Tax Reform And The Trump Administration: A Critical Analysis And Path Forward

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Tax Reform and the Trump Administration: A Critical Analysis and Path Forward

The Tax Cuts and Jobs Act of 2017, a cornerstone of the Trump administration's economic agenda, significantly reshaped the American tax code. While touted as a boon for businesses and individuals, its long-term effects remain a subject of intense debate and critical analysis. This article delves into the key provisions of the reform, examines its successes and failures, and explores potential paths forward for future tax policy.

Key Provisions of the 2017 Tax Reform:

The 2017 tax reform implemented several sweeping changes, including:

- Significant corporate tax rate reduction: The top corporate tax rate plummeted from 35% to 21%, a dramatic shift intended to boost business investment and economic growth. This was a central promise of the Trump administration.

- Individual income tax bracket changes: The reform altered individual income tax brackets, resulting in lower rates for many taxpayers, particularly in the higher income brackets. However, some lower-income earners saw minimal changes or even slight increases.

- Standard deduction increase: The standard deduction was substantially increased, simplifying tax filing for many and potentially reducing the number of taxpayers itemizing deductions.

- Changes to the alternative minimum tax (AMT): The AMT, designed to ensure high-income earners pay a minimum level of tax, was modified, affecting fewer taxpayers.

- Elimination of individual mandate penalty: The penalty for not having health insurance under the Affordable Care Act (ACA) was eliminated.

Successes and Shortcomings of the Reform:

While proponents lauded the reform for stimulating economic growth and simplifying the tax code, critics pointed to several shortcomings:

- Increased national debt: The tax cuts significantly increased the national debt, a concern that persists even amidst economic growth. [Link to a reputable source on national debt increase].

- Disproportionate benefits to the wealthy: Critics argue that the benefits of the tax cuts disproportionately favored high-income earners and corporations, exacerbating income inequality. [Link to a reputable source on income inequality].

- Temporary provisions: Several key provisions of the reform, including individual tax cuts, are set to expire, leading to uncertainty in future tax planning. [Link to relevant legislation].

- Limited impact on investment: While proponents claimed the reform would stimulate investment, the evidence remains mixed, with some studies showing limited impact on business capital expenditure. [Link to economic study on investment].

A Path Forward: Addressing the Challenges:

Moving forward, a more comprehensive and equitable approach to tax reform is needed. This could include:

- Addressing the national debt: Future tax policies should prioritize fiscal responsibility and sustainable debt reduction. This might involve exploring revenue-enhancing measures alongside spending cuts.

- Promoting greater tax fairness: Reforming the tax code to ensure a more equitable distribution of the tax burden, possibly through targeted tax credits for low- and middle-income earners, is crucial.

- Investing in infrastructure: A significant portion of any future tax revenue could be earmarked for critical infrastructure improvements, creating jobs and boosting long-term economic growth. [Link to article on infrastructure investment].

- Simplifying the tax code further: While the 2017 reform simplified some aspects, further simplification could enhance compliance and reduce administrative burdens.

Conclusion:

The 2017 tax reform remains a complex and controversial topic. While it achieved some positive outcomes, its long-term effects and its impact on inequality and the national debt remain critical concerns. A future path towards tax reform requires a holistic approach that balances economic growth with fiscal responsibility and social equity. The debate on tax policy is far from over, and ongoing critical analysis is essential to ensure a fair and sustainable tax system for all Americans.

Keywords: Tax Reform, Trump Administration, Tax Cuts and Jobs Act, Corporate Tax Rate, Individual Income Tax, National Debt, Income Inequality, Tax Policy, Fiscal Responsibility, Economic Growth, Tax Fairness.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Tax Reform And The Trump Administration: A Critical Analysis And Path Forward. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Public Appearance Fuels Concern 85 Year Old Film Icons Deteriorating Health

