Tariff Chaos And Rising Stock Prices: Unraveling The Economic Paradox

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Tariff Chaos and Rising Stock Prices: Unraveling the Economic Paradox

The seemingly contradictory scenario of rising stock prices amidst escalating tariff disputes is leaving economists and investors alike scratching their heads. While trade wars and increased tariffs are typically associated with economic uncertainty and market downturns, recent months have witnessed a puzzling divergence: stock markets, particularly in the US, have continued to climb despite the ongoing tariff chaos. This article delves into this economic paradox, exploring the contributing factors and potential implications.

The Paradox Explained: Why Are Stocks Rising Despite Tariffs?

The current situation defies traditional economic models. Increased tariffs, intended to protect domestic industries, often lead to higher prices for consumers, reduced consumer spending, and ultimately, slower economic growth. This usually translates to lower stock prices as companies face reduced demand and profitability. However, several factors are contributing to the current disconnect:

-

Strong Corporate Earnings: Despite the headwinds of tariffs, many large US corporations have reported surprisingly strong earnings. This resilience stems from various factors, including robust consumer spending, efficient cost management, and a shift towards automation.

-

Low Interest Rates: The Federal Reserve's policy of maintaining low interest rates has made borrowing cheaper for businesses, enabling them to invest and expand even in the face of tariff uncertainty. This accessibility to capital fuels growth and supports higher stock valuations.

-

Market Sentiment and Investor Behavior: Investor sentiment plays a crucial role. While some investors remain cautious, others perceive the current tariff situation as temporary or manageable, leading to continued investment and driving up stock prices. This can be attributed to a belief that the current administration will eventually negotiate favorable trade deals. Further contributing to this optimistic outlook is the continued strong performance of the tech sector.

-

Global Economic Growth (albeit slowing): While global economic growth has shown signs of slowing, it hasn't completely stalled. Emerging markets, particularly in Asia, continue to show potential for growth, offering a counterbalance to the negative effects of tariffs in certain sectors.

The Potential Downside: A Looming Storm?

While the current market performance may seem positive, the situation is far from certain. The continued escalation of trade disputes poses significant risks:

-

Supply Chain Disruptions: Tariffs are causing significant disruptions to global supply chains, leading to increased costs and delays for businesses. This can negatively impact profitability and ultimately affect stock prices.

-

Inflationary Pressures: Tariffs directly increase the cost of imported goods, leading to inflationary pressures. Persistent inflation can erode consumer purchasing power and stifle economic growth.

-

Geopolitical Uncertainty: The ongoing trade war adds to existing geopolitical uncertainties, creating a volatile environment for businesses and investors. This uncertainty can lead to decreased investment and market instability.

Looking Ahead: Navigating the Uncertain Future

The current economic landscape presents a complex challenge for investors. While the stock market’s resilience is remarkable, the underlying risks associated with the ongoing tariff disputes cannot be ignored. It is crucial to monitor key economic indicators, including inflation rates, consumer spending, and corporate earnings, to assess the potential impact of the trade war on long-term market performance. Diversification remains a critical strategy for mitigating risk in this unpredictable environment.

Conclusion:

The seemingly paradoxical relationship between tariff chaos and rising stock prices highlights the complexity of modern economics. While strong corporate earnings and low interest rates have so far buffered the negative impact of tariffs, the potential for long-term economic damage remains significant. Careful analysis and prudent investment strategies are crucial for navigating the uncertain future. Staying informed about evolving economic trends and geopolitical developments is paramount for investors seeking to make informed decisions in this volatile climate.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Tariff Chaos And Rising Stock Prices: Unraveling The Economic Paradox. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Justice Leagues Dceu Cameo Removed From Peacemaker The Story Behind The Cut

Aug 14, 2025

Justice Leagues Dceu Cameo Removed From Peacemaker The Story Behind The Cut

Aug 14, 2025 -

Dcus Peacemaker Behind The Scenes Look At Removed Justice League Cameo

Aug 14, 2025

Dcus Peacemaker Behind The Scenes Look At Removed Justice League Cameo

Aug 14, 2025 -

Tuesday Heat Warning Las Vegas Under Extreme Temperature Conditions

Aug 14, 2025

Tuesday Heat Warning Las Vegas Under Extreme Temperature Conditions

Aug 14, 2025 -

The 1985 Jal Crash Investigating The Causes And Aftermath Of Japans Worst Air Disaster

