Surging Crypto And Trading Volumes Drive Robinhood To $255 Billion In Assets

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Surging Crypto and Trading Volumes Propel Robinhood to $255 Billion in Assets

Record-breaking trading activity and a surge in cryptocurrency investment catapults Robinhood's assets under custody to a staggering $255 billion. The online brokerage giant has seen phenomenal growth, driven by a confluence of factors including increased retail investor participation and the volatile yet exciting world of cryptocurrencies. This impressive figure represents a significant milestone for the company and underscores the changing landscape of the financial markets.

The Crypto Catalyst:

A major contributor to Robinhood's soaring asset value is the undeniable boom in cryptocurrency trading. The platform's user-friendly interface and relatively low fees have attracted a significant number of first-time crypto investors. The increasing mainstream adoption of digital assets like Bitcoin and Ethereum, coupled with Robinhood's accessibility, has fueled this growth. This surge in crypto trading directly translates into increased assets under management for the platform.

Beyond Crypto: Trading Volume Drives Growth:

While cryptocurrency plays a significant role, the overall increase in trading volume across all asset classes on Robinhood is equally important. The recent market volatility, driven by factors like inflation and geopolitical uncertainty, has encouraged more active participation from retail investors. This heightened trading activity, encompassing stocks, options, and ETFs, significantly contributes to the $255 billion figure.

Robinhood's Strategic Positioning:

Robinhood's success isn't just about luck; it’s a testament to the company's strategic positioning within the evolving financial technology landscape. By offering a streamlined, commission-free trading experience, Robinhood has successfully tapped into a growing demand for accessible and affordable investment platforms. Their focus on user experience and mobile-first approach has further enhanced their appeal to a younger generation of investors.

Challenges and Future Outlook:

Despite its impressive growth, Robinhood faces challenges. Regulatory scrutiny of the cryptocurrency market remains a key concern. Competition from established brokerage firms and newer fintech players is also intensifying. However, with its large and engaged user base and a commitment to innovation, Robinhood is well-positioned to navigate these hurdles. The company's future success will likely depend on its ability to adapt to changing market dynamics and continue providing a seamless and secure trading experience.

Key Takeaways:

- $255 Billion Milestone: Robinhood's assets under custody have reached a record-breaking $255 billion.

- Cryptocurrency's Impact: The surge in cryptocurrency trading is a major driver of this growth.

- Increased Trading Volume: Overall trading volume across all asset classes has also significantly contributed.

- Strategic Positioning: Robinhood's user-friendly platform and commission-free trading have fueled its success.

- Future Challenges: Regulatory uncertainty and competition pose ongoing challenges.

The future of investing is undeniably changing, and Robinhood's remarkable growth highlights the power of accessible finance and the growing influence of cryptocurrencies. This milestone marks a significant step for the company, and its continued performance will be closely watched by investors and market analysts alike. Learn more about the evolving landscape of online brokerage by exploring resources like [link to relevant financial news site].

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Surging Crypto And Trading Volumes Drive Robinhood To $255 Billion In Assets. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

U S Open Update Sam Burns Discusses Round 2 Score Of 65 At Oakmont

Jun 14, 2025

U S Open Update Sam Burns Discusses Round 2 Score Of 65 At Oakmont

Jun 14, 2025 -

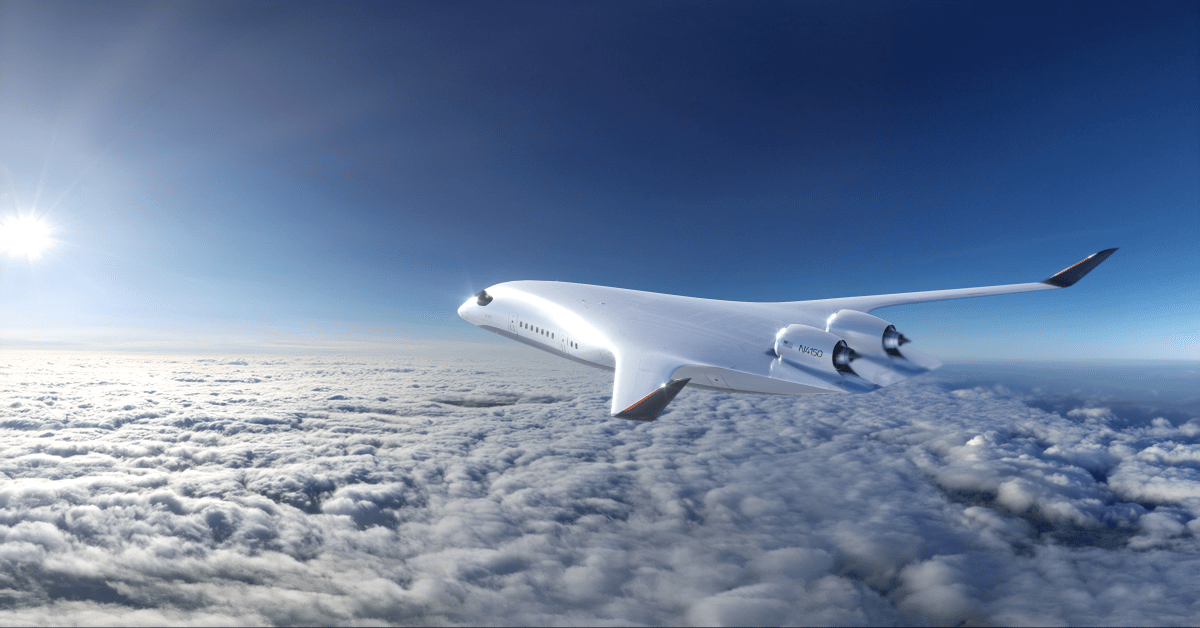

Could This Company Be The Future Of Low Carbon Air Travel

Jun 14, 2025

Could This Company Be The Future Of Low Carbon Air Travel

Jun 14, 2025 -

Behind The Scenes Paula Pattons Experience Filming Her New Movie

Jun 14, 2025

Behind The Scenes Paula Pattons Experience Filming Her New Movie

Jun 14, 2025 -

Kittles Strong Support For Samuel After New Controversy

Jun 14, 2025

Kittles Strong Support For Samuel After New Controversy

Jun 14, 2025 -

Sam Burns Scorching Round Third Lowest Us Open Score At Oakmont 2025

Jun 14, 2025

Sam Burns Scorching Round Third Lowest Us Open Score At Oakmont 2025

Jun 14, 2025