Surging Crypto And Stock Trading Drives Robinhood To $255B In Assets

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Robinhood Rides the Crypto and Stock Surge: Assets Soar to $255 Billion

The meteoric rise of cryptocurrency and continued interest in the stock market have propelled Robinhood's assets under custody to a staggering $255 billion, marking a significant milestone for the popular trading platform. This impressive figure, revealed in the company's latest financial report, underscores the growing appetite for retail investment and the platform's pivotal role in democratizing access to financial markets. But what's driving this phenomenal growth, and what does it mean for the future of Robinhood?

The Perfect Storm: Crypto's Ascent and Stock Market Enthusiasm

Several factors contributed to this unprecedented surge in Robinhood's assets. The cryptocurrency market, despite its volatility, continues to attract significant investment. The rise of Bitcoin and the emergence of numerous altcoins have fueled a wave of retail participation, with platforms like Robinhood offering easy access to these digital assets. This surge in crypto trading activity directly translates to increased assets under management for Robinhood.

Simultaneously, the stock market, while experiencing periods of uncertainty, remains a focal point for many investors. The ease of use and commission-free trading offered by Robinhood have attracted millions of new users, particularly among younger demographics. The platform's user-friendly interface and accessible investment options have played a crucial role in this growth.

Robinhood's Strategic Positioning and Future Outlook

Robinhood's success is not solely attributable to market trends. The company has strategically expanded its offerings beyond basic stock and crypto trading. The introduction of features like options trading, fractional shares, and educational resources has broadened its appeal and cemented its position as a leading retail investment platform. This strategic diversification has proven crucial in navigating market fluctuations and maintaining consistent growth.

However, the company faces ongoing challenges. Regulatory scrutiny remains a significant concern, with ongoing investigations into its practices. Furthermore, increased competition from established players and new entrants in the fintech space presents a constant threat. The company's long-term success will depend on its ability to adapt to evolving market conditions and address regulatory challenges effectively.

Looking Ahead: Challenges and Opportunities

- Increased Competition: The fintech landscape is rapidly evolving, with numerous competitors vying for market share. Robinhood must continue to innovate and differentiate itself to maintain its competitive edge.

- Regulatory Scrutiny: Navigating the complexities of financial regulations is paramount. Maintaining compliance and building trust with regulators is crucial for long-term sustainability.

- Expanding Product Offerings: Diversifying beyond its core offerings, potentially into areas such as wealth management or personalized financial advice, could unlock new growth opportunities.

While the $255 billion figure represents a remarkable achievement, it's essential to approach this growth with a balanced perspective. The volatile nature of both the crypto and stock markets presents inherent risks. Investors should always conduct thorough research and understand the inherent risks before engaging in any investment activity. For more information on responsible investing, consider exploring resources like the .

Conclusion:

Robinhood's surge to $255 billion in assets reflects the broader trends in retail investment and the platform's successful capture of a significant market share. While the future holds both challenges and opportunities, the company's strategic positioning and adaptability suggest it is well-placed to navigate the complexities of the evolving financial landscape. However, investors should always remember to practice responsible investing and manage their risk effectively.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Surging Crypto And Stock Trading Drives Robinhood To $255B In Assets. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Update Missing Child Found Safe Following Amber Alert

Jun 14, 2025

Update Missing Child Found Safe Following Amber Alert

Jun 14, 2025 -

L A Protests Curfew Brings Second Night Of Confrontation

Jun 14, 2025

L A Protests Curfew Brings Second Night Of Confrontation

Jun 14, 2025 -

Resultados Eleitorais Em Angola Onofre Dos Santos Defende Selo De Autenticidade Com Tecnologia

Jun 14, 2025

Resultados Eleitorais Em Angola Onofre Dos Santos Defende Selo De Autenticidade Com Tecnologia

