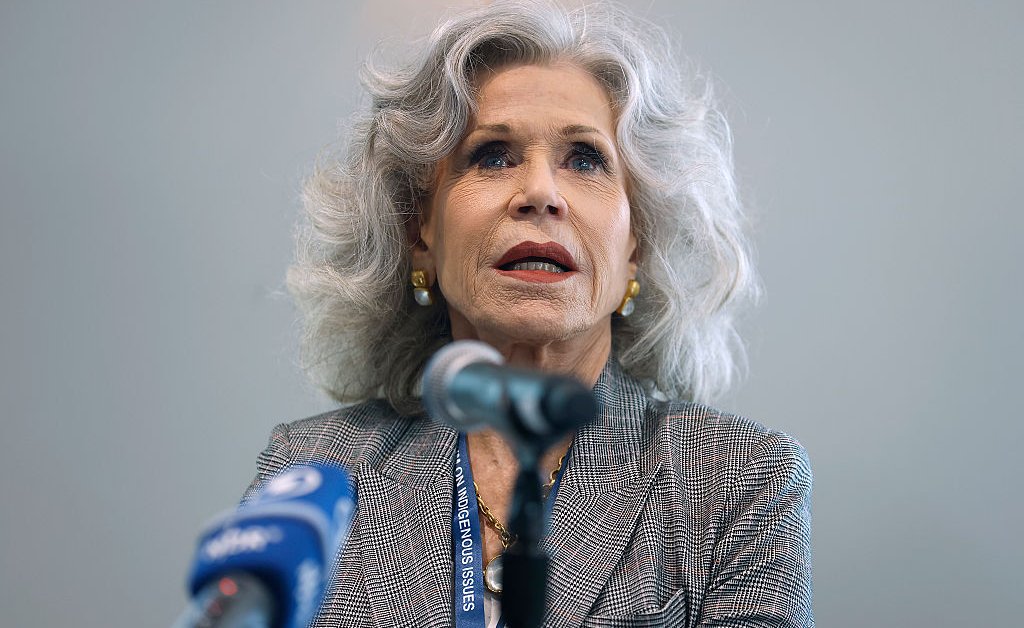

The Urgent Need For Rainforest Protection Jane Fondas Ecuador Project

May 17, 2025

The Urgent Need For Rainforest Protection Jane Fondas Ecuador Project

May 17, 2025 -

Key Defeat For Trumps Border Wall Bill House Vote Imminent

May 17, 2025

Key Defeat For Trumps Border Wall Bill House Vote Imminent

May 17, 2025 -

Liberty Celebrate 2024 Wnba Title Championship Rings Ceremony Before Las Vegas Game

May 17, 2025

Liberty Celebrate 2024 Wnba Title Championship Rings Ceremony Before Las Vegas Game

May 17, 2025