StubHub IPO: $9.2 Billion Target, Share Price Set At $22-$25

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

StubHub Aims for $9.2 Billion IPO, Setting Share Price at $22-$25

The secondary ticket marketplace giant, StubHub, is gearing up for a highly anticipated initial public offering (IPO), targeting a valuation of up to $9.2 billion. The company, recently acquired by Viagogo, has set its initial share price range between $22 and $25, signaling strong investor interest despite a challenging economic climate for many tech companies. This move marks a significant milestone for the ticketing industry and could reshape the landscape of how fans access live events.

This IPO comes at a pivotal moment for StubHub, following its acquisition by Viagogo in 2020. The merger aimed to create a global leader in the secondary ticketing market, combining StubHub's established brand recognition in North America with Viagogo's international reach. Now, this IPO represents a significant step towards solidifying that leadership position and unlocking significant capital for future growth and expansion.

A $9.2 Billion Valuation: What Does it Mean?

A valuation of $9.2 billion signifies significant investor confidence in StubHub's future prospects. This figure reflects the company's dominant market share, its robust technology platform, and its potential for growth in both established and emerging markets. However, it's crucial to remember that valuations are subject to market fluctuations and overall investor sentiment. The final valuation will depend on the actual share price achieved during the IPO process.

Share Price Range: $22-$25 – A Calculated Risk?

The chosen share price range of $22-$25 per share represents a calculated strategy by StubHub and its underwriters. This range aims to balance attracting sufficient investor interest while ensuring a fair valuation for existing shareholders. The final price will be determined through the IPO process, taking into account demand from investors.

Challenges and Opportunities in the Secondary Ticketing Market

StubHub faces several challenges in the dynamic secondary ticketing market. Competition from other players, regulatory scrutiny regarding ticket pricing and resale practices, and the ever-present threat of counterfeiting all pose significant hurdles. However, the company also enjoys several significant opportunities. The increasing popularity of live events, the continued growth of online ticket sales, and the potential for expansion into new markets all present avenues for substantial growth.

- Increased Competition: StubHub faces stiff competition from other online ticket marketplaces.

- Regulatory Landscape: The regulatory environment surrounding ticket resale continues to evolve, posing both challenges and opportunities.

- Technological Innovation: Continued investment in technology is crucial for staying ahead of the competition and improving the user experience.

What's Next for StubHub?

The success of StubHub's IPO will depend on several factors, including investor sentiment, market conditions, and the company's ability to execute its long-term growth strategy. This IPO provides a significant opportunity for StubHub to strengthen its position in the market, invest in new technologies, and expand its operations globally. Investors will be closely watching the performance of the stock following the IPO, as it will be a key indicator of the company's future trajectory. The coming weeks will be critical in determining the long-term success of StubHub's ambitious plans.

Are you interested in learning more about the IPO market and similar significant financial events? Stay tuned for further updates and analysis!

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on StubHub IPO: $9.2 Billion Target, Share Price Set At $22-$25. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Us Military Buildup Near Venezuela Trump On Regime Change

Sep 09, 2025

Us Military Buildup Near Venezuela Trump On Regime Change

Sep 09, 2025 -

Historic Low Mortgage Rates Hit October 2024 Levels

Sep 09, 2025

Historic Low Mortgage Rates Hit October 2024 Levels

Sep 09, 2025 -

Michigan Wolverines Football Coaching Change As Poggi Replaces Suspended Moore

Sep 09, 2025

Michigan Wolverines Football Coaching Change As Poggi Replaces Suspended Moore

Sep 09, 2025 -

New Mortgage Rates See How Much Less You Could Pay Each Month

Sep 09, 2025

New Mortgage Rates See How Much Less You Could Pay Each Month

Sep 09, 2025 -

2026 World Cup How Fifa Generated Millions In Revenue Before Public Ticket Sales

Sep 09, 2025

2026 World Cup How Fifa Generated Millions In Revenue Before Public Ticket Sales

Sep 09, 2025

Latest Posts

-

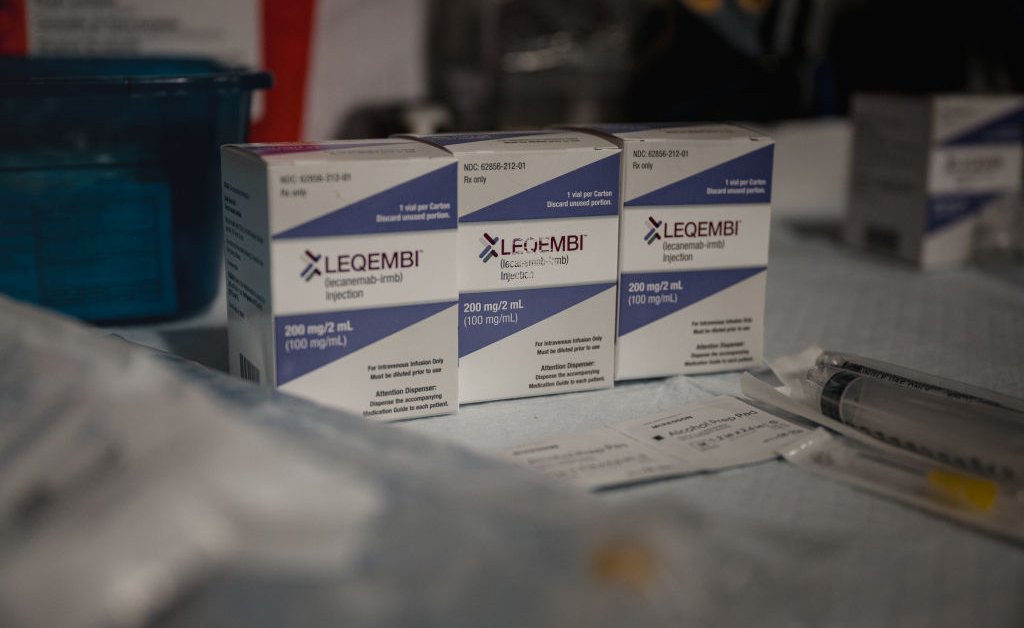

Home Administration Of Alzheimers Medication A New Era Of Treatment

Sep 09, 2025

Home Administration Of Alzheimers Medication A New Era Of Treatment

Sep 09, 2025 -

From Gridiron To Green Screen J J Watts Transition To Cbs And The Lessons From Romo

Sep 09, 2025

From Gridiron To Green Screen J J Watts Transition To Cbs And The Lessons From Romo

Sep 09, 2025 -

Sherrone Moore Suspended Biff Poggi Takes The Helm For Michigan

Sep 09, 2025

Sherrone Moore Suspended Biff Poggi Takes The Helm For Michigan

Sep 09, 2025 -

Wall Street Rallies S And P 500 Nasdaq And Dow Higher Ahead Of Inflation Data

Sep 09, 2025

Wall Street Rallies S And P 500 Nasdaq And Dow Higher Ahead Of Inflation Data

Sep 09, 2025 -

Supreme Court Upholds Trump Era Immigration Raids Live Updates

Sep 09, 2025

Supreme Court Upholds Trump Era Immigration Raids Live Updates

Sep 09, 2025