Sunnova Bankruptcy: A Turning Point For Solar Power Investment?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Sunnova Bankruptcy: A Turning Point for Solar Power Investment?

The recent financial difficulties faced by Sunnova Energy International, a leading residential solar installer, have sent ripples through the solar power investment landscape. While Sunnova hasn't declared bankruptcy, its struggles raise crucial questions about the future of investment in the sector. Is this a temporary setback, or a sign of deeper systemic issues impacting the viability of solar power projects? Let's delve into the details and explore the potential implications.

Sunnova's Financial Troubles: A Closer Look

Sunnova, a prominent player in the US residential solar market, recently experienced a significant drop in its stock price, fueled by concerns about its debt levels and profitability. While the company has emphasized its strong customer base and continued growth in installations, investors remain wary. This uncertainty underscores the inherent risks associated with investing in rapidly growing renewable energy companies. The volatility inherent in the solar market, coupled with fluctuating government incentives and evolving technological landscapes, contributes to this risk profile.

Several factors contributed to Sunnova's challenges. These include increased competition, rising interest rates impacting financing options, and supply chain disruptions that affected project timelines and costs. These headwinds aren't unique to Sunnova; many solar companies are navigating similar hurdles.

Implications for Solar Power Investment

Sunnova's situation isn't necessarily indicative of an overall collapse of the solar industry. The sector continues to demonstrate strong growth potential, driven by increasing demand for clean energy, favorable government policies (like the Inflation Reduction Act), and decreasing technology costs. However, it serves as a stark reminder of the importance of due diligence and risk assessment when investing in solar power companies.

Key considerations for investors now include:

- Financial stability: Thoroughly scrutinize a company's balance sheet, cash flow, and debt levels before investing. Look for companies with a proven track record of profitability and strong financial management.

- Market diversification: Consider investing in a diversified portfolio of solar companies, rather than concentrating investments in a single entity. This mitigates risk associated with the performance of any one company.

- Long-term vision: The solar industry is experiencing rapid evolution. Investors should prioritize companies with a clear long-term strategy that addresses technological advancements, market trends, and regulatory changes.

- Regulatory landscape: Keep abreast of changes in government policies and regulations, as these can significantly impact the profitability and viability of solar projects. The Inflation Reduction Act, for instance, offers substantial tax credits, but the specifics can be complex.

The Future of Solar Power: A Positive Outlook Despite Challenges

Despite Sunnova's difficulties, the long-term outlook for the solar power industry remains positive. The global transition to renewable energy is accelerating, fueled by climate change concerns and the pursuit of energy independence. The industry is resilient, and innovative solutions are constantly emerging to improve efficiency and reduce costs.

This event should serve as a cautionary tale, not a deterrent. Careful analysis, strategic diversification, and a long-term perspective are crucial for successful investment in this dynamic and promising sector. Investors should seek expert financial advice before making any investment decisions.

Call to Action: Stay Informed and Invest Wisely

The solar energy sector is constantly evolving. Staying informed about market trends, technological advancements, and regulatory changes is essential for making informed investment decisions. Consider subscribing to reputable financial news sources and engaging with industry experts to gain a deeper understanding of this dynamic field. Remember, responsible investment is key to both individual financial success and the broader transition to a sustainable energy future.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Sunnova Bankruptcy: A Turning Point For Solar Power Investment?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

