Tax Reform And Deception: Learning From The Trump Tax Cuts

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

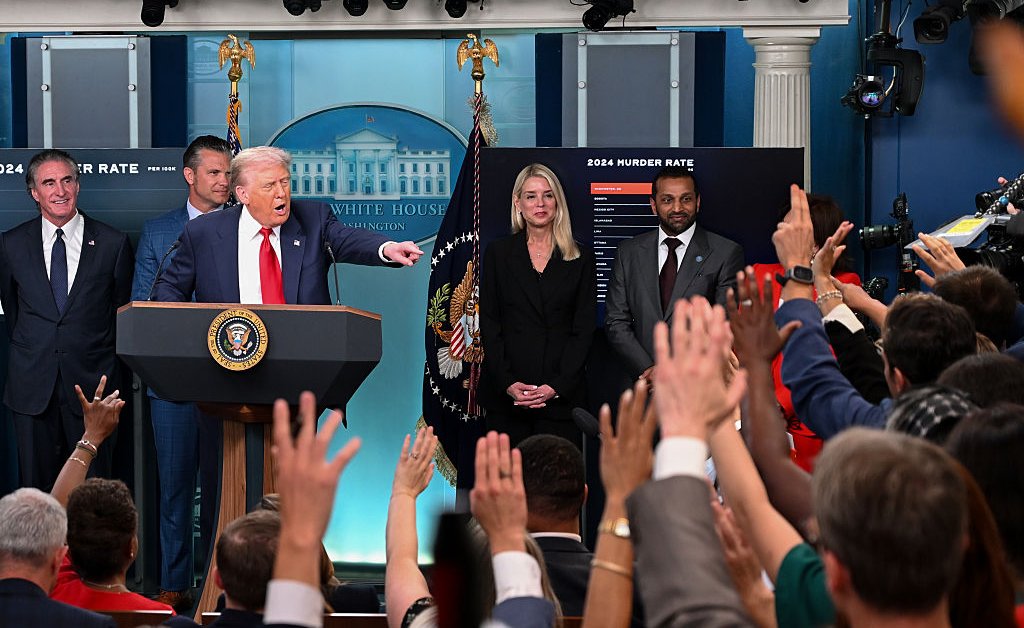

Tax Reform and Deception: Learning from the Trump Tax Cuts

The 2017 Tax Cuts and Jobs Act, championed by the Trump administration, promised widespread economic prosperity. However, the reality fell far short of the rosy predictions, offering a cautionary tale about the complexities of tax reform and the potential for deceptive rhetoric surrounding such significant policy changes. Analyzing the legislation's long-term effects reveals crucial lessons for future tax reform efforts, highlighting the importance of transparency and realistic assessments.

The Promises vs. the Reality: A Disenchanted Look Back

The Trump tax cuts, officially known as the Tax Cuts and Jobs Act (TCJA), drastically slashed corporate and individual income tax rates. Proponents argued this would stimulate economic growth through increased investment and job creation. The promised "trickle-down" effect, however, failed to materialize significantly. While some corporations did experience increased profits, this didn't translate into widespread wage increases or substantial job growth as predicted. [Link to a reputable source analyzing the economic impact of the TCJA].

Deception and Misleading Claims: Unfulfilled Expectations

Beyond the economic impact, the rollout of the TCJA was marred by misleading claims and a lack of transparency. Many Americans were led to believe they would receive substantial tax cuts, when in reality, the benefits were unevenly distributed, disproportionately favouring high-income earners and corporations. The complexity of the legislation itself contributed to this deception, making it difficult for ordinary citizens to understand the true implications of the changes. [Link to an article detailing criticisms of the TCJA's communication strategy].

The National Debt: A Growing Concern

One of the most significant criticisms of the TCJA was its impact on the national debt. The massive tax cuts resulted in a significant decrease in government revenue, leading to a substantial increase in the national deficit. This long-term consequence highlights a critical flaw in the legislation's design and the deceptive nature of portraying it as fiscally responsible. [Link to data on the national debt increase following the TCJA].

Lessons Learned: Transparency and Realistic Expectations

The experience with the Trump tax cuts provides invaluable lessons for future tax reform efforts. Firstly, transparency is paramount. The legislation needs to be clearly communicated to the public, avoiding misleading claims and ensuring that everyone understands the potential consequences. Secondly, realistic expectations must be set. Promising unrealistic economic growth or tax benefits can lead to disillusionment and erode public trust in government. Finally, long-term consequences must be carefully considered. Focusing solely on short-term gains can result in significant long-term challenges, such as increased national debt and uneven distribution of wealth.

Moving Forward: A Call for Responsible Tax Reform

Future tax reforms must prioritize fairness, transparency, and long-term sustainability. Detailed impact assessments and comprehensive public consultations are crucial to ensure that tax policies serve the interests of all citizens, not just a select few. This requires a move away from deceptive rhetoric and a commitment to evidence-based policymaking. [Link to an article advocating for responsible tax reform].