Aug 13, 2025

Public Appearance Fuels Concern 85 Year Old Film Icons Deteriorating Health

Aug 13, 2025 -

Emory Cdc Area Daycare Shelter In Place Active Shooter Investigation Update

Aug 13, 2025

Emory Cdc Area Daycare Shelter In Place Active Shooter Investigation Update

Aug 13, 2025 -

Where Trump Deployed Troops Domestically Locations And Rationale

Aug 13, 2025

Where Trump Deployed Troops Domestically Locations And Rationale

Aug 13, 2025 -

Severe Thunderstorm Warning Urgent Alert For Metro Detroit Residents

Aug 13, 2025

Severe Thunderstorm Warning Urgent Alert For Metro Detroit Residents

Aug 13, 2025 -

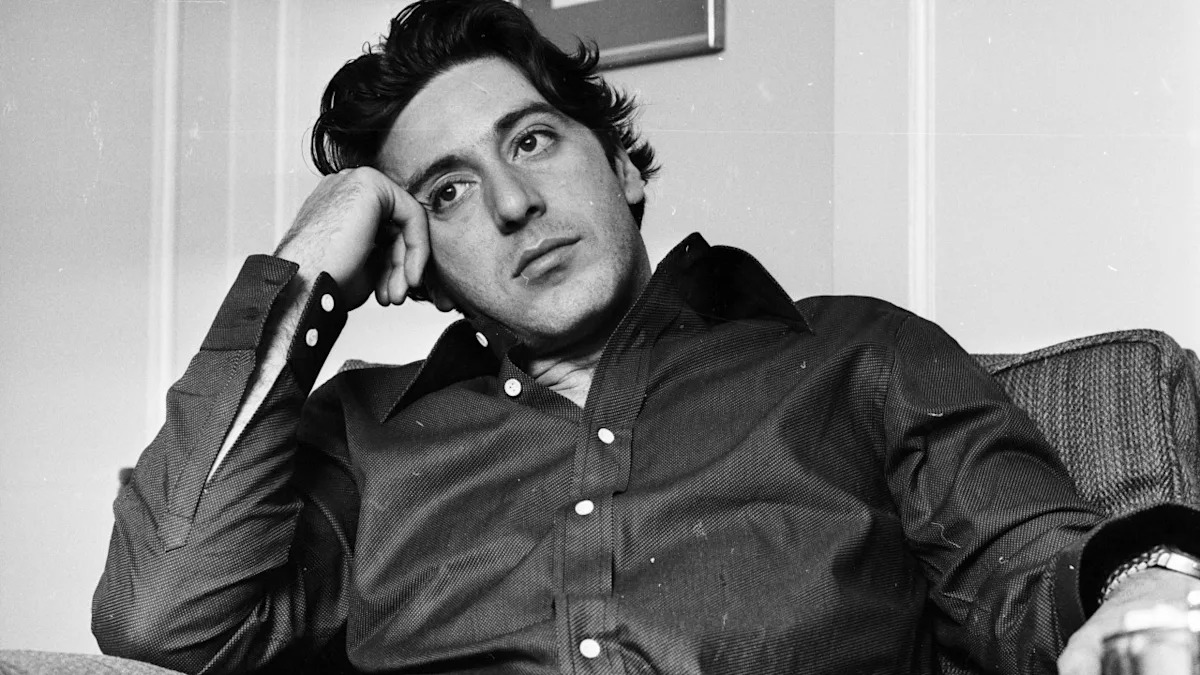

The 12 Best Al Pacino Movie Roles A Critics Selection

Aug 13, 2025

The 12 Best Al Pacino Movie Roles A Critics Selection

Aug 13, 2025

Latest Posts

-

37 Years After Reflecting On The Impact Of The 1985 Japan Airlines Crash

Aug 13, 2025

37 Years After Reflecting On The Impact Of The 1985 Japan Airlines Crash

Aug 13, 2025 -

How Spirituality Improves Mental Health Evidence Based Insights

Aug 13, 2025

How Spirituality Improves Mental Health Evidence Based Insights

Aug 13, 2025 -

Extreme Heat Returns To Southern Nevada Prepare For 114 F

Aug 13, 2025

Extreme Heat Returns To Southern Nevada Prepare For 114 F

Aug 13, 2025 -

Strengthening Mental Resilience The Benefits Of A Spiritual Practice

Aug 13, 2025

Strengthening Mental Resilience The Benefits Of A Spiritual Practice

Aug 13, 2025 -

Leak Reveals Resident Evil 4 Remake Could Be Leon Kennedys Send Off Game

Aug 13, 2025

Leak Reveals Resident Evil 4 Remake Could Be Leon Kennedys Send Off Game

Aug 13, 2025