The Clean Energy Tax Debate: Economic Impacts And Policy Choices

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

The Clean Energy Tax Debate: Economic Impacts and Policy Choices

The transition to clean energy is a global imperative, but the path forward is fraught with economic and political complexities. A central point of contention lies in the role of taxation – specifically, how tax policies can incentivize clean energy adoption while mitigating potential negative economic impacts. This debate is far from settled, with significant implications for businesses, consumers, and the environment.

The Economic Landscape of Clean Energy Transition:

The shift away from fossil fuels presents both opportunities and challenges. While investments in renewable energy sources like solar and wind power create jobs and stimulate economic growth in certain sectors, it also necessitates significant changes in established industries. The potential job displacement in fossil fuel-dependent regions is a major concern, sparking heated debates about just transition strategies and retraining programs.

Tax Incentives: A Powerful Tool, but Not Without Drawbacks:

Tax credits, deductions, and other financial incentives are crucial tools for accelerating clean energy adoption. They can make renewable energy technologies more competitive, attracting investment and driving innovation. For example, the Investment Tax Credit (ITC) in the United States has significantly boosted the solar industry. However, the design and implementation of these incentives are critical. Inefficiently designed programs can lead to wasteful spending or disproportionately benefit large corporations rather than smaller businesses and communities.

The Debate: Weighing Costs and Benefits:

The central argument revolves around the optimal balance between incentivizing clean energy and minimizing economic disruption. Critics of aggressive tax policies argue that they impose undue burdens on businesses and consumers, potentially hindering economic growth. They point to increased energy costs and potential inflationary pressures.

Conversely, proponents argue that the long-term economic benefits of a clean energy transition – reduced healthcare costs associated with air pollution, increased energy security, and the creation of high-skilled jobs in emerging technologies – far outweigh the short-term costs. They emphasize the need for proactive policies to mitigate the negative impacts on affected workers and communities.

Policy Choices: Navigating the Complexities:

Several policy choices are at the heart of the debate:

- Carbon Pricing: Implementing a carbon tax or cap-and-trade system internalizes the environmental cost of carbon emissions, making clean energy more competitive. However, concerns about regressive impacts on low-income households require careful consideration of revenue recycling mechanisms.

- Targeted Subsidies: Providing direct financial support to specific clean energy technologies can accelerate their deployment, but careful evaluation is needed to avoid market distortions and ensure the long-term viability of supported industries.

- Investment in Infrastructure: Significant investment in renewable energy infrastructure (transmission lines, smart grids) is essential for a successful transition. Tax policies can play a key role in attracting private investment and facilitating public-private partnerships.

- Just Transition Policies: Addressing the economic and social impacts on workers and communities affected by the decline of fossil fuel industries is crucial for building public support for the clean energy transition. This includes retraining programs, job creation initiatives, and economic diversification strategies.

The Path Forward:

The clean energy tax debate is far from resolved. Finding the right balance between economic growth, environmental protection, and social equity requires careful consideration of various policy options. A nuanced approach, combining targeted incentives, effective carbon pricing mechanisms, and robust just transition policies, will be essential for creating a sustainable and prosperous future powered by clean energy. Further research and open dialogue are vital to inform effective policy decisions and ensure a smooth transition to a cleaner, more sustainable economy.

Learn More:

This article aims to provide comprehensive information and encourage further exploration of this critical issue. We encourage readers to engage in informed discussions and advocate for policies that promote a sustainable and equitable energy future.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on The Clean Energy Tax Debate: Economic Impacts And Policy Choices. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Jamie Lee Curtis Defends Lindsay Lohan A Longstanding Friendship Revealed

May 20, 2025

Jamie Lee Curtis Defends Lindsay Lohan A Longstanding Friendship Revealed

May 20, 2025 -

Putins Calculated Move Underscoring Trumps Diminished Influence

May 20, 2025

Putins Calculated Move Underscoring Trumps Diminished Influence

May 20, 2025 -

Are We Prepared Nasas Urgent Warning On Solar Flares And Blackouts

May 20, 2025

Are We Prepared Nasas Urgent Warning On Solar Flares And Blackouts

May 20, 2025 -

Untold Brett Favre A J Perez Discusses Intimidation And Documentary Fallout

May 20, 2025

Untold Brett Favre A J Perez Discusses Intimidation And Documentary Fallout

May 20, 2025 -

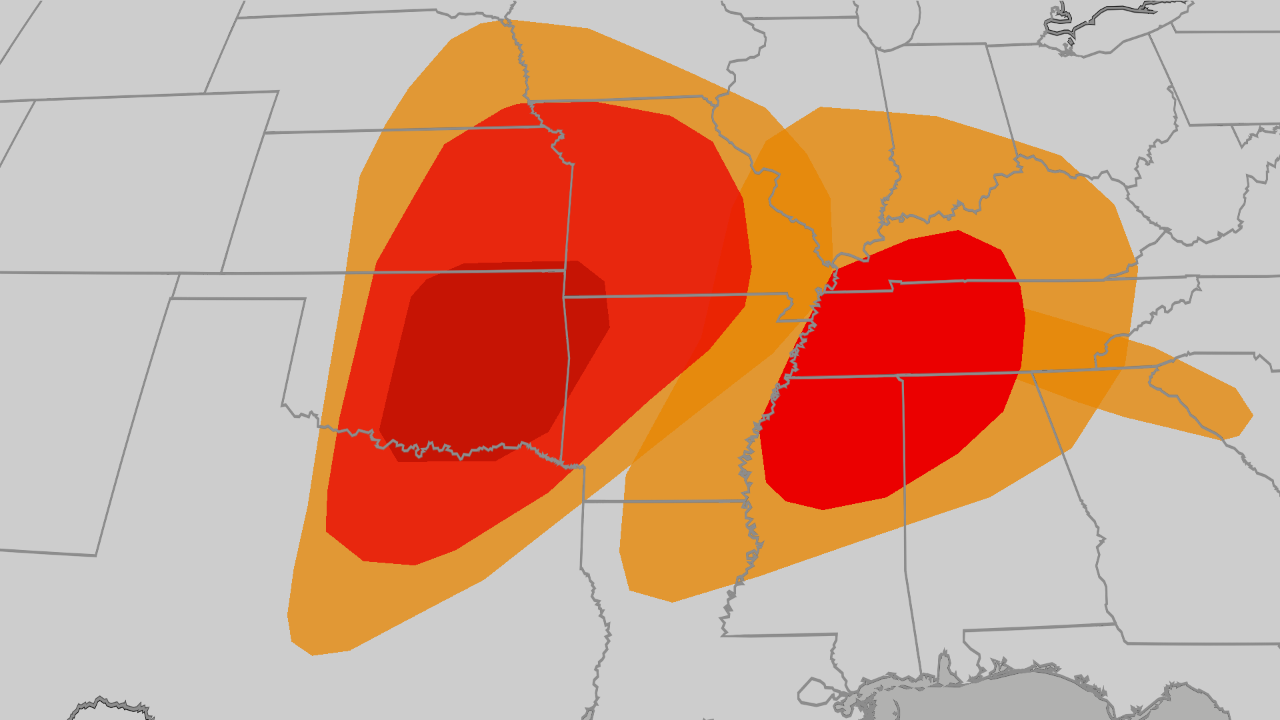

Powerful Storms And Tornado Threat Plains Midwest And South Brace For Severe Weather

May 20, 2025

Powerful Storms And Tornado Threat Plains Midwest And South Brace For Severe Weather

May 20, 2025