StubHub Aims For $9.2 Billion IPO, Shares Priced Between $22 And $25

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

StubHub Aims for $9.2 Billion IPO, Shares Priced Between $22 and $25

Ticket Resale Giant Seeks Massive Public Debut

StubHub, the world's leading ticket marketplace, is gearing up for a potentially massive Initial Public Offering (IPO), aiming to raise up to $9.2 billion. The company announced its intention to price shares between $22 and $25, signaling a significant valuation for the online ticket resale giant. This highly anticipated IPO is expected to generate considerable excitement amongst investors and within the broader entertainment industry.

The move marks a significant milestone for StubHub, which has grown exponentially since its inception. This IPO represents a culmination of years of strategic growth, expansion into new markets, and technological innovation in the online ticket resale sector. The company's success hinges on its ability to connect buyers and sellers of tickets for a vast array of events, from concerts and sporting events to theater productions and festivals.

A Look at StubHub's Market Position and Growth Strategy

StubHub's dominance in the secondary ticketing market is undeniable. The company's user-friendly platform, coupled with its robust security measures and wide selection of tickets, has attracted millions of users worldwide. Their success can be attributed to several key factors:

- Wide Event Selection: StubHub boasts a comprehensive catalog of tickets covering a wide range of events and venues globally.

- Secure Transaction Platform: The company prioritizes secure transactions, providing buyers and sellers with a safe and reliable platform.

- User-Friendly Interface: Navigating the StubHub website and app is straightforward, even for first-time users.

- Robust Customer Service: StubHub invests heavily in customer service, ensuring a positive experience for both buyers and sellers.

However, the company also faces challenges. Competition in the online ticket resale market is fierce, with other players vying for market share. Furthermore, the company needs to navigate regulatory hurdles and address concerns surrounding ticket price inflation and scalping.

IPO Details and Market Expectations

The planned IPO of StubHub is expected to be one of the largest in recent years. The pricing range of $22 to $25 per share suggests a strong market confidence in the company's future prospects. However, the actual pricing and overall success of the IPO will depend on various market factors, including investor sentiment and broader economic conditions. Analysts predict high demand for StubHub shares, given the company’s strong brand recognition and market position.

The Future of Ticket Resale and StubHub's Role

StubHub's IPO signifies not just a financial milestone for the company but also a significant moment for the broader ticket resale industry. The company's continued success will depend on its ability to adapt to evolving consumer preferences, embrace technological innovations, and address ethical concerns surrounding ticket pricing and accessibility. As the industry continues to evolve, StubHub's strategic vision and ability to navigate the complexities of the market will be crucial to its long-term success.

Call to Action: Stay tuned for further updates on StubHub's IPO and its impact on the online ticket resale market. What are your thoughts on this significant event? Share your predictions in the comments below!

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on StubHub Aims For $9.2 Billion IPO, Shares Priced Between $22 And $25. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

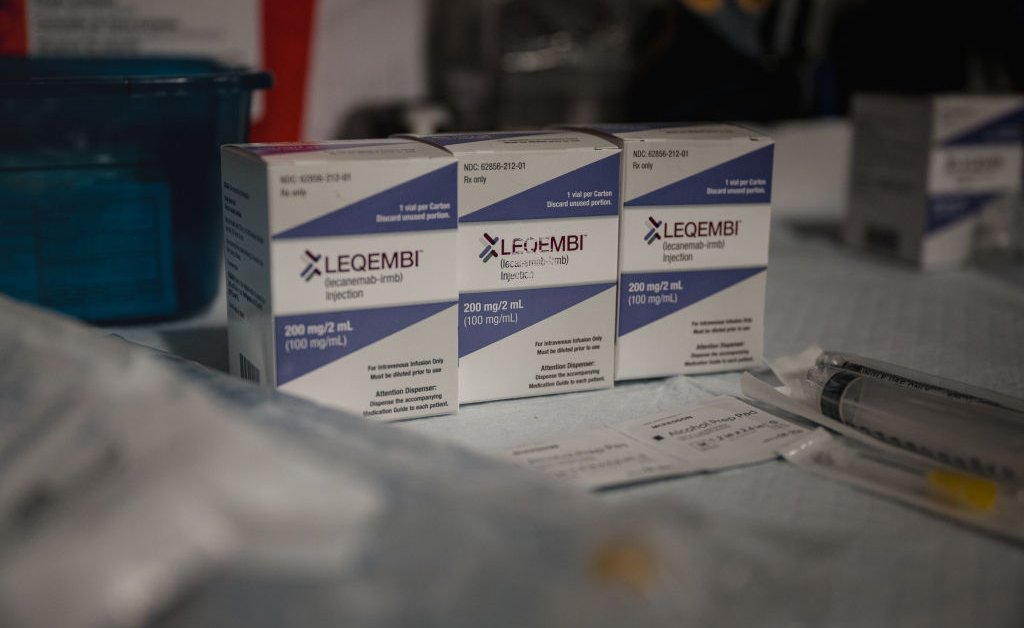

Injectable Alzheimers Drug A Convenient Home Treatment Option

Sep 09, 2025

Injectable Alzheimers Drug A Convenient Home Treatment Option

Sep 09, 2025 -

Commentary Debut Jj Watt Shows Off Edgy New Hairstyle

Sep 09, 2025

Commentary Debut Jj Watt Shows Off Edgy New Hairstyle

Sep 09, 2025 -

The Cdc Brain Drain Examining The Correlation Between Departures And Rfk Jr S Anti Vaccination Crusade

Sep 09, 2025

The Cdc Brain Drain Examining The Correlation Between Departures And Rfk Jr S Anti Vaccination Crusade

Sep 09, 2025 -

Giorgio Armanis Design Legacy Defining Moments In Fashion

Sep 09, 2025

Giorgio Armanis Design Legacy Defining Moments In Fashion

Sep 09, 2025 -

Faith Democracy And The Misunderstanding Of Christian Nationalism

Sep 09, 2025

Faith Democracy And The Misunderstanding Of Christian Nationalism

Sep 09, 2025

Latest Posts

-

From Gridiron To Green Screen J J Watts Transition To Cbs And The Lessons From Romo

Sep 09, 2025

From Gridiron To Green Screen J J Watts Transition To Cbs And The Lessons From Romo

Sep 09, 2025 -

Sherrone Moore Suspended Biff Poggi Takes The Helm For Michigan

Sep 09, 2025

Sherrone Moore Suspended Biff Poggi Takes The Helm For Michigan

Sep 09, 2025 -

Wall Street Rallies S And P 500 Nasdaq And Dow Higher Ahead Of Inflation Data

Sep 09, 2025

Wall Street Rallies S And P 500 Nasdaq And Dow Higher Ahead Of Inflation Data

Sep 09, 2025 -

Supreme Court Upholds Trump Era Immigration Raids Live Updates

Sep 09, 2025

Supreme Court Upholds Trump Era Immigration Raids Live Updates

Sep 09, 2025 -

The Evolution Of Armani Tracing The Iconic Looks That Shaped A Brand

Sep 09, 2025

The Evolution Of Armani Tracing The Iconic Looks That Shaped A Brand

Sep 09, 2025