Sunnova Bankruptcy Filing: A Turning Point For The Solar Energy Market?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Sunnova Bankruptcy Filing: A Turning Point for the Solar Energy Market?

The recent news of Sunnova Energy International Inc., a prominent residential solar energy provider, filing for Chapter 11 bankruptcy protection has sent shockwaves through the industry. While the company insists this is a strategic restructuring move to alleviate debt and improve its financial position, many are questioning whether this marks a significant turning point for the broader solar energy market. The implications are complex and far-reaching, prompting serious consideration of the future of residential solar installations and investor confidence.

Sunnova's Stumble: A Deeper Dive

Sunnova's bankruptcy filing isn't a sudden collapse. The company has been grappling with increasing debt and declining profitability for some time. Several factors contributed to this precarious situation, including:

- Rising interest rates: The Federal Reserve's aggressive interest rate hikes have significantly impacted the cost of borrowing, making financing solar projects more expensive for both consumers and companies like Sunnova.

- Supply chain disruptions: The ongoing global supply chain issues have led to increased costs and delays in procuring necessary equipment for solar installations.

- Competition: The residential solar market is becoming increasingly competitive, with numerous players vying for market share. This intensified competition has squeezed profit margins.

- Regulatory hurdles: Navigating the complex web of state and federal regulations related to renewable energy can be challenging and costly for solar companies.

These challenges, combined with Sunnova's own financial strategies, have culminated in the bankruptcy filing. The company hopes to restructure its debt, streamline operations, and emerge stronger. However, the success of this restructuring remains to be seen.

Ripple Effects Across the Solar Industry

The Sunnova situation raises crucial questions about the health and stability of the wider solar energy sector. While many analysts believe that this is an isolated incident related to Sunnova's specific circumstances, the event could impact:

- Investor confidence: The bankruptcy filing might deter some investors from pouring money into the solar energy sector, potentially hindering the growth of other companies.

- Consumer sentiment: News of a major solar company filing for bankruptcy could create uncertainty and hesitation among potential customers considering solar panel installations.

- Financing options: Lenders might become more cautious about extending credit to solar companies, potentially making it harder for smaller players to secure funding.

Is This a Turning Point, or a Temporary Setback?

The long-term implications of Sunnova's bankruptcy are uncertain. While it undoubtedly presents challenges, it also offers opportunities. The restructuring could lead to a more efficient and financially sound Sunnova, and it might even force the industry to adapt and innovate, leading to increased resilience in the face of future economic headwinds. The broader solar energy market, however, continues to show significant growth potential driven by increasing demand for renewable energy sources and supportive government policies. Organizations like the continue to highlight the sector's overall strength and projected expansion.

Looking Ahead:

The Sunnova bankruptcy filing serves as a cautionary tale for the solar industry. It underscores the importance of robust financial planning, efficient operations, and navigating the complexities of the market. While the immediate future may hold some uncertainty, the long-term prospects for solar energy remain positive. The industry needs to learn from this event and adapt to ensure continued growth and stability. Further analysis and market observation are crucial in determining whether this is truly a turning point or simply a temporary setback in the journey towards a cleaner energy future. This event highlights the need for more transparent and sustainable business practices within the solar industry. Stay informed and follow reputable news sources for further updates on this developing story.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Sunnova Bankruptcy Filing: A Turning Point For The Solar Energy Market?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

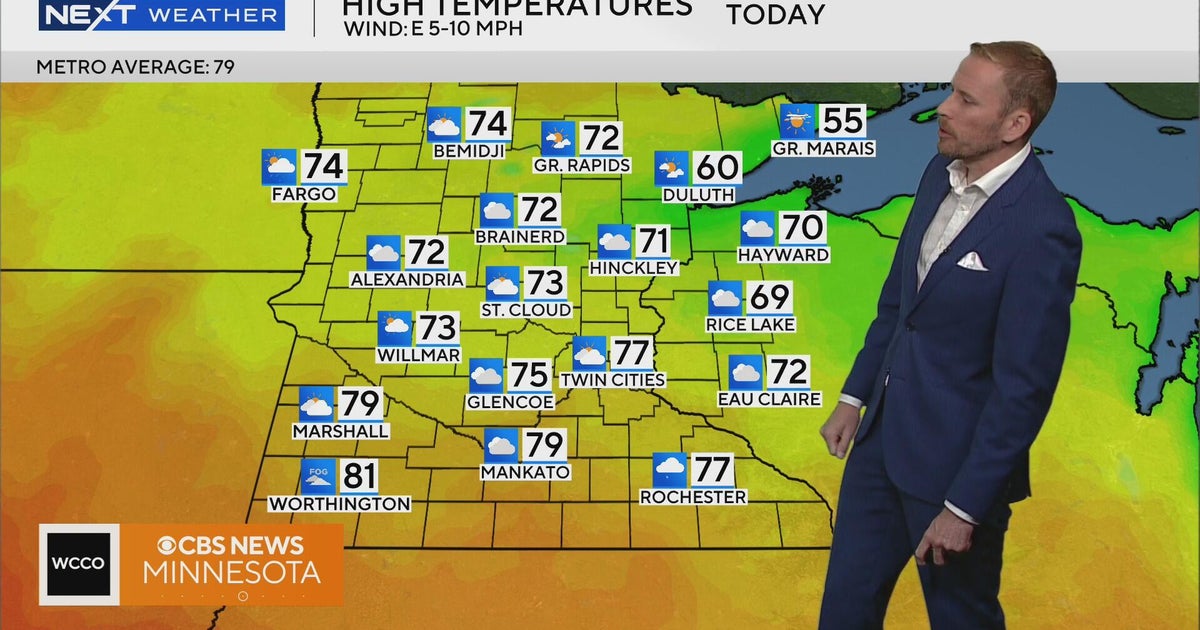

Early Morning Weather Update Minnesota June 15 2025

Jun 17, 2025

Early Morning Weather Update Minnesota June 15 2025

Jun 17, 2025 -

Jonas Brothers Smaller Venues Replace Stadium Tour Dates

Jun 17, 2025

Jonas Brothers Smaller Venues Replace Stadium Tour Dates

Jun 17, 2025 -

What Happens Next Irans Nuclear Program In The Wake Of Israeli Action

Jun 17, 2025

What Happens Next Irans Nuclear Program In The Wake Of Israeli Action

Jun 17, 2025 -

Vote Winner Announced Pedro Neto Claims Chelseas 2024 25 Goal Of The Season Award

Jun 17, 2025

Vote Winner Announced Pedro Neto Claims Chelseas 2024 25 Goal Of The Season Award

Jun 17, 2025 -

Record Setting Win Bayern Munich Dominates Club World Cup

Jun 17, 2025

Record Setting Win Bayern Munich Dominates Club World Cup

Jun 17, 2025