Keywords: Tax Reform, Trump Tax Cuts, Tax Cuts and Jobs Act (TCJA), Economic Impact, National Debt, Deception, Misleading Claims, Fiscal Policy, Tax Policy, Fairness, Transparency, Economic Growth, Tax Legislation, Government Revenue

This article provides a comprehensive overview of the topic, incorporating relevant keywords naturally, and utilizes internal and external links to enhance credibility and user experience. The use of headings, bullet points, and bold text improves readability and engagement. The concluding paragraph serves as a subtle call to action, encouraging readers to engage with the issues discussed.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Tax Reform And Deception: Learning From The Trump Tax Cuts. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Trumps 2024 Dc Strategy A Repeat Of 2020 Tactics

Aug 14, 2025

Trumps 2024 Dc Strategy A Repeat Of 2020 Tactics

Aug 14, 2025 -

How Spirituality Improves Mental Health A Comprehensive Guide

Aug 14, 2025

How Spirituality Improves Mental Health A Comprehensive Guide

Aug 14, 2025 -

Record Breaking Heat Las Vegas Valley Faces 2025s Highest Temperature

Aug 14, 2025

Record Breaking Heat Las Vegas Valley Faces 2025s Highest Temperature

Aug 14, 2025 -

35 Years After Flight 123 Lessons Learned From Japans Airliner Tragedy

Aug 14, 2025

35 Years After Flight 123 Lessons Learned From Japans Airliner Tragedy

Aug 14, 2025 -

Extreme Heat Warning Issued For Las Vegas On Tuesday

Aug 14, 2025

Extreme Heat Warning Issued For Las Vegas On Tuesday

Aug 14, 2025

Latest Posts

-

Increased Light Levels Impact On Eye Health

Aug 14, 2025

Increased Light Levels Impact On Eye Health

Aug 14, 2025 -

Brighter Lights Is This A Threat To Your Vision

Aug 14, 2025

Brighter Lights Is This A Threat To Your Vision

Aug 14, 2025 -

Newsoms Deadline For Trump A Crucial Moment In California Redistricting

Aug 14, 2025

Newsoms Deadline For Trump A Crucial Moment In California Redistricting

Aug 14, 2025 -

Taylor Swift Announces New Album The Life Of A Showgirl A Deep Dive

Aug 14, 2025

Taylor Swift Announces New Album The Life Of A Showgirl A Deep Dive

Aug 14, 2025 -

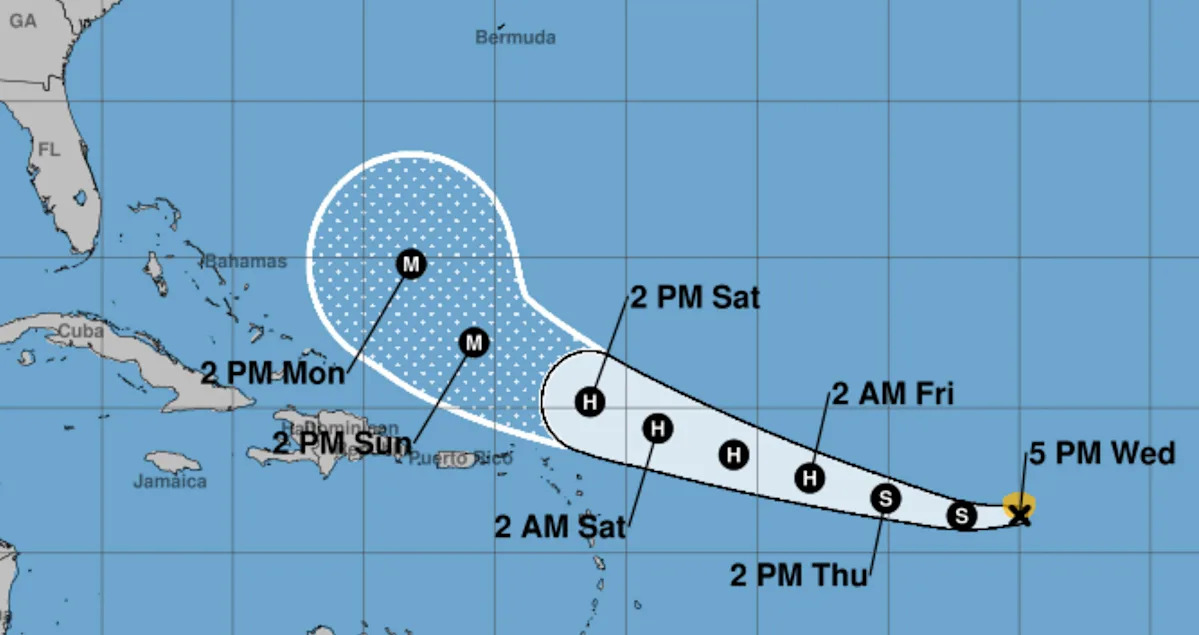

Hurricane Erin Forecast Update Projected Path And Strengthening Potential This Week

Aug 14, 2025

Hurricane Erin Forecast Update Projected Path And Strengthening Potential This Week

Aug 14, 2025