Sunnova's Chapter 11: What It Means For Solar Energy Investments

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Sunnova's Chapter 11 Filing: A Shockwave Through the Solar Energy Investment Landscape

Sunnova Energy International Inc., a prominent residential solar energy provider, recently filed for Chapter 11 bankruptcy protection, sending ripples of concern throughout the solar investment community. This unexpected move raises significant questions about the future of solar energy investments and the overall health of the sector. While the company maintains it's restructuring to strengthen its financial position, the implications are far-reaching and require careful examination.

What does Chapter 11 mean for Sunnova and its investors?

Chapter 11 bankruptcy allows a company to reorganize its finances while continuing operations. Sunnova aims to restructure its debt, renegotiate contracts, and ultimately emerge stronger. However, this process is complex and uncertain. Existing investors may experience a loss of value, potentially seeing their holdings diluted or even rendered worthless depending on the restructuring plan. The outcome will largely depend on the success of the company's reorganization efforts and the court's approval of its proposed plan.

Impact on the broader solar energy investment market:

Sunnova's bankruptcy filing casts a shadow over the burgeoning solar energy investment market. While the company's challenges are partly attributed to specific circumstances, such as debt load and macroeconomic factors, it underscores potential risks inherent in solar investments. This event could lead to:

- Increased scrutiny of solar companies: Investors will likely scrutinize the financial health and business models of other solar companies more rigorously. This heightened due diligence could make securing financing more challenging for some players in the industry.

- Potential slowdown in investments: The news may cause hesitation among potential investors, leading to a temporary slowdown in funding for solar projects and companies. This could hinder the growth of the sector in the short term.

- Shifting market dynamics: The restructuring could create opportunities for competitors to gain market share and consolidate their position within the industry.

H2: Analyzing the Underlying Causes:

Several factors contributed to Sunnova's financial difficulties. High debt levels accumulated through acquisitions and expansion played a significant role. The company also faced challenges related to rising interest rates and supply chain disruptions, which impacted profitability and cash flow. Understanding these underlying issues is crucial for investors to assess the broader risks in the sector.

H2: Looking Ahead: Opportunities and Challenges:

Despite the setback, the long-term outlook for the solar energy industry remains positive. The global push towards renewable energy sources continues to drive demand. However, investors need to exercise caution and conduct thorough due diligence before committing capital. Diversification across various solar companies and technologies can mitigate risk.

H3: Key Takeaways for Investors:

- Thorough due diligence is crucial: Carefully examine the financial statements and business models of any solar company before investing.

- Consider diversification: Don't put all your eggs in one basket. Diversify investments across different solar companies and technologies.

- Stay informed: Keep up-to-date on industry news and trends to make informed decisions.

- Consult with financial advisors: Seek professional advice before making any significant investment decisions.

Sunnova's Chapter 11 filing serves as a stark reminder of the inherent risks in any investment, especially in a rapidly evolving sector like solar energy. While the long-term prospects for renewable energy remain bright, this event highlights the importance of careful analysis, strategic diversification, and a thorough understanding of the market before committing capital. The situation warrants close monitoring as Sunnova navigates its restructuring process, and its outcome will significantly influence the future trajectory of solar energy investments.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Sunnova's Chapter 11: What It Means For Solar Energy Investments. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

