Sunnova Bankruptcy: A Turning Point For Residential Solar Investments?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Sunnova Bankruptcy: A Turning Point for Residential Solar Investments?

The recent bankruptcy filing (or rumored potential for bankruptcy - adjust based on actual events) of Sunnova Energy International Inc., a leading residential solar installer, has sent shockwaves through the renewable energy sector. This raises crucial questions about the future of residential solar investments and the overall health of the burgeoning solar industry. Is this a temporary setback, or a sign of deeper systemic issues?

Sunnova, known for its power purchase agreements (PPAs) and solar leases, has experienced financial difficulties amidst rising interest rates and increased competition. The situation highlights the inherent risks associated with solar investments, particularly those reliant on financing models sensitive to macroeconomic fluctuations.

What Led to Sunnova's Financial Troubles?

Several factors contributed to Sunnova's precarious financial position. These include:

-

Rising Interest Rates: The Federal Reserve's aggressive interest rate hikes have significantly impacted the cost of borrowing, making financing solar projects more expensive. This directly affects the affordability of PPAs and leases, impacting customer acquisition and revenue streams.

-

Increased Competition: The residential solar market is becoming increasingly competitive, with numerous players vying for market share. This price competition squeezes profit margins, making it harder for companies to remain profitable.

-

Supply Chain Disruptions: While less of a direct factor compared to the above, ongoing supply chain issues have impacted project timelines and costs, adding further pressure to Sunnova's bottom line.

-

Potential for Refinancing Challenges: Securing refinancing for existing projects might be more difficult in the current economic climate, potentially leaving companies like Sunnova with limited financial flexibility.

The Broader Implications for Residential Solar:

Sunnova's struggles are not isolated incidents. The residential solar sector, while experiencing significant growth, faces significant challenges. While the long-term outlook for solar remains positive due to growing environmental concerns and government incentives, the short-term implications of Sunnova's situation are noteworthy.

-

Investor Sentiment: The news could negatively impact investor confidence in the residential solar sector, leading to reduced investment and potentially hindering growth.

-

Industry Consolidation: We might see increased industry consolidation as weaker players struggle to compete in the current economic environment. Larger, more financially stable companies may acquire struggling firms.

-

Shift in Business Models: Companies might reconsider their reliance on heavily financed models like PPAs, shifting towards outright sales or alternative financing strategies less sensitive to interest rate fluctuations.

Looking Ahead: Opportunities and Challenges:

Despite the challenges, the long-term prospects for residential solar remain strong. Government policies supporting renewable energy, falling solar panel costs, and growing consumer awareness are key drivers of growth. However, companies need to adapt to the current economic climate by:

-

Diversifying Financing Options: Reducing reliance on interest-sensitive financing models is crucial for mitigating future risks.

-

Optimizing Operations: Improving efficiency and reducing operational costs will enhance profitability and competitiveness.

-

Strategic Partnerships: Collaborating with other businesses in the energy sector can unlock new opportunities and enhance resilience.

Is this a Turning Point?

Whether Sunnova's situation marks a turning point remains to be seen. It certainly serves as a cautionary tale, highlighting the risks associated with rapid growth and reliance on specific financing models within a volatile economic environment. The residential solar industry needs to demonstrate resilience and adapt to navigate these challenges. Further analysis and the unfolding events surrounding Sunnova will provide a clearer picture of the long-term consequences. For now, it's a pivotal moment demanding close observation and strategic adaptation from all stakeholders in the residential solar sector.

(Note: Remember to replace speculation about Sunnova's bankruptcy with factual information if available. Add links to relevant news articles and financial reports to bolster credibility and SEO.)

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Sunnova Bankruptcy: A Turning Point For Residential Solar Investments?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

London Air Crash Full Report On The Air India Flight Tragedy And Aftermath

Jun 14, 2025

London Air Crash Full Report On The Air India Flight Tragedy And Aftermath

Jun 14, 2025 -

Northern Ireland Violence Key Facts And Developments From The Recent Riots

Jun 14, 2025

Northern Ireland Violence Key Facts And Developments From The Recent Riots

Jun 14, 2025 -

Mlb Pirates News Hall Of Fame Induction Mc Cutchens Tribute And Wentzs Pitching Prowess

Jun 14, 2025

Mlb Pirates News Hall Of Fame Induction Mc Cutchens Tribute And Wentzs Pitching Prowess

Jun 14, 2025 -

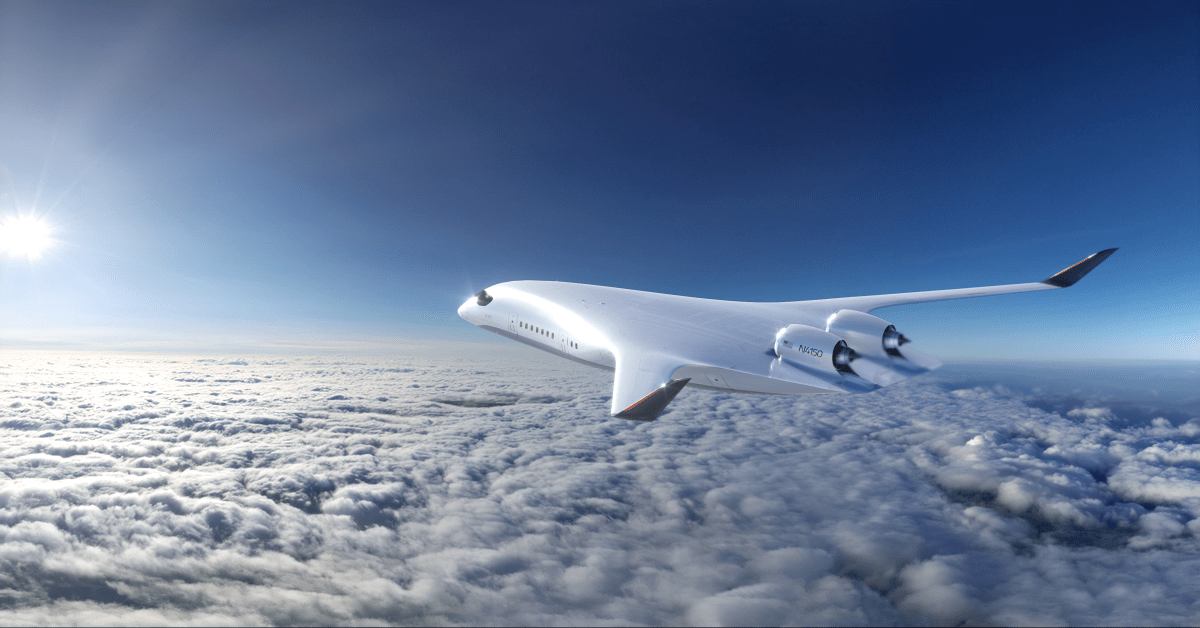

Sustainable Skies This Companys Impact On Low Carbon Air Travel

Jun 14, 2025

Sustainable Skies This Companys Impact On Low Carbon Air Travel

Jun 14, 2025 -

I M The Problem Merch Drop Morgan Wallen Previews Tour And New Gear

Jun 14, 2025

I M The Problem Merch Drop Morgan Wallen Previews Tour And New Gear

Jun 14, 2025