Aug 14, 2025

The 1985 Jal Crash Investigating The Causes And Aftermath Of Japans Worst Air Disaster

Aug 14, 2025 -

West Virginia Lottery Winning Numbers August 13 2025 Powerball Lotto America

Aug 14, 2025

West Virginia Lottery Winning Numbers August 13 2025 Powerball Lotto America

Aug 14, 2025

Latest Posts

-

Increased Light Levels Impact On Eye Health

Aug 14, 2025

Increased Light Levels Impact On Eye Health

Aug 14, 2025 -

Brighter Lights Is This A Threat To Your Vision

Aug 14, 2025

Brighter Lights Is This A Threat To Your Vision

Aug 14, 2025 -

Newsoms Deadline For Trump A Crucial Moment In California Redistricting

Aug 14, 2025

Newsoms Deadline For Trump A Crucial Moment In California Redistricting

Aug 14, 2025 -

Taylor Swift Announces New Album The Life Of A Showgirl A Deep Dive

Aug 14, 2025

Taylor Swift Announces New Album The Life Of A Showgirl A Deep Dive

Aug 14, 2025 -

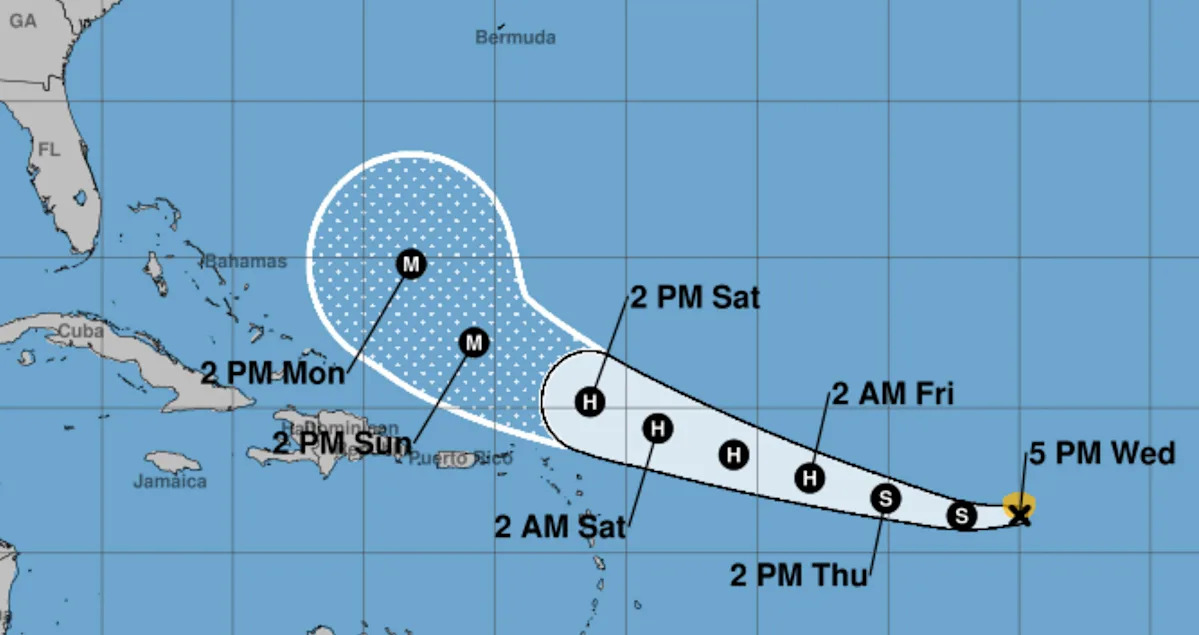

Hurricane Erin Forecast Update Projected Path And Strengthening Potential This Week

Aug 14, 2025

Hurricane Erin Forecast Update Projected Path And Strengthening Potential This Week

Aug 14, 2025