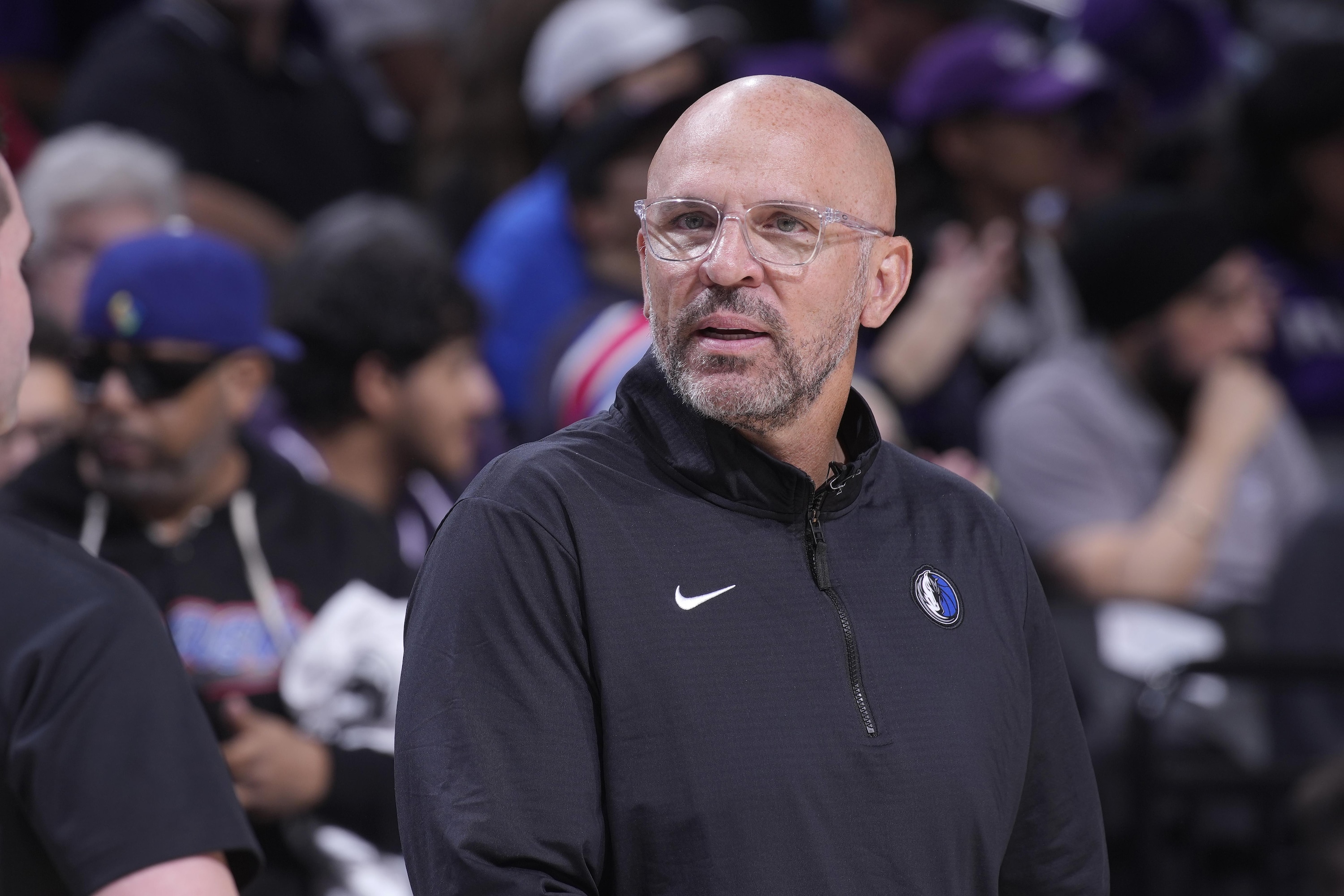

New York Knicks Dallas Mavericks Feasibility Of A Jason Kidd Trade

Jun 16, 2025

New York Knicks Dallas Mavericks Feasibility Of A Jason Kidd Trade

Jun 16, 2025 -

Coach Giraldez Absent For Washington Spirits Game Against Portland Thorns

Jun 16, 2025

Coach Giraldez Absent For Washington Spirits Game Against Portland Thorns

Jun 16, 2025 -

From Hawkins To Broadway Maya Hawkes New York Theater Performance

Jun 16, 2025

From Hawkins To Broadway Maya Hawkes New York Theater Performance

Jun 16, 2025 -

Opposition Mounts Veterans Reject Trumps Vision For A Military Parade

Jun 16, 2025

Opposition Mounts Veterans Reject Trumps Vision For A Military Parade

Jun 16, 2025 -

Oklahomas Gotterup Dominates Leads Us Open After Suspension

Jun 16, 2025

Oklahomas Gotterup Dominates Leads Us Open After Suspension

Jun 16, 2025