Tech Sector Drives S&P 500 Recovery, Erasing 2023 Losses: Live Market Data

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Tech Sector Drives S&P 500 Recovery, Erasing 2023 Losses: Live Market Data

The tech sector's remarkable resurgence has spearheaded a stunning recovery for the S&P 500, completely erasing the index's losses incurred throughout 2023. This unexpected turnaround has sent shockwaves through the financial world, leaving investors scrambling to understand the driving forces behind this impressive rally. Live market data paints a clear picture: tech giants are leading the charge, fueled by a combination of factors that are rewriting the narrative of the year.

The S&P 500, a leading indicator of US stock market performance, had experienced a challenging first half of 2023, grappling with persistent inflation, rising interest rates, and geopolitical uncertainty. However, the tide has dramatically shifted, with the index not only recovering lost ground but even surpassing its previous highs. This remarkable feat is largely attributable to the stellar performance of the technology sector.

The Tech Titans Leading the Charge

Several key factors contribute to the tech sector's dominance in this recovery:

-

Artificial Intelligence (AI) Boom: The explosive growth of AI, particularly generative AI, has ignited investor enthusiasm. Companies at the forefront of AI development, such as NVIDIA (NVDA) and Microsoft (MSFT), have seen their stock prices skyrocket, significantly boosting the overall tech index and consequently, the S&P 500. This surge reflects the market's belief in AI's transformative potential across various industries.

-

Easing Inflation Concerns: While inflation remains a concern, recent data suggests a potential cooling trend. This easing of inflationary pressures has reduced the likelihood of further aggressive interest rate hikes by the Federal Reserve, creating a more favorable environment for riskier assets like technology stocks.

-

Strong Earnings Reports: Many tech companies have reported unexpectedly strong second-quarter earnings, surpassing analysts' expectations. These positive results reinforce investor confidence in the sector's resilience and growth potential.

-

Increased Investor Sentiment: A shift in overall investor sentiment towards optimism has played a crucial role. The combination of positive economic indicators and strong corporate performance has boosted market confidence, leading to increased investment in the tech sector.

What Does This Mean for Investors?

This dramatic recovery raises important questions for investors. While the tech sector's resurgence is undeniably impressive, it's crucial to remember that market fluctuations are inherent. The current rally could be sustained, but it's equally important to be aware of potential risks and avoid impulsive decisions based solely on short-term gains. Diversification remains a key strategy for mitigating risk in any market environment.

Further research into individual company performance within the tech sector is advised before making any investment decisions. Consulting with a qualified financial advisor is always recommended to assess your personal risk tolerance and develop a tailored investment strategy.

Staying Updated with Live Market Data

Staying informed about live market data is critical for navigating the ever-changing landscape of the stock market. Reliable sources like [link to reputable financial news website] and [link to another reputable source] provide real-time updates and analysis to help you make informed investment choices. Remember to critically evaluate the information you consume and cross-reference data from multiple sources.

This unexpected tech-driven recovery of the S&P 500 highlights the dynamic and often unpredictable nature of the stock market. While the current trend is positive, maintaining a balanced perspective and informed approach to investing is crucial for long-term success. Stay tuned for further updates and analysis as the market continues to evolve.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Tech Sector Drives S&P 500 Recovery, Erasing 2023 Losses: Live Market Data. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Climate Risk A Business And Finance Industry Conversation

May 14, 2025

Climate Risk A Business And Finance Industry Conversation

May 14, 2025 -

Steve Witkoff And The Shifting Sands Of U S Israel Relations A Loss Of Confidence

May 14, 2025

Steve Witkoff And The Shifting Sands Of U S Israel Relations A Loss Of Confidence

May 14, 2025 -

Significant Job Cuts At Microsoft Over 6 000 Employees Impacted

May 14, 2025

Significant Job Cuts At Microsoft Over 6 000 Employees Impacted

May 14, 2025 -

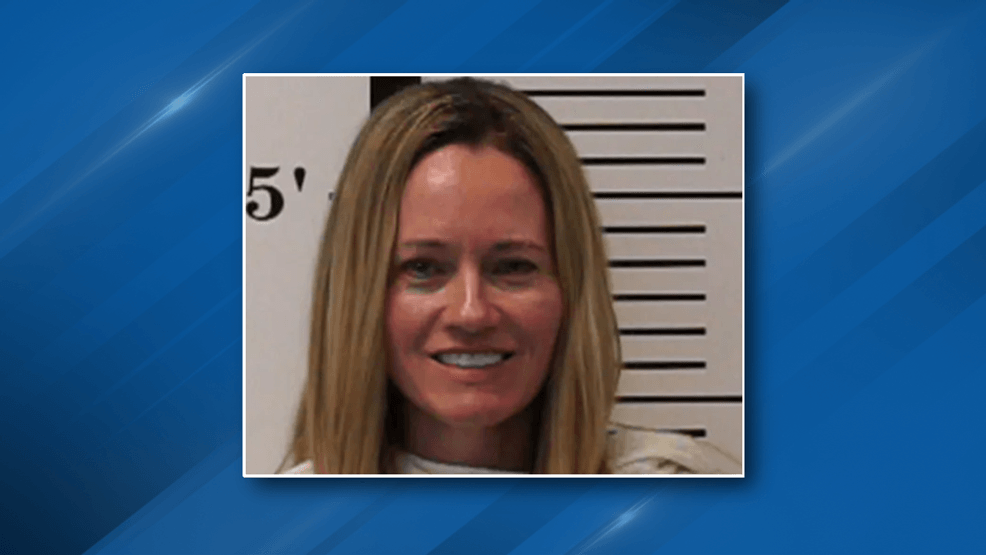

Severe Penalty For Mother Involved In Child Sexual Abuse Case

May 14, 2025

Severe Penalty For Mother Involved In Child Sexual Abuse Case

May 14, 2025 -

Extravagant Welcome For Trump As Middle East Tour Kicks Off

May 14, 2025

Extravagant Welcome For Trump As Middle East Tour Kicks Off

May 14, 2025