Sunnova Bankruptcy Filing: Assessing The Risks And Opportunities In Solar Power

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Sunnova Bankruptcy Filing: Assessing the Risks and Opportunities in Solar Power

The recent news of Sunnova Energy International Inc. exploring strategic alternatives, including a potential bankruptcy filing, sent shockwaves through the solar power industry. While the company has since clarified that it's not currently filing for bankruptcy, the possibility highlights crucial questions about the sector's stability and future trajectory. This event underscores both the inherent risks and exciting opportunities within the burgeoning renewable energy market.

Understanding Sunnova's Situation:

Sunnova, a leading residential solar installer and energy services provider, faces challenges common to many companies in the rapidly evolving solar landscape. High debt levels, coupled with rising interest rates and potential supply chain disruptions, have squeezed profitability. The company's exploration of strategic options suggests a need for restructuring to navigate these financial headwinds. This situation isn't unique to Sunnova; many solar companies are grappling with similar pressures, making this a pivotal moment for industry analysis.

Risks in the Solar Power Sector:

The Sunnova situation highlights several key risks within the solar power industry:

- High Debt Levels: Many solar companies have taken on significant debt to fuel expansion. Rising interest rates increase the cost of servicing this debt, impacting profitability and financial stability.

- Supply Chain Disruptions: Global supply chains continue to be volatile, impacting the availability and cost of essential components like solar panels and inverters. This can lead to project delays and increased expenses.

- Regulatory Uncertainty: Changes in government policies and regulations, including tax credits and incentives, can significantly impact the financial viability of solar projects. This uncertainty creates risk for investors and developers.

- Competition: The solar industry is increasingly competitive, with numerous players vying for market share. This competition can pressure pricing and profit margins.

Opportunities Despite the Challenges:

Despite these risks, the long-term outlook for the solar power sector remains overwhelmingly positive. The global push towards renewable energy, driven by climate change concerns and energy security considerations, presents significant opportunities:

- Growing Demand: The demand for clean energy continues to rise exponentially, creating a huge market for solar power solutions. This demand is fueled by both residential and commercial sectors.

- Technological Advancements: Continuous innovation in solar technology is leading to increased efficiency and reduced costs, making solar power increasingly competitive with fossil fuels.

- Government Support: Many governments worldwide are implementing policies to support the growth of renewable energy, including tax incentives, subsidies, and mandates for renewable energy adoption. This governmental support acts as a catalyst for industry growth.

- Energy Independence: Solar power offers a pathway towards greater energy independence, reducing reliance on volatile global energy markets.

Navigating the Future:

The Sunnova situation serves as a cautionary tale, emphasizing the importance of prudent financial management and risk mitigation within the solar industry. Companies need to carefully manage their debt, diversify their supply chains, and adapt to evolving regulatory landscapes. However, the underlying growth potential of the solar power sector remains substantial. Investors and developers who can navigate these challenges effectively stand to reap significant rewards. The industry needs to focus on sustainable growth models, ensuring long-term viability alongside the pursuit of renewable energy goals.

Call to Action: Stay informed about developments in the solar energy sector. Follow reputable news sources and industry analyses to stay abreast of the latest trends and challenges. Understanding the risks and opportunities is crucial for making informed decisions in this dynamic market.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Sunnova Bankruptcy Filing: Assessing The Risks And Opportunities In Solar Power. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Fias Amended Statutes Reactions And Future Implications

Jun 16, 2025

Fias Amended Statutes Reactions And Future Implications

Jun 16, 2025 -

Israel Iran Conflict Missile Strikes Prompt Fierce Warning From Jerusalem

Jun 16, 2025

Israel Iran Conflict Missile Strikes Prompt Fierce Warning From Jerusalem

Jun 16, 2025 -

Tragedy Strikes Minnesota Elected Official And Spouse Dead In Apparent Targeted Attack

Jun 16, 2025

Tragedy Strikes Minnesota Elected Official And Spouse Dead In Apparent Targeted Attack

Jun 16, 2025 -

Gordon On Horsepower Experience And Expertise From A 4 Time Winner

Jun 16, 2025

Gordon On Horsepower Experience And Expertise From A 4 Time Winner

Jun 16, 2025 -

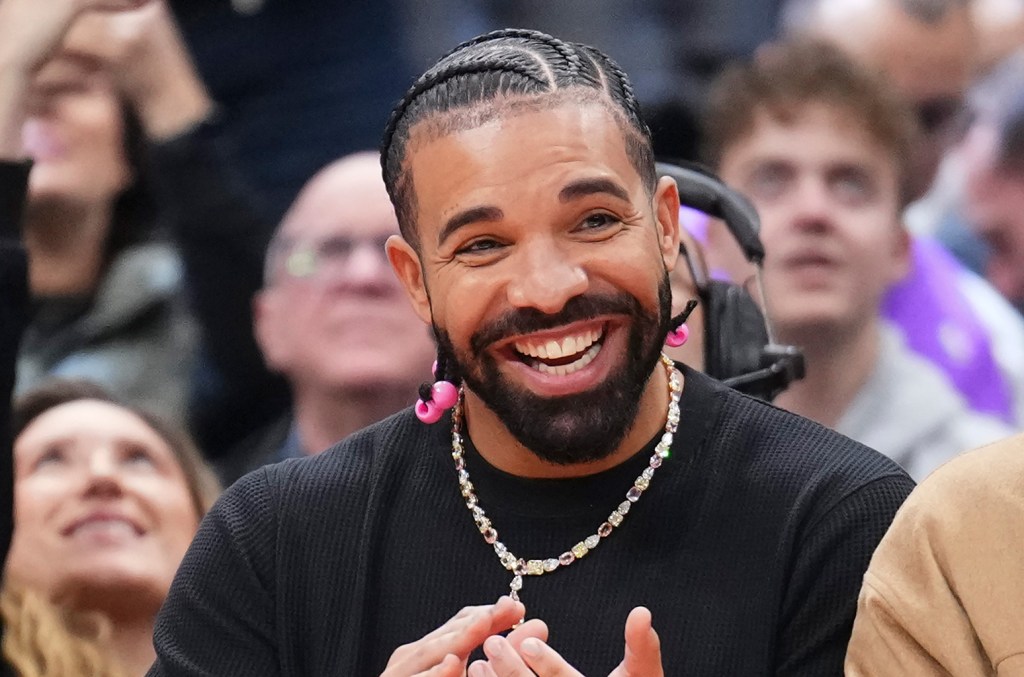

Drakes Somebody Loves Me Cash Giveaway Kai Cenat Joins During Kendrick Lamar Concert

Jun 16, 2025

Drakes Somebody Loves Me Cash Giveaway Kai Cenat Joins During Kendrick Lamar Concert

Jun 16, 2025