Sunnova's Financial Troubles: What Does It Mean For The Future Of Solar Power?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Sunnova's Financial Troubles: What Does it Mean for the Future of Solar Power?

Sunnova Energy International Inc., a leading residential solar energy provider, has recently faced significant financial headwinds, raising concerns about its future and the broader implications for the solar power industry. The company's stock price has plummeted, prompting questions about its long-term viability and the potential impact on the burgeoning renewable energy sector. But does Sunnova's struggle signal a broader crisis, or is it an isolated case reflecting specific challenges within the industry? Let's delve into the details.

Sunnova's Financial Challenges: A Closer Look

Sunnova's financial troubles stem from a confluence of factors. High interest rates, impacting financing options for both Sunnova and its customers, have played a significant role. Increased competition in the solar market, with a growing number of players vying for market share, has also exerted pressure on profit margins. Furthermore, supply chain disruptions and inflationary pressures have added to the company's operational challenges.

These factors have combined to create a perfect storm, resulting in:

- Decreased profitability: Sunnova has reported lower-than-expected profits, raising investor concerns about its ability to sustain growth.

- Stock price decline: The company's stock has experienced a substantial drop, eroding investor confidence.

- Debt burden: Managing its existing debt load has become a major concern for Sunnova.

Implications for the Solar Industry: A Broader Perspective

While Sunnova's struggles are noteworthy, it's crucial to avoid generalizing its predicament to the entire solar industry. The solar energy sector remains robust, driven by strong demand, government incentives like the Inflation Reduction Act (IRA), and increasing environmental awareness. However, Sunnova's difficulties highlight some inherent challenges within the industry:

- Financing risks: The sensitivity of the solar industry to interest rate fluctuations is a key takeaway. Securing affordable financing remains crucial for both companies and consumers.

- Competitive pressures: The competitive landscape is intensifying, requiring companies to innovate and optimize their business models to stay ahead.

- Supply chain vulnerabilities: Dependence on global supply chains exposes the industry to potential disruptions, impacting project timelines and costs.

The Future of Sunnova and the Solar Market

Sunnova is actively working to address its challenges, implementing cost-cutting measures and refining its business strategy. The success of these efforts will be crucial in determining its long-term prospects. However, the company's experience serves as a valuable lesson for other players in the solar industry:

- Diversification of funding sources: Reducing reliance on single funding streams is essential for mitigating risk.

- Operational efficiency improvements: Streamlining processes and optimizing costs are critical for maintaining profitability in a competitive market.

- Strategic partnerships: Collaborations with other companies can offer access to new technologies, markets, and resources.

The solar power industry's future remains bright, driven by long-term growth potential and increasing global demand for renewable energy. Sunnova's situation, while concerning, doesn't signal a systemic crisis. Instead, it serves as a cautionary tale, emphasizing the importance of prudent financial management, strategic adaptability, and resilience in the face of economic headwinds. The industry needs to learn from Sunnova's experience to build a more sustainable and resilient future.

Keywords: Sunnova, solar power, renewable energy, financial troubles, stock price, solar industry, Inflation Reduction Act, IRA, financing, competition, supply chain, profitability, debt.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Sunnova's Financial Troubles: What Does It Mean For The Future Of Solar Power?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

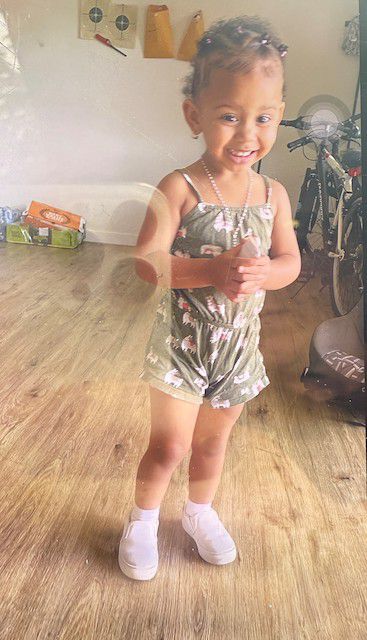

Tacoma Police Issue Amber Alert 2 Year Old Child Missing

Jun 15, 2025

Tacoma Police Issue Amber Alert 2 Year Old Child Missing

Jun 15, 2025 -

Green Aviation Takes Flight A Look At This Companys Breakthrough

Jun 15, 2025

Green Aviation Takes Flight A Look At This Companys Breakthrough

Jun 15, 2025 -

Missing Child Subject Of Amber Alert Returned Home Safely

Jun 15, 2025

Missing Child Subject Of Amber Alert Returned Home Safely

Jun 15, 2025 -

Urgent Amber Alert 2 Year Old Abducted In Tacoma Washington

Jun 15, 2025

Urgent Amber Alert 2 Year Old Abducted In Tacoma Washington

Jun 15, 2025 -

Urgent Amber Alert Issued For Child Kidnapping At Tacoma Wendys

Jun 15, 2025

Urgent Amber Alert Issued For Child Kidnapping At Tacoma Wendys

Jun 15, 2025