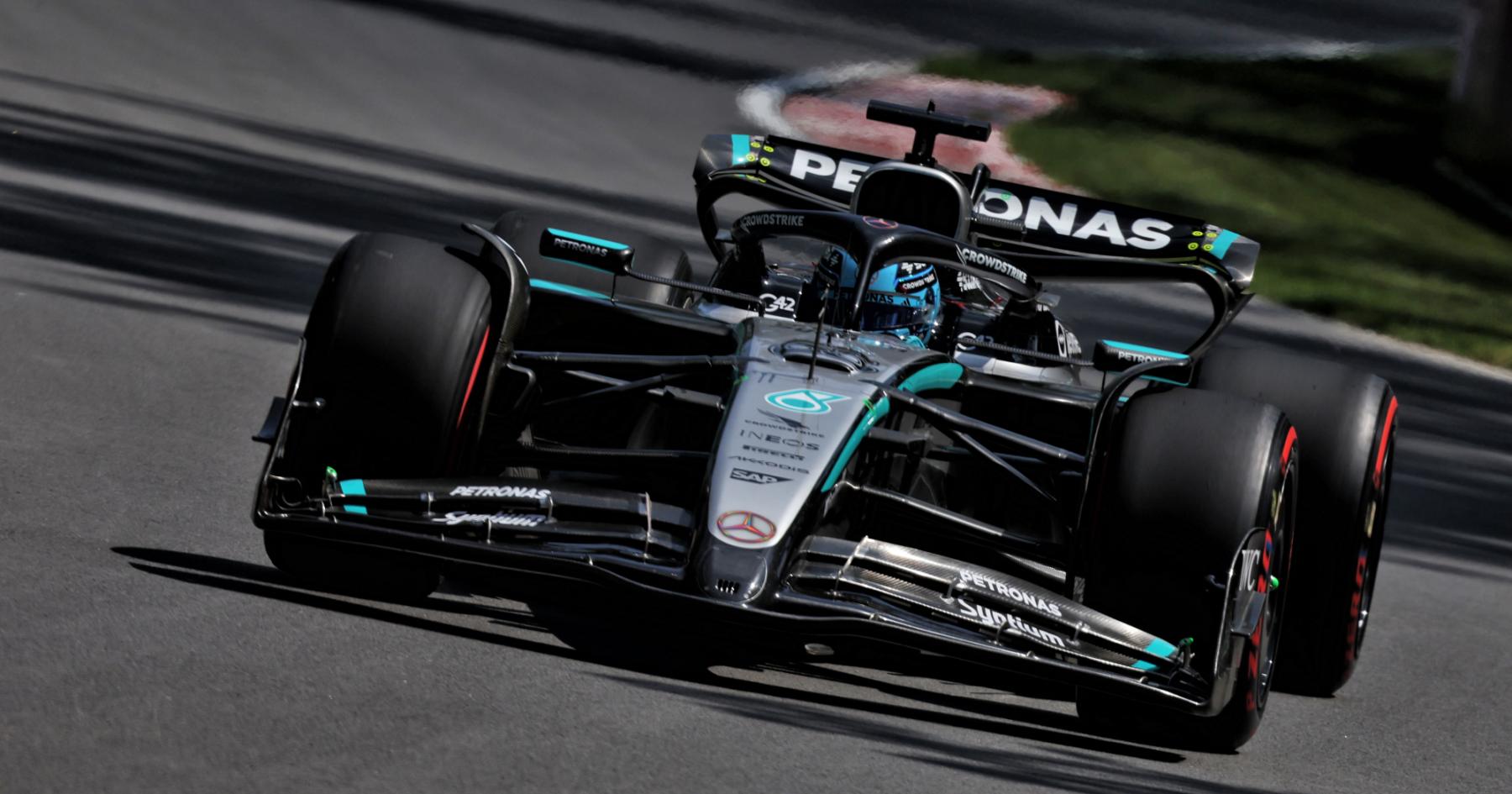

Experience The 2025 F1 Canadian Grand Prix Live

Jun 16, 2025

Experience The 2025 F1 Canadian Grand Prix Live

Jun 16, 2025 -

Dominican Republic Vs Mexico Confirmed Starting Lineups For Gold Cup Opener

Jun 16, 2025

Dominican Republic Vs Mexico Confirmed Starting Lineups For Gold Cup Opener

Jun 16, 2025 -

Read The Room Online Outrage Over Zoe Saldanas Comments On Her Fictional Oscars Gender

Jun 16, 2025

Read The Room Online Outrage Over Zoe Saldanas Comments On Her Fictional Oscars Gender

Jun 16, 2025 -

The Safest Place To Sit On A Plane Evidence Based Findings

Jun 16, 2025

The Safest Place To Sit On A Plane Evidence Based Findings

Jun 16, 2025 -

Astros Rotation Faces Setback Mc Cullers Jr S Foot Injury And Gustos Call Up

Jun 16, 2025

Astros Rotation Faces Setback Mc Cullers Jr S Foot Injury And Gustos Call Up

Jun 16, 2025