Strong Q2 Growth Portfolio Boosts Bristol Myers Squibb Share Price

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Strong Q2 Growth Portfolio Boosts Bristol Myers Squibb Share Price

Bristol Myers Squibb (BMS) saw its share price surge following a strong second-quarter performance, driven by robust growth across its diverse portfolio of medicines. The pharmaceutical giant exceeded analysts' expectations, signaling a healthy trajectory for the remainder of the year and bolstering investor confidence. This positive news comes amidst a challenging landscape for the pharmaceutical industry, making BMS's results all the more impressive.

Impressive Q2 Results: Beyond Expectations

BMS reported a significant increase in revenue and earnings per share (EPS) for Q2, surpassing Wall Street projections. This robust performance was attributed to strong sales across several key therapeutic areas, highlighting the effectiveness of the company's diversified strategy. Specifically, the company highlighted exceptional growth in:

-

Immuno-oncology: Sales of their leading immuno-oncology drugs, including Opdivo (nivolumab) and Yervoy (ipilimumab), continued to demonstrate strong momentum. This consistent performance underscores the enduring demand for these crucial cancer treatments. Further research and development in this area are expected to fuel future growth.

-

Cardiovascular Disease: BMS also reported notable success within its cardiovascular portfolio, driven by increased prescriptions and market share gains. This success demonstrates the company's ability to compete effectively in a highly competitive market.

-

Hematology: The company's hematology portfolio also contributed significantly to the overall positive results, reflecting a growing need for effective treatments in this area.

Strategic Investments Fueling Growth

BMS's strategic investments in research and development (R&D) have clearly paid off. The company's commitment to innovation and pipeline development has resulted in a robust portfolio of products, positioning them for continued success in the long term. This commitment to R&D is a crucial factor contributing to their strong Q2 performance and future prospects.

Analyst Reactions and Future Outlook

Analysts have responded positively to BMS's Q2 results, with several firms raising their price targets for the company's stock. This upward revision reflects the strong belief in BMS's continued growth potential. The company's management expressed optimism regarding the remainder of the year, citing the strength of their current portfolio and the promising pipeline of future drugs.

Long-Term Growth Strategy Remains Strong

BMS's strong Q2 results underscore the effectiveness of their long-term growth strategy. This strategy is characterized by:

- A focus on innovation: Consistent investments in R&D ensure a pipeline of innovative therapies to address unmet medical needs.

- Strategic acquisitions: Acquisitions have expanded their portfolio and strengthened their market position. [Link to a relevant article about BMS acquisitions, if available]

- Global reach: A strong global presence allows BMS to capitalize on market opportunities worldwide.

Investment Implications

The strong Q2 performance makes Bristol Myers Squibb an attractive investment prospect for those interested in the pharmaceutical sector. However, it's crucial to conduct thorough research before making any investment decisions. Consult a financial advisor for personalized guidance. [Link to a reputable financial news site]

Conclusion:

Bristol Myers Squibb's impressive Q2 results demonstrate the strength of their diversified portfolio and their commitment to innovation. This positive performance has boosted investor confidence and driven a surge in the company's share price. The future outlook remains promising, indicating continued growth and success for BMS in the years to come. The company's commitment to R&D and strategic acquisitions positions them well to navigate the challenges within the pharmaceutical industry and maintain their leadership position.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Strong Q2 Growth Portfolio Boosts Bristol Myers Squibb Share Price. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Robust Revenue Growth And Expanded Footprint Luckin Coffees Q2 2025 Performance

Aug 01, 2025

Robust Revenue Growth And Expanded Footprint Luckin Coffees Q2 2025 Performance

Aug 01, 2025 -

The 2025 Schedule A Look At The Most Intriguing Contests

Aug 01, 2025

The 2025 Schedule A Look At The Most Intriguing Contests

Aug 01, 2025 -

Battlefield 6 Eas All In Strategy For Massive Success

Aug 01, 2025

Battlefield 6 Eas All In Strategy For Massive Success

Aug 01, 2025 -

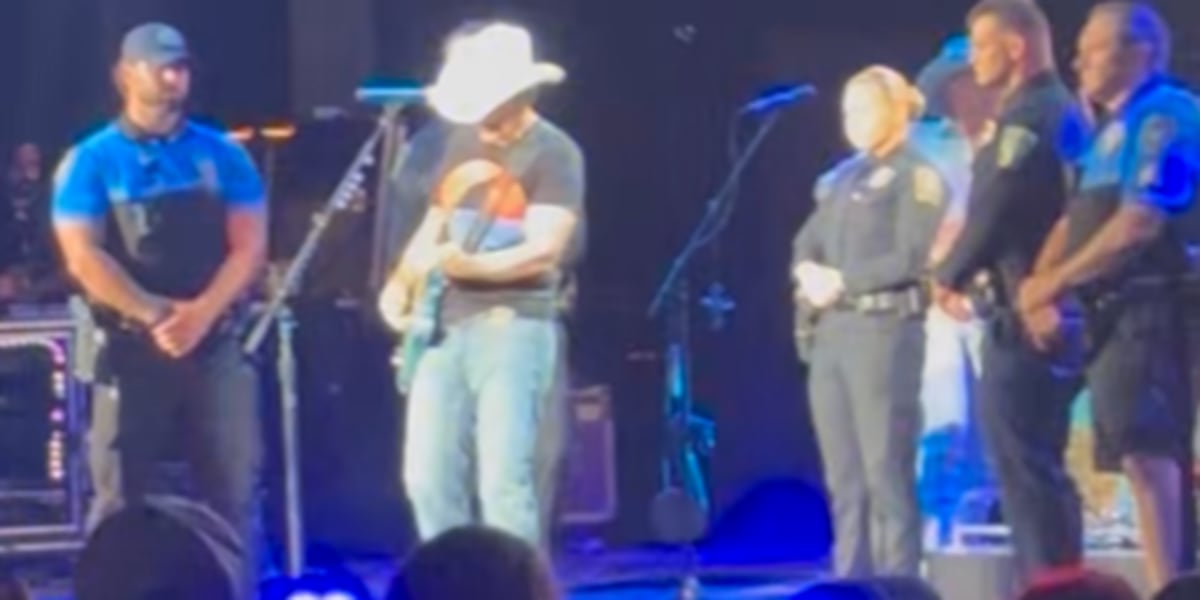

Brad Paisleys Unexpected Guest Performers Wilmingtons Finest

Aug 01, 2025

Brad Paisleys Unexpected Guest Performers Wilmingtons Finest

Aug 01, 2025 -

Predicting 2025 The Most Challenging Straightforward And Compelling Sporting Events

Aug 01, 2025

Predicting 2025 The Most Challenging Straightforward And Compelling Sporting Events

Aug 01, 2025