Jun 14, 2025 -

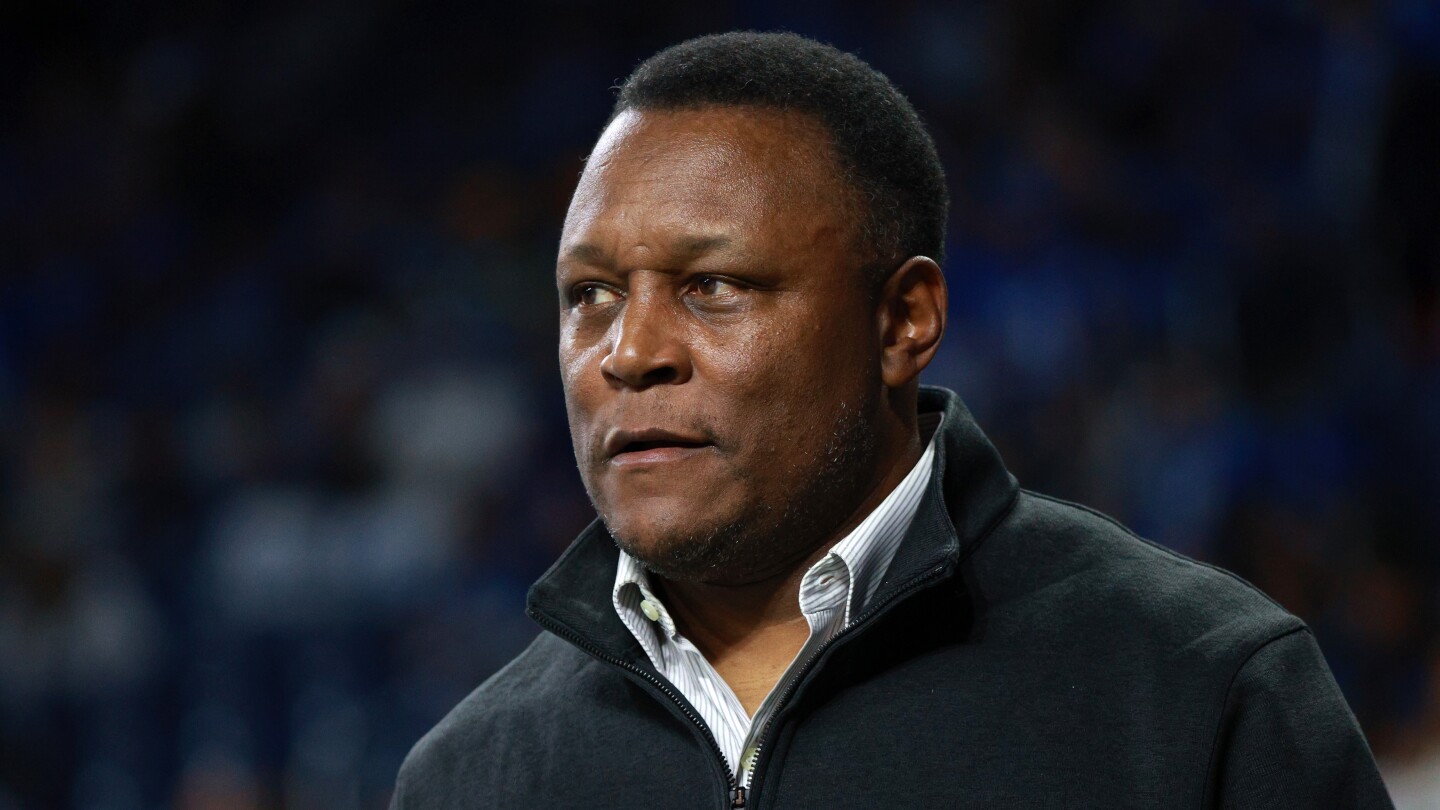

Barry Sanders On His Road To Recovery A Call To Action For Heart Health

Jun 14, 2025

Barry Sanders On His Road To Recovery A Call To Action For Heart Health

Jun 14, 2025 -

In Depth Report The Latest From The Korn Ferry Tour News Conference

Jun 14, 2025

In Depth Report The Latest From The Korn Ferry Tour News Conference

Jun 14, 2025