Tech Sector Drives S&P 500 Recovery, 2023 Losses Wiped Out

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Tech Sector Drives S&P 500 Recovery, 2023 Losses Wiped Out

The tech-heavy Nasdaq Composite has led a stunning market rebound, completely erasing its 2023 losses and propelling the S&P 500 to impressive gains. This remarkable turnaround is a testament to the sector's resilience and the market's renewed faith in its growth potential. But what's behind this surge, and is it sustainable?

Mega-Cap Tech Giants Fuel the Rally

The recovery is largely attributed to the stellar performance of mega-cap tech companies like Apple (AAPL), Microsoft (MSFT), Alphabet (GOOGL), and Nvidia (NVDA). These giants, often considered bellwethers for the broader market, have reported robust earnings and positive outlooks, exceeding analysts' expectations and boosting investor confidence. Nvidia, in particular, has been a standout performer, with its AI-related chips driving significant growth and fueling speculation about the future of artificial intelligence.

AI: The Driving Force Behind the Tech Boom?

The burgeoning field of artificial intelligence (AI) is undoubtedly playing a crucial role in this tech-fueled recovery. Investor enthusiasm for AI-related technologies is palpable, with significant investment pouring into companies developing AI hardware, software, and applications. This surge in investment has created a positive feedback loop, driving innovation and further fueling market optimism. Learn more about the from this helpful Investopedia resource.

Interest Rate Hikes and Economic Uncertainty Remain Concerns

Despite the impressive recovery, several factors could temper future growth. The Federal Reserve's ongoing efforts to combat inflation through interest rate hikes continue to pose a significant challenge. Higher interest rates increase borrowing costs for businesses, potentially slowing economic growth and impacting corporate earnings. Furthermore, lingering economic uncertainty, including concerns about a potential recession, adds another layer of complexity to the market outlook.

Is This Recovery Sustainable? Analyzing the Risks

While the current rally is undeniably impressive, the question of its sustainability remains a key concern for investors. The rapid rise of tech stocks, fueled by AI enthusiasm, raises concerns about a potential bubble. A sudden shift in investor sentiment or unforeseen economic headwinds could easily trigger a market correction.

Key Factors to Watch:

- Inflation data: Continued progress in bringing inflation under control will be crucial for maintaining market confidence.

- Federal Reserve policy: The future trajectory of interest rates will significantly impact corporate earnings and market sentiment.

- AI development: Continued innovation and adoption of AI technologies will be key drivers of future growth in the tech sector.

- Geopolitical risks: Global political instability and economic uncertainty can significantly impact market performance.

Navigating the Market:

The current market situation necessitates a cautious approach. While the tech sector's recovery is encouraging, investors should carefully consider the risks associated with this rapid growth. Diversification and a long-term investment strategy remain crucial for mitigating potential losses. Consult with a financial advisor to develop a personalized investment plan that aligns with your risk tolerance and financial goals. Remember, past performance is not indicative of future results.

This remarkable rebound highlights the significant influence of the tech sector on the overall market. However, maintaining a balanced perspective and considering potential risks is crucial for navigating the ever-evolving landscape of the stock market.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Tech Sector Drives S&P 500 Recovery, 2023 Losses Wiped Out. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Nvidia Sending 18 000 Ai Chips To Saudi Arabia A Strategic Tech Deal

