The Clean Energy Tax Debate: Analyzing The Economic Pros And Cons For America

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

The Clean Energy Tax Debate: Analyzing the Economic Pros and Cons for America

America stands at a crossroads, grappling with the economic implications of transitioning to clean energy. The debate surrounding clean energy tax credits and incentives is fierce, pitting proponents who champion economic growth and environmental protection against skeptics who raise concerns about costs and potential downsides. Understanding both sides is crucial for navigating this complex issue and shaping a sustainable energy future for the nation.

The Allure of Clean Energy Tax Credits: Fueling Economic Growth?

Proponents argue that investing in clean energy through tax credits and incentives isn't just environmentally responsible; it's economically savvy. The argument centers around several key pillars:

-

Job Creation: The clean energy sector is a significant job creator. Tax credits incentivize the development of renewable energy technologies like solar, wind, and geothermal, leading to a surge in manufacturing, installation, and maintenance jobs. This translates to increased employment opportunities across various skill levels, boosting local economies and reducing unemployment rates. A recent study by [link to reputable study on job creation in clean energy] highlights the substantial job creation potential of the sector.

-

Technological Innovation: Tax incentives foster innovation by encouraging research and development in clean energy technologies. This competition drives down costs, making renewable energy sources more competitive with fossil fuels. Furthermore, it positions the US at the forefront of a global green technology revolution, attracting investment and establishing a competitive advantage in the burgeoning international clean energy market.

-

Energy Independence: Reducing reliance on foreign oil and gas through domestic clean energy production enhances national security and strengthens economic resilience. This independence lessens vulnerability to global energy price fluctuations and geopolitical instability. A diversified energy portfolio, fueled by clean energy investments, provides greater stability and predictability for businesses and consumers alike.

-

Reduced Healthcare Costs: The transition to clean energy promises significant public health benefits by reducing air and water pollution. The resulting decrease in respiratory illnesses and other pollution-related health problems translates to lower healthcare costs for individuals and the government. [link to a credible source supporting this claim].

The Counterarguments: Weighing the Economic Costs

However, critics raise legitimate concerns about the economic implications of clean energy tax incentives:

-

Increased Energy Costs: While the long-term goal is to lower energy costs through innovation, the upfront investments in clean energy infrastructure can lead to increased electricity prices in the short term. This can disproportionately impact low-income households and businesses with limited budgets.

-

Government Spending: Tax credits and subsidies require significant government spending, potentially diverting resources from other critical areas like education, infrastructure, or healthcare. Finding a balance between clean energy investment and other essential public services is a crucial challenge.

-

Potential Job Losses in Fossil Fuel Industries: The transition away from fossil fuels could lead to job losses in traditional energy sectors, requiring significant retraining and workforce adaptation programs to mitigate the impact on affected communities. This necessitates proactive policies to support workers transitioning to new careers within the clean energy sector.

-

Geographic Disparities: The benefits of clean energy investments might not be evenly distributed across the country, potentially exacerbating existing economic inequalities between regions. Strategic planning and targeted policies are needed to ensure equitable access to clean energy jobs and benefits.

Navigating the Path Forward: A Balanced Approach

The clean energy tax debate is far from settled. Finding a balanced approach that maximizes the economic benefits while mitigating potential downsides requires careful consideration and collaboration. This includes:

-

Targeted Incentives: Focusing tax incentives on the most promising clean energy technologies and regions can maximize their effectiveness and minimize wasteful spending.

-

Investing in Workforce Development: Significant investment in retraining programs for workers displaced from the fossil fuel industry is crucial for a just transition to a clean energy economy.

-

Addressing Geographic Disparities: Policies aimed at ensuring equitable access to clean energy jobs and benefits across different regions are necessary for inclusive growth.

-

Transparency and Accountability: Regular evaluation and monitoring of clean energy programs are essential to assess their effectiveness and make necessary adjustments.

