The Clean Energy Tax Debate: Analyzing The Economic Implications For America

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

The Clean Energy Tax Debate: Analyzing the Economic Implications for America

The debate surrounding clean energy tax credits and incentives is heating up, sparking discussions about their economic impact on the United States. Are these policies a boon for the economy, fostering innovation and job growth, or do they represent an undue burden on taxpayers and hinder overall economic progress? Let's delve into the complexities of this crucial discussion.

The Arguments in Favor of Clean Energy Tax Credits:

Proponents argue that investing in clean energy through tax incentives is essential for several key reasons:

-

Job Creation: The clean energy sector is a significant job creator. Tax credits stimulate investment in renewable energy sources like solar, wind, and geothermal, leading to the creation of manufacturing jobs, installation jobs, and maintenance jobs. A study by the National Renewable Energy Laboratory (NREL) [link to NREL study if available] highlights the substantial employment potential within this sector.

-

Economic Growth: Investment in clean energy infrastructure fuels economic growth. This includes not only the direct jobs created but also the indirect effects on related industries, such as construction and manufacturing. Furthermore, a transition to cleaner energy sources reduces reliance on volatile fossil fuel markets, enhancing energy security and price stability.

-

Technological Innovation: Tax credits incentivize research and development in clean energy technologies. This fosters innovation, leading to more efficient and cost-effective renewable energy solutions, ultimately benefiting consumers and businesses.

-

Environmental Benefits: While not strictly an economic argument, the environmental benefits of transitioning to clean energy are undeniably linked to long-term economic stability. Reduced pollution and the mitigation of climate change prevent costly future damages from extreme weather events and environmental degradation.

The Counterarguments: Concerns about Economic Impact:

Critics of clean energy tax credits raise several concerns:

-

Taxpayer Burden: The cost of these tax credits is ultimately borne by taxpayers. Opponents argue that the financial burden disproportionately affects lower and middle-income families, while benefiting larger corporations and wealthy individuals.

-

Market Distortions: Some argue that tax credits distort the free market, artificially inflating the clean energy sector while potentially hindering the competitiveness of other industries.

-

Inefficiency and Waste: Concerns exist regarding the potential for inefficiency and waste in the allocation of tax credits. Ensuring accountability and preventing fraud is crucial to maximizing the effectiveness of these programs.

-

International Competitiveness: Critics worry that generous tax credits could make American companies less competitive internationally, particularly if other countries do not implement similar policies.

Analyzing the Economic Data:

The economic impact of clean energy tax credits is a subject of ongoing research and debate. Studies have yielded varying results, depending on the methodologies used and the specific policies analyzed. It's crucial to critically evaluate the data and consider the long-term implications alongside short-term costs. Independent economic analysis from reputable sources is vital for informed decision-making.

Conclusion: A Balancing Act

The clean energy tax debate requires a nuanced approach. While the economic benefits of transitioning to a cleaner energy future are significant, careful consideration must be given to the potential costs and the equitable distribution of those costs. Designing effective and efficient policies that maximize benefits while minimizing burdens is essential for ensuring a sustainable and prosperous economic future for America. Further research, transparent policy implementation, and open public discourse are crucial for navigating this complex issue effectively. This ongoing debate will continue to shape the economic landscape of the United States for years to come.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on The Clean Energy Tax Debate: Analyzing The Economic Implications For America. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

A J Perez On Brett Favre Threats Untolds Future And The Favre Scandal

May 21, 2025

A J Perez On Brett Favre Threats Untolds Future And The Favre Scandal

May 21, 2025 -

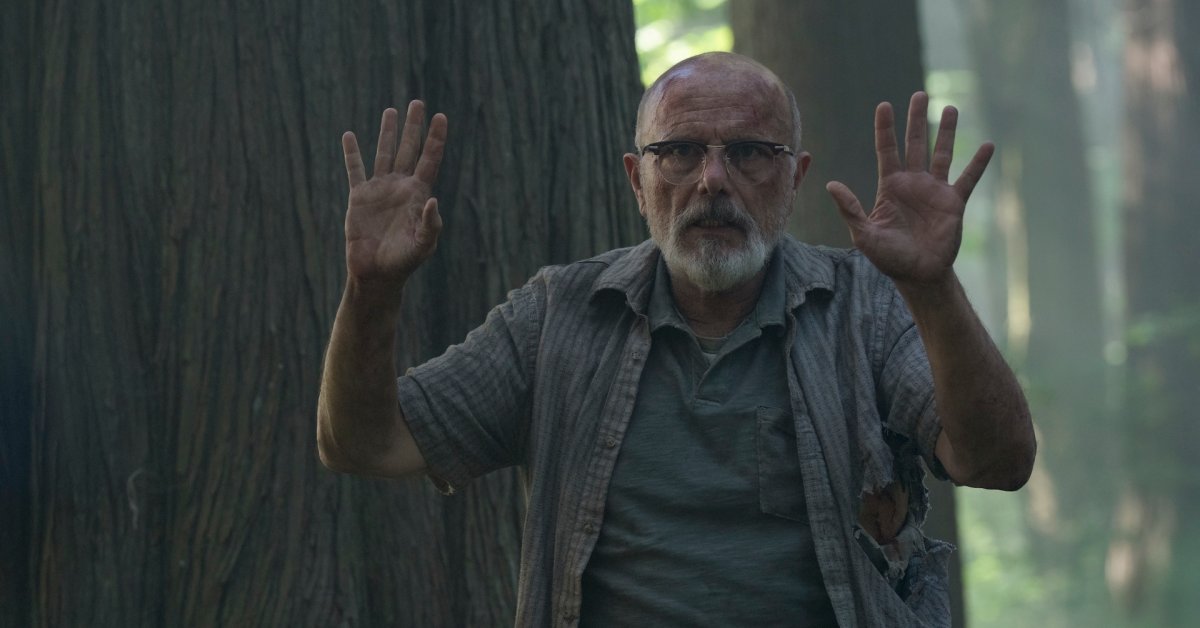

The Last Of Us Season 2 Exploring The Impact Of Narrative Changes On Joel And Ellies Relationship

May 21, 2025

The Last Of Us Season 2 Exploring The Impact Of Narrative Changes On Joel And Ellies Relationship

May 21, 2025 -

Police Investigate Church Break In Two Boys Suspected Of Defecating Inside

May 21, 2025

Police Investigate Church Break In Two Boys Suspected Of Defecating Inside

May 21, 2025 -

I M Done Jon Jones Cryptic Tweet Ignites Ufc Retirement Speculation

May 21, 2025

I M Done Jon Jones Cryptic Tweet Ignites Ufc Retirement Speculation

May 21, 2025 -

Police Investigate Church Break In Two Boys Suspected Of Defecating On Floor

May 21, 2025

Police Investigate Church Break In Two Boys Suspected Of Defecating On Floor

May 21, 2025