May 14, 2025

Nvidia Sending 18 000 Ai Chips To Saudi Arabia A Strategic Tech Deal

May 14, 2025 -

Urgent Tsunami Warning For Greece After Major Earthquake

May 14, 2025

Urgent Tsunami Warning For Greece After Major Earthquake

May 14, 2025 -

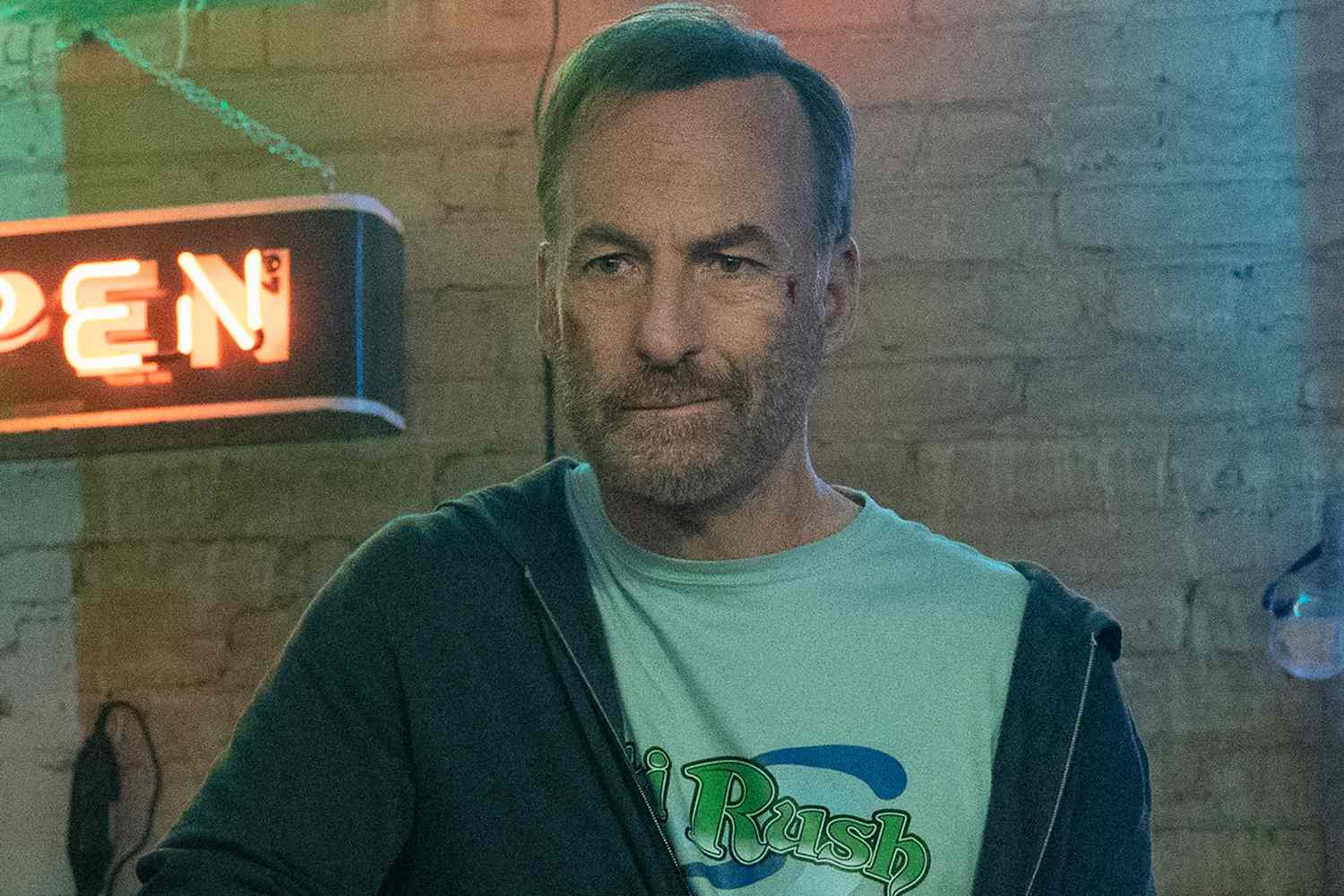

Nobody 2 Trailer A Violent Family Getaway

May 14, 2025

Nobody 2 Trailer A Violent Family Getaway

May 14, 2025 -

Wirtz Besucht Liverpool Deutliche Botschaft An Den Fc Bayern Muenchen

May 14, 2025

Wirtz Besucht Liverpool Deutliche Botschaft An Den Fc Bayern Muenchen

May 14, 2025 -

Times 2025 Influential List Who Made The Cut And Why

May 14, 2025

Times 2025 Influential List Who Made The Cut And Why

May 14, 2025