Stock Market Update: Fed Rate Decisions And Iran Tensions Weigh On S&P 500 And Nasdaq

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Stock Market Update: Fed Rate Decisions and Iran Tensions Weigh on S&P 500 and Nasdaq

Wall Street experienced a turbulent week, with the S&P 500 and Nasdaq indices taking a significant hit amidst rising concerns over the Federal Reserve's interest rate hikes and escalating geopolitical tensions in Iran. Investors are grappling with uncertainty as they navigate a complex economic landscape. This volatility underscores the interconnectedness of global events and their impact on the US stock market.

The Federal Reserve's Influence: The Federal Reserve's recent decision to maintain its hawkish stance on interest rates continues to cast a long shadow over market sentiment. While the Fed paused its rate-hiking cycle in June, market analysts widely expect further increases before the year's end. This expectation of continued monetary tightening aims to combat persistent inflation, but it also raises concerns about a potential economic slowdown or even a recession. Higher interest rates increase borrowing costs for businesses, potentially impacting investment and hindering economic growth. This uncertainty is a major factor contributing to the current market jitters.

<h3>Rising Geopolitical Risks: Iran Tensions Add to Market Volatility</h3>

The escalating tensions surrounding Iran are adding another layer of complexity to the already challenging market environment. Recent events, including [insert specific recent news event related to Iran tensions], have heightened investor anxieties. Geopolitical uncertainty often leads to increased risk aversion, causing investors to shift their focus towards safer assets like government bonds, thereby reducing demand for stocks. This flight to safety further contributes to the downward pressure on indices like the S&P 500 and Nasdaq.

Specific Impacts on Tech Stocks: The Nasdaq, heavily weighted with technology stocks, has been particularly vulnerable to the current market downturn. Higher interest rates disproportionately impact growth stocks like those in the tech sector, as their valuations are often based on future earnings expectations. These expectations become less certain in an environment of rising borrowing costs and economic uncertainty. This explains why tech giants have seen their share prices decline more sharply than some other sectors.

<h3>Expert Opinions and Market Predictions</h3>

Many market analysts are divided on the future direction of the market. Some believe that the current dip presents a buying opportunity, anticipating that the market will recover once the uncertainty surrounding interest rates and geopolitical issues subsides. Others remain cautious, suggesting that further corrections are possible before a sustained recovery can begin. [Include a quote from a reputable financial analyst here, properly attributed]. The overall consensus seems to be that continued volatility should be expected in the short term.

What Investors Should Do: Given the current climate of uncertainty, investors are advised to adopt a cautious approach. Diversification remains crucial, spreading investments across different asset classes to mitigate risk. Thorough due diligence is essential before making any investment decisions, and seeking advice from a qualified financial advisor is always recommended.

Keywords: S&P 500, Nasdaq, Stock Market, Fed Rate, Interest Rates, Inflation, Iran, Geopolitical Risk, Market Volatility, Recession, Investment Strategy, Economic Uncertainty, Stock Market Update, Financial News

Call to Action (subtle): Stay informed about market developments by regularly checking reputable financial news sources. Understanding the factors driving market fluctuations empowers you to make informed investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Stock Market Update: Fed Rate Decisions And Iran Tensions Weigh On S&P 500 And Nasdaq. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

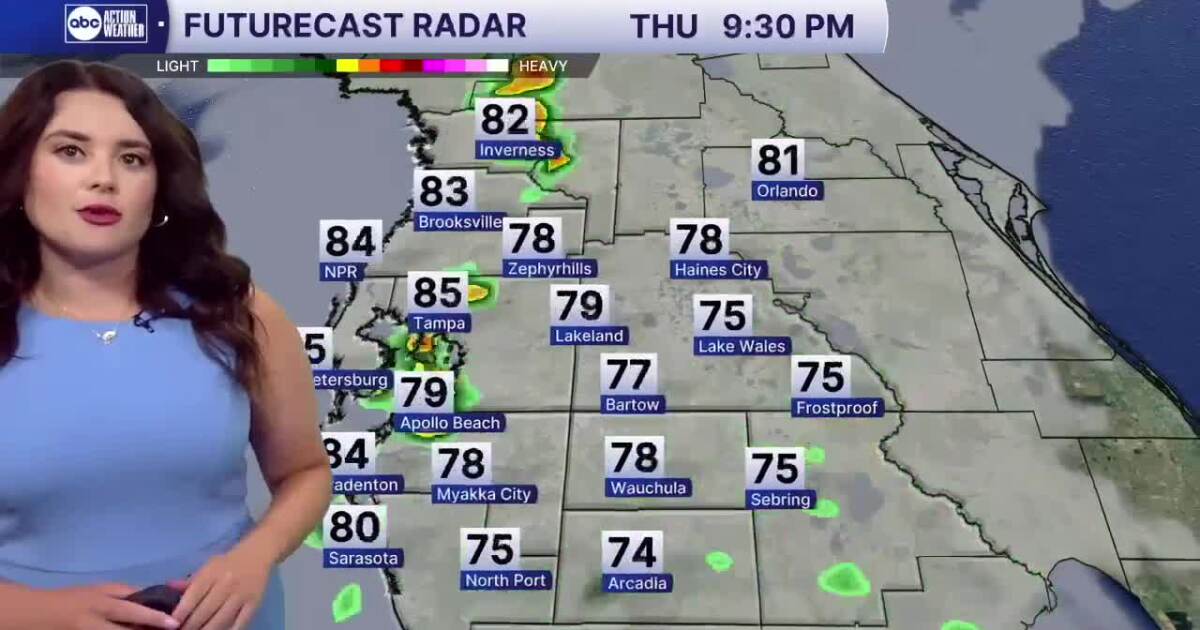

Todays Forecast Muggy Conditions With A Chance Of Late Day Rain

Jun 21, 2025

Todays Forecast Muggy Conditions With A Chance Of Late Day Rain

Jun 21, 2025 -

Tulsi Gabbard Sidelined In Key Trump Administration Discussions On Iran And Israel

Jun 21, 2025

Tulsi Gabbard Sidelined In Key Trump Administration Discussions On Iran And Israel

Jun 21, 2025 -

Colorado Moms Husband Barry Morphew Faces Renewed Murder Charges

Jun 21, 2025

Colorado Moms Husband Barry Morphew Faces Renewed Murder Charges

Jun 21, 2025 -

Major Indictment 19 Mexican Mafia Members Accused In La Rappers Murder

Jun 21, 2025

Major Indictment 19 Mexican Mafia Members Accused In La Rappers Murder

Jun 21, 2025 -

Bayern Munich Vs Boca Juniors Club World Cup Match Preview Start Time And Team News

Jun 21, 2025

Bayern Munich Vs Boca Juniors Club World Cup Match Preview Start Time And Team News

Jun 21, 2025