Stock Market Update: S&P 500's Six-Day Rally, Dow And Nasdaq Gains, Moody's Impact

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Stock Market Update: S&P 500's Six-Day Rally, Dow and Nasdaq Gains, and Moody's Downgrade Ripple Effect

The US stock market experienced a significant surge this week, with the S&P 500 enjoying a remarkable six-day winning streak. The Dow Jones Industrial Average and the Nasdaq Composite also saw substantial gains, leaving investors wondering if this marks the start of a sustained bull market or merely a temporary reprieve. However, a shadow looms large: Moody's recent downgrade of several US banking giants has injected a note of caution into the overall positive sentiment.

This article delves into the details of this week's market movements, analyzing the factors contributing to the rally and exploring the potential long-term implications of Moody's actions.

S&P 500's Impressive Run:

The S&P 500's six-day rally is a noteworthy event, pushing the index to its highest levels in months. This positive momentum stems from a confluence of factors, including:

- Easing Inflation Concerns: Recent economic data suggests that inflation might be cooling faster than anticipated, reducing pressure on the Federal Reserve to continue aggressively raising interest rates. This has boosted investor confidence.

- Strong Corporate Earnings: While some companies have reported disappointing earnings, many others have exceeded expectations, fueling optimism about corporate profitability.

- Increased Investor Appetite for Risk: The combination of easing inflation and strong earnings has led to increased investor appetite for riskier assets, including equities.

Dow and Nasdaq Gains Follow Suit:

The Dow Jones Industrial Average and the Nasdaq Composite mirrored the S&P 500's upward trajectory, reflecting a broad-based market rally. The tech-heavy Nasdaq, particularly, benefited from positive sentiment surrounding the AI sector.

Moody's Downgrade: A Cloud on the Horizon?

While the current market optimism is palpable, the recent downgrade of several major US banks by Moody's introduces a significant caveat. This action highlights concerns about the banking sector's vulnerability to rising interest rates and potential economic slowdown. While the immediate market reaction has been relatively muted, the long-term consequences of Moody's assessment remain to be seen. This downgrade could:

- Increase Borrowing Costs: A lower credit rating makes it more expensive for banks to borrow money, potentially impacting lending activities and economic growth.

- Reduce Investor Confidence: The downgrade could erode investor confidence in the banking sector, leading to further market volatility.

- Trigger Further Downgrades: Moody's action might prompt other rating agencies to reassess the creditworthiness of US banks, potentially exacerbating the negative sentiment.

What Lies Ahead?

The current market rally presents a complex picture. While positive economic indicators and strong corporate earnings provide grounds for optimism, the impact of Moody's downgrade cannot be ignored. Investors should proceed with caution, carefully monitoring economic data and regulatory developments. Diversification remains crucial in navigating this period of uncertainty.

Further Reading:

For a deeper understanding of the current economic climate, you may want to explore resources like the Federal Reserve's website () and the latest reports from reputable financial news outlets.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Consult with a qualified financial advisor before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Stock Market Update: S&P 500's Six-Day Rally, Dow And Nasdaq Gains, Moody's Impact. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Tom Aspinall Negotiations And Jon Jones Cryptic Message Fuel Ufc Speculation

May 21, 2025

Tom Aspinall Negotiations And Jon Jones Cryptic Message Fuel Ufc Speculation

May 21, 2025 -

Assassins Creed Valhalla Why Ubisoft Restricted Animal Killing

May 21, 2025

Assassins Creed Valhalla Why Ubisoft Restricted Animal Killing

May 21, 2025 -

Solo Levelings Award Winning Success A Look At The Future

May 21, 2025

Solo Levelings Award Winning Success A Look At The Future

May 21, 2025 -

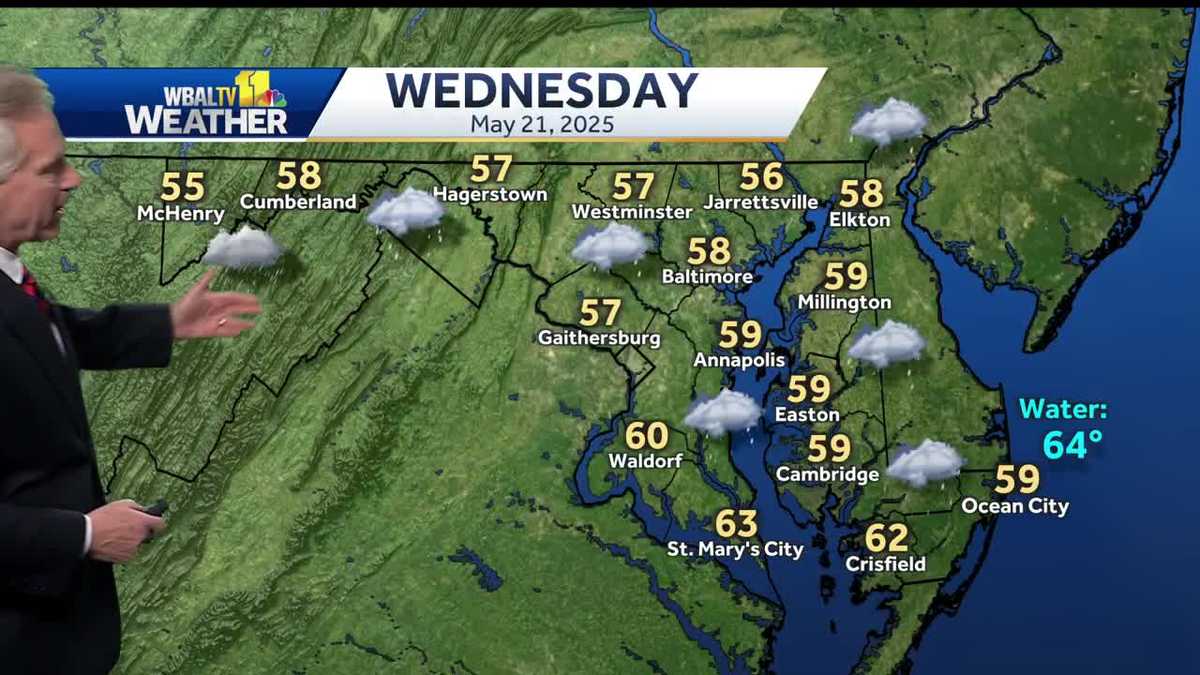

Chilly Rain To Blanket The Region Wednesday Weather Forecast

May 21, 2025

Chilly Rain To Blanket The Region Wednesday Weather Forecast

May 21, 2025 -

Celebrated Web Novel Solo Leveling Awarded For Excellence

May 21, 2025

Celebrated Web Novel Solo Leveling Awarded For Excellence

May 21, 2025