Stock Market Volatility: S&P 500 And Nasdaq Drop On Fed Rate Hike Speculation And Iran Concerns

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Stock Market Volatility: S&P 500 and Nasdaq Plunge Amidst Fed Rate Hike Fears and Iran Tensions

The stock market experienced a significant downturn on Tuesday, with the S&P 500 and Nasdaq Composite suffering notable losses amidst growing speculation of further Federal Reserve interest rate hikes and escalating tensions in the Middle East concerning Iran. This volatility underscores the interconnectedness of global geopolitical events and monetary policy on investor sentiment and market performance.

Fed Rate Hike Speculation Fuels Market Uncertainty:

The primary driver behind Tuesday's market slump appears to be renewed concerns about the Federal Reserve's future monetary policy. Recent economic data, suggesting persistent inflation, has fueled expectations that the Fed might implement additional interest rate increases to cool down the economy. Higher interest rates generally increase borrowing costs for businesses, potentially slowing economic growth and reducing corporate profits – a major factor influencing stock valuations. This uncertainty has led investors to adopt a more cautious approach, triggering a sell-off in equities. Analysts at [link to reputable financial news source] predict a further rate hike by the end of the year, citing persistent inflationary pressures.

Iran Tensions Add to Market Jitters:

Adding to the market's woes are rising geopolitical concerns surrounding Iran. Recent developments in the region, [mention specific news event relevant to the day's article], have heightened anxieties about potential instability and its impact on global oil prices. Higher oil prices can lead to increased inflation and reduced consumer spending, further dampening economic prospects and impacting corporate earnings. This uncertainty contributes significantly to the overall market volatility.

S&P 500 and Nasdaq Bear the Brunt:

The S&P 500, a broad measure of the US stock market, experienced a [percentage]% drop, while the tech-heavy Nasdaq Composite saw an even steeper decline of [percentage]%. This indicates that investors are particularly apprehensive about the future performance of growth-oriented technology stocks, which are generally more sensitive to interest rate changes. These sectors are often more reliant on borrowed capital for expansion and innovation.

What Does This Mean for Investors?

The current market volatility presents both challenges and opportunities for investors. For long-term investors, this downturn might be viewed as a potential buying opportunity, provided they have a well-diversified portfolio and a long-term investment horizon. However, short-term investors might find themselves facing significant losses.

Key Takeaways:

- Interest Rate Hikes: The prospect of further Fed rate hikes is a major contributor to market uncertainty.

- Geopolitical Risks: Escalating tensions in the Middle East, particularly concerning Iran, add to the overall volatility.

- Sectoral Impact: Technology stocks, represented by the Nasdaq, are disproportionately affected by interest rate changes.

- Investment Strategy: Long-term investors may see buying opportunities, while short-term investors need to exercise caution.

Looking Ahead:

The market's direction in the coming days and weeks will depend heavily on further economic data releases, the Fed's next policy decision, and developments in the geopolitical landscape. Investors are advised to closely monitor these factors and adjust their investment strategies accordingly. Consulting a financial advisor is recommended for personalized advice.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Always conduct thorough research and seek professional guidance before making investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Stock Market Volatility: S&P 500 And Nasdaq Drop On Fed Rate Hike Speculation And Iran Concerns. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Was Tulsi Gabbard Marginalized In Trumps Middle East Policy The Evidence

Jun 21, 2025

Was Tulsi Gabbard Marginalized In Trumps Middle East Policy The Evidence

Jun 21, 2025 -

Bayern Munich Vs Boca Juniors Club World Cup Start Time Lineups And Team News

Jun 21, 2025

Bayern Munich Vs Boca Juniors Club World Cup Start Time Lineups And Team News

Jun 21, 2025 -

Mark Cuban Reveals Harris Campaigns Inquiry Into Vp Vetting Process

Jun 21, 2025

Mark Cuban Reveals Harris Campaigns Inquiry Into Vp Vetting Process

Jun 21, 2025 -

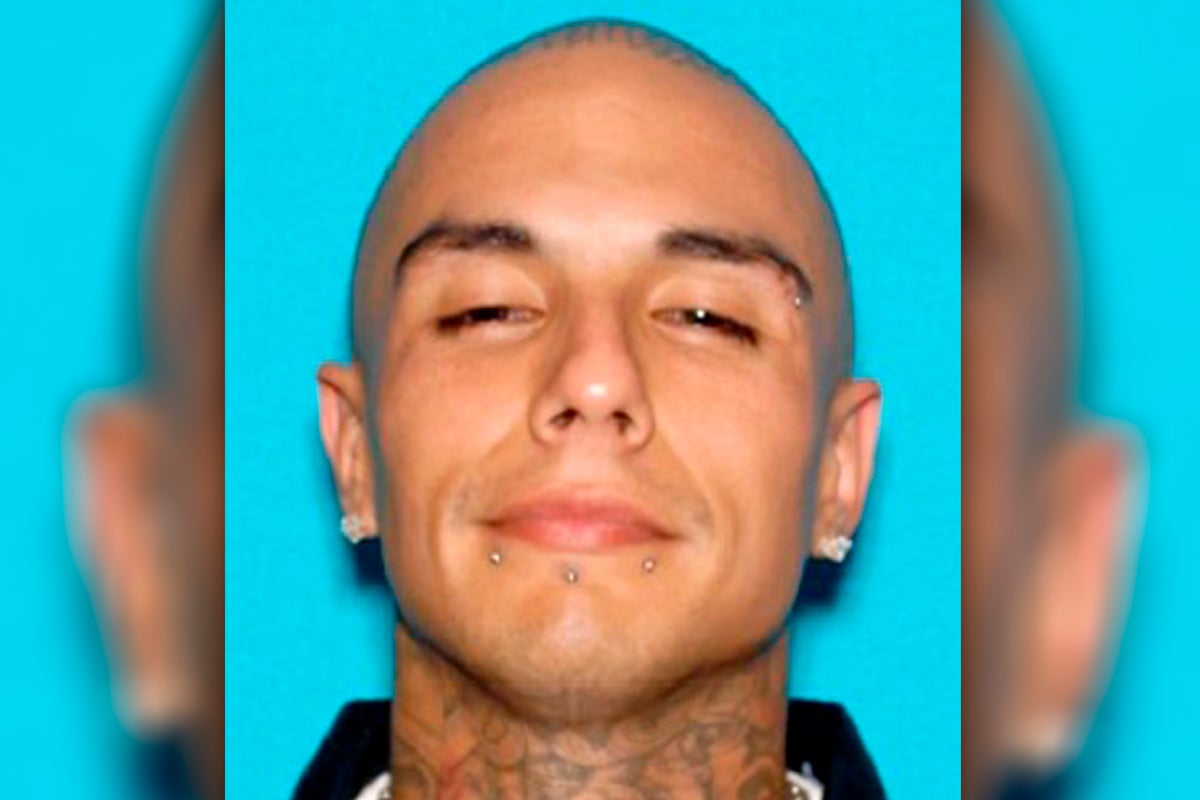

Rapper Targeted 19 Mexican Mafia Members Face Murder Charges

Jun 21, 2025

Rapper Targeted 19 Mexican Mafia Members Face Murder Charges

Jun 21, 2025 -

Mark Cuban Claims Harris Campaign Requested His Papers For Vp Vetting

Jun 21, 2025

Mark Cuban Claims Harris Campaign Requested His Papers For Vp Vetting

Jun 21, 2025