Tech Sector Leads S&P 500 Recovery, 2023 Losses Wiped Out: Live Market News

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Tech Sector Leads S&P 500 Recovery, 2023 Losses Wiped Out: Live Market News

The tech-heavy Nasdaq Composite surged past its 2023 highs on [Date], leading a broader market rally that saw the S&P 500 fully recover its losses from earlier this year. This dramatic turnaround marks a significant shift in market sentiment and offers a glimmer of hope for investors after a period of volatility and uncertainty. The stunning recovery is largely attributed to strong earnings reports from major tech companies and renewed optimism about artificial intelligence (AI) advancements.

A Tech-Fueled Resurgence:

The impressive performance of the tech sector is undeniable. Mega-cap tech companies, often considered bellwethers of market health, have posted impressive gains, fueled by robust revenue growth and positive investor outlook. This resurgence is particularly noteworthy given the significant downturn these companies experienced earlier in 2023, characterized by concerns over rising interest rates, inflation, and a potential recession. The recovery isn't just about a few giants; many mid-cap and smaller tech firms are also experiencing significant growth, signaling a broader sector-wide rebound.

AI: The Driving Force Behind the Rally?

The rapid advancement and adoption of artificial intelligence is arguably the biggest catalyst for this remarkable recovery. Investors are pouring money into companies at the forefront of AI development, viewing the technology as a transformative force with the potential to revolutionize numerous industries. From cloud computing to autonomous vehicles, AI is shaping the future of technology, and this optimism is clearly reflected in the market's performance. This renewed interest in AI is not only driving stock prices higher but also sparking significant innovation and investment across the technology ecosystem. We are witnessing a true AI boom, with implications that extend far beyond the stock market.

What Does This Mean for Investors?

The S&P 500's complete recovery from its 2023 lows presents both opportunities and challenges for investors. While the market's positive trajectory is encouraging, it's crucial to remember that market fluctuations are inherent. Experts advise maintaining a diversified portfolio and adopting a long-term investment strategy. This recovery doesn't signal the end of market volatility; external factors like geopolitical instability and economic uncertainty could still impact future performance.

Looking Ahead:

The sustained strength of the tech sector, particularly in the AI sphere, indicates a potential shift in the long-term market landscape. However, investors should approach this bullish trend with caution. Careful analysis of individual company performance, alongside a comprehensive understanding of broader economic indicators, remains crucial for informed investment decisions. Staying informed about [mention relevant economic news sources or indices] will help navigate the evolving market dynamics.

Key Takeaways:

- Tech leads the charge: The tech sector has been the primary driver of the S&P 500's recovery.

- AI fuels the rally: The excitement surrounding artificial intelligence is a major catalyst for the market's resurgence.

- Cautious optimism: While the recovery is positive, investors should remain vigilant and diversify their portfolios.

- Long-term perspective: A long-term investment strategy is crucial for navigating market volatility.

This market recovery highlights the importance of staying informed about market trends and adapting investment strategies accordingly. Remember to consult with a financial advisor before making any significant investment decisions. What are your thoughts on this significant market shift? Share your opinions in the comments below.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Tech Sector Leads S&P 500 Recovery, 2023 Losses Wiped Out: Live Market News. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Po K Remains Central Pm Modis Conditions For India Pakistan Dialogue On Kashmir

May 13, 2025

Po K Remains Central Pm Modis Conditions For India Pakistan Dialogue On Kashmir

May 13, 2025 -

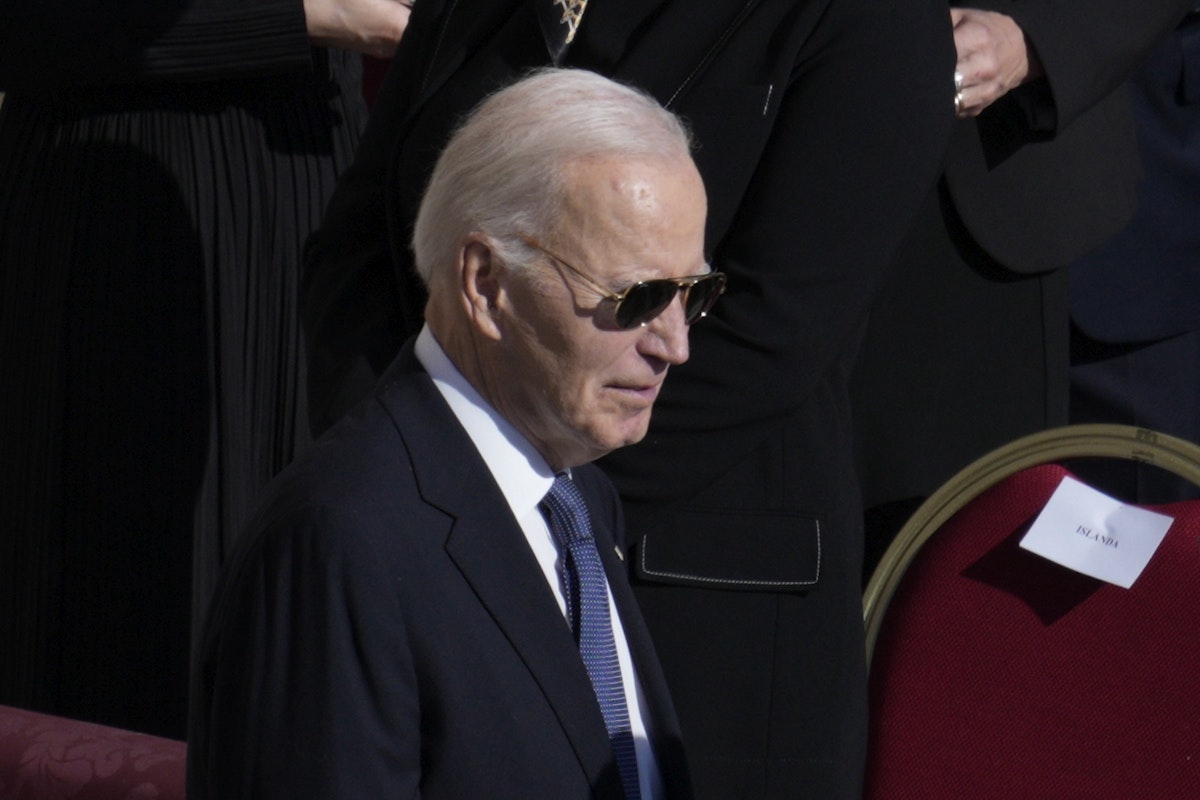

Bidens Health Staff Discrepancies Highlight Concerns Over Fitness For Office

May 13, 2025

Bidens Health Staff Discrepancies Highlight Concerns Over Fitness For Office

May 13, 2025 -

Atp Rome Day 6 Sinner De Jong Showdown And Full Match Predictions

May 13, 2025

Atp Rome Day 6 Sinner De Jong Showdown And Full Match Predictions

May 13, 2025 -

Carlo Ancelottis Brazil Appointment A Year Early For World Cup Hopes

May 13, 2025

Carlo Ancelottis Brazil Appointment A Year Early For World Cup Hopes

May 13, 2025 -

Report Jameer Nelson Joins 76ers Front Office As Assistant Gm

May 13, 2025

Report Jameer Nelson Joins 76ers Front Office As Assistant Gm

May 13, 2025