StubHub's Initial Public Offering: $22-$25 Per Share, $9.2 Billion Goal

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

StubHub's IPO Aims High: $22-$25 Per Share, Targeting $9.2 Billion Valuation

StubHub, the popular online ticket marketplace, is gearing up for its highly anticipated initial public offering (IPO), aiming for a valuation between $9 billion and $9.5 billion. The company has set a price range of $22 to $25 per share for its offering, signaling strong investor confidence despite a fluctuating market. This move marks a significant milestone for StubHub, transforming it from a privately held company to a publicly traded entity.

The IPO, expected to generate significant buzz in the financial world, represents a substantial opportunity for both StubHub and its investors. The planned offering of approximately 370 million shares could inject a much-needed boost into the company's growth strategy and expansion plans. This comes at a time when the secondary ticket market is experiencing both growth and increased competition.

A Look at StubHub's Market Position

StubHub has long held a dominant position in the online ticket resale market. Its user-friendly platform, extensive inventory, and strong brand recognition have contributed significantly to its success. However, the company faces stiff competition from other players such as Vivid Seats and SeatGeek, necessitating a strategic approach to maintain its market leadership. The IPO proceeds will likely be used to fund technological advancements, enhance customer experience, and potentially explore acquisitions to further consolidate its market share.

Challenges and Opportunities in the Secondary Ticket Market

The secondary ticket market is a dynamic and often volatile environment. Factors such as fluctuating demand, ticket pricing regulations, and the rise of dynamic pricing models present significant challenges. However, StubHub's proven track record and substantial brand recognition position it well to navigate these challenges. The IPO could also provide the company with the financial resources needed to adapt to evolving market trends and invest in innovative solutions to maintain its competitive edge.

Key aspects of StubHub's IPO Strategy:

- Strong Brand Recognition: StubHub's well-established brand is a major asset, attracting both buyers and sellers to its platform.

- Technological Innovation: Continuous investment in technology is crucial for improving the user experience and combating fraud.

- Strategic Partnerships: Collaborations with event venues and organizers can provide access to exclusive ticket inventory.

- Global Expansion: Expanding into new international markets offers significant growth potential.

What the IPO Means for Investors

The IPO presents a compelling investment opportunity for those seeking exposure to the growing online ticket resale market. However, potential investors should carefully consider the risks associated with investing in a publicly traded company, particularly in a volatile sector. Analyzing StubHub's financial performance, competitive landscape, and future growth prospects is crucial before making any investment decisions. It is advisable to consult with a financial advisor before investing.

The Future of StubHub

StubHub's IPO represents a crucial turning point in the company's history. Success in the public markets will depend on its ability to adapt to changing market dynamics, maintain its competitive edge, and deliver strong financial performance. The company's future growth trajectory will likely be influenced by its ability to innovate, expand into new markets, and solidify its position as a leading player in the ever-evolving world of online ticket sales.

Call to action: Stay informed about the latest developments in the IPO market by subscribing to our newsletter or following us on social media for continuous updates. Learn more about investing in IPOs [link to reputable financial news source].

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on StubHub's Initial Public Offering: $22-$25 Per Share, $9.2 Billion Goal. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Inside The Cdc Departures And The Rise Of Anti Vaccine Sentiment

Sep 09, 2025

Inside The Cdc Departures And The Rise Of Anti Vaccine Sentiment

Sep 09, 2025 -

Are Mortgage Rates At Their Lowest Since October 2024

Sep 09, 2025

Are Mortgage Rates At Their Lowest Since October 2024

Sep 09, 2025 -

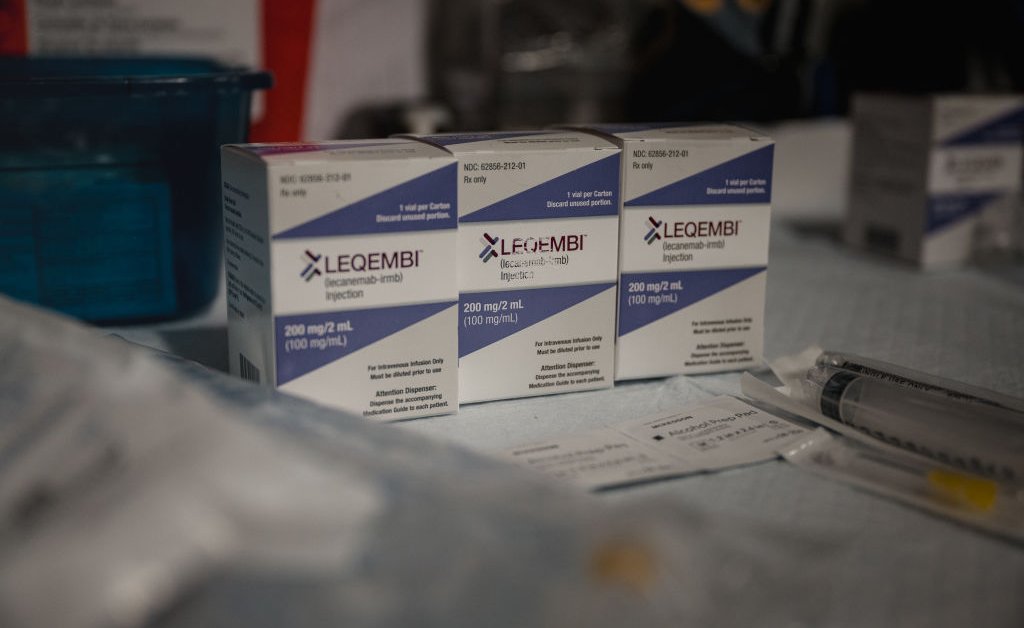

Self Injectable Alzheimers Medication Safety Efficacy And Accessibility

Sep 09, 2025

Self Injectable Alzheimers Medication Safety Efficacy And Accessibility

Sep 09, 2025 -

J J Watt Unleashes On Justin Fields Analyzing The Heated Exchange

Sep 09, 2025

J J Watt Unleashes On Justin Fields Analyzing The Heated Exchange

Sep 09, 2025 -

Stock Market Rally Will Wall Street Hit New Record This Week

Sep 09, 2025

Stock Market Rally Will Wall Street Hit New Record This Week

Sep 09, 2025

Latest Posts

-

From Gridiron To Green Screen J J Watts Transition To Cbs And The Lessons From Romo

Sep 09, 2025

From Gridiron To Green Screen J J Watts Transition To Cbs And The Lessons From Romo

Sep 09, 2025 -

Sherrone Moore Suspended Biff Poggi Takes The Helm For Michigan

Sep 09, 2025

Sherrone Moore Suspended Biff Poggi Takes The Helm For Michigan

Sep 09, 2025 -

Wall Street Rallies S And P 500 Nasdaq And Dow Higher Ahead Of Inflation Data

Sep 09, 2025

Wall Street Rallies S And P 500 Nasdaq And Dow Higher Ahead Of Inflation Data

Sep 09, 2025 -

Supreme Court Upholds Trump Era Immigration Raids Live Updates

Sep 09, 2025

Supreme Court Upholds Trump Era Immigration Raids Live Updates

Sep 09, 2025 -

The Evolution Of Armani Tracing The Iconic Looks That Shaped A Brand

Sep 09, 2025

The Evolution Of Armani Tracing The Iconic Looks That Shaped A Brand

Sep 09, 2025