The future of America's energy landscape and economy hinges on navigating this complex debate effectively. A well-informed and balanced approach is critical for creating a sustainable, prosperous, and environmentally responsible future.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on The Clean Energy Tax Debate: Analyzing The Economic Pros And Cons For America. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Nick Sirianni Remains Eagles Head Coach With New Contract

May 20, 2025

Nick Sirianni Remains Eagles Head Coach With New Contract

May 20, 2025 -

Trumps Tariff Rhetoric Walmart Responds With Price Hike Warning

May 20, 2025

Trumps Tariff Rhetoric Walmart Responds With Price Hike Warning

May 20, 2025 -

Stricter Rules For Tourists In Bali Addressing Misconduct And Protecting The Island

May 20, 2025

Stricter Rules For Tourists In Bali Addressing Misconduct And Protecting The Island

May 20, 2025 -

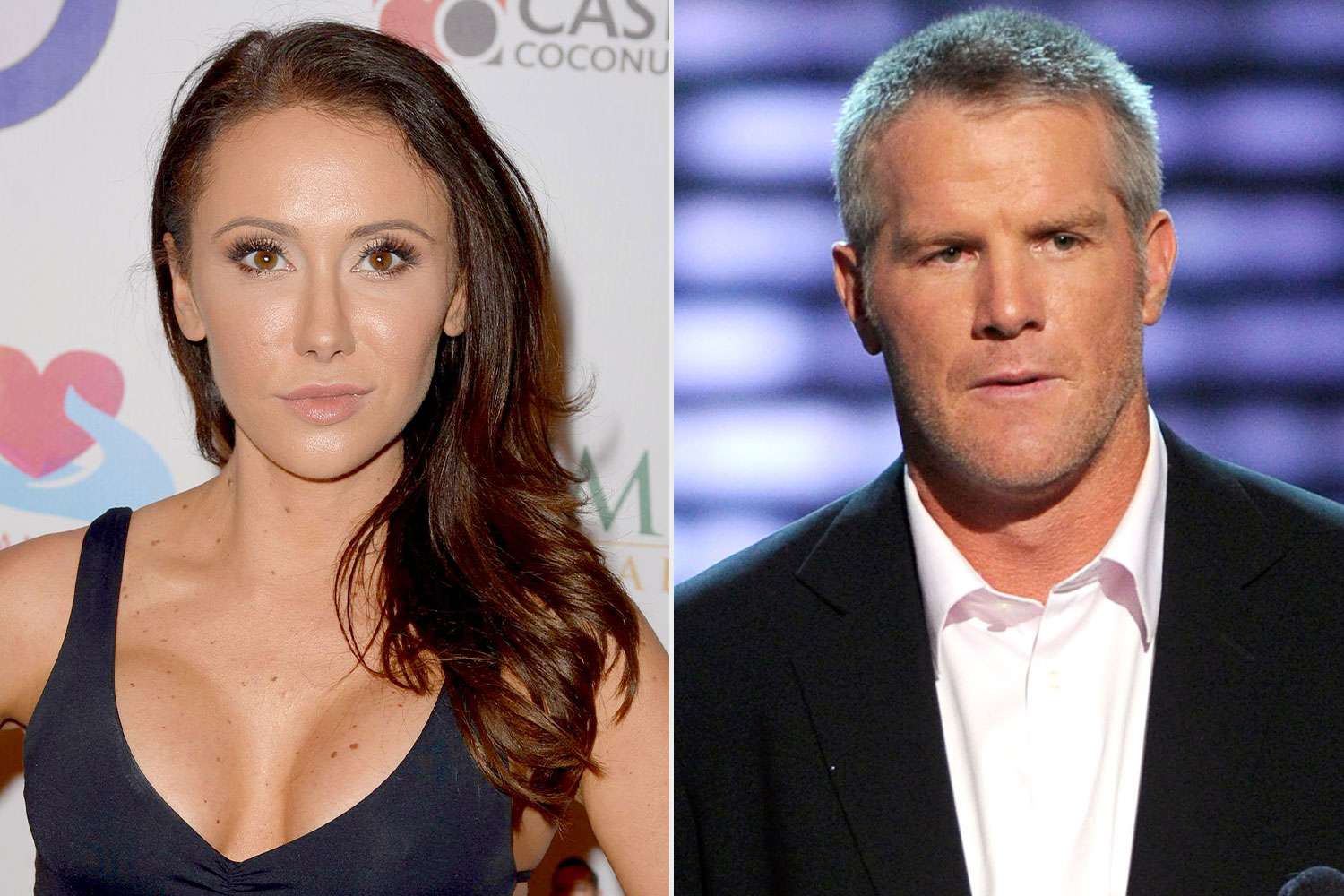

Jenn Sterger Reflects On The Brett Favre Scandal A Story Of Betrayal And Disrespect

May 20, 2025

Jenn Sterger Reflects On The Brett Favre Scandal A Story Of Betrayal And Disrespect

May 20, 2025 -

Watch Now Intense Wwi Movie Starring Daniel Craig Cillian Murphy And Tom Hardy

May 20, 2025

Watch Now Intense Wwi Movie Starring Daniel Craig Cillian Murphy And Tom Hardy

May 20, 2025