Stock Market Update: Fed Rate Decision And Iran Situation Impact S&P 500, Nasdaq

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Stock Market Update: Fed Rate Decision and Iran Situation Rock S&P 500, Nasdaq

The stock market experienced significant volatility this week, with the S&P 500 and Nasdaq indices taking a beating following the Federal Reserve's interest rate decision and escalating tensions in Iran. Investors are grappling with uncertainty, prompting a reassessment of risk across various sectors. This article delves into the key factors driving the market's recent performance and offers insights into potential future trends.

Fed Rate Hike Fuels Market Jitters:

The Federal Reserve's decision to raise interest rates, [cite source: e.g., Federal Reserve press release], sent shockwaves through the market. While largely expected, the magnitude of the increase and the accompanying hawkish commentary concerning future rate hikes fueled concerns about a potential recession. Higher interest rates increase borrowing costs for businesses, potentially slowing economic growth and impacting corporate earnings – key drivers of stock prices. This directly impacts investor confidence, leading to sell-offs across the board.

-

Impact on Tech Stocks: The Nasdaq, heavily weighted with technology companies, felt the brunt of the rate hike. Tech stocks are particularly sensitive to interest rate increases as they often rely on future earnings projections, which are discounted more heavily in a higher interest rate environment. Companies with high debt loads are also more vulnerable.

-

S&P 500's Broader Concerns: The S&P 500, representing a broader range of industries, also experienced declines. While some sectors showed resilience, the overall negative sentiment stemming from the Fed's decision overshadowed positive developments in other areas.

Iran Situation Adds to Market Uncertainty:

The escalating situation in Iran, [cite source: e.g., reputable news source on Iran], further exacerbated market anxieties. Geopolitical instability often triggers risk-aversion among investors, leading them to seek safer havens like government bonds. This flight to safety puts downward pressure on stock prices. The potential for disruptions to oil supplies also contributes to market uncertainty, impacting energy prices and potentially fueling inflation.

What to Expect Next:

The coming weeks will be crucial in determining the market's trajectory. Investors will be closely monitoring several key indicators, including:

- Inflation data: Further insights into inflation rates will be critical in gauging the Fed's future policy decisions. Persistently high inflation could lead to more aggressive rate hikes.

- Corporate earnings reports: Upcoming earnings reports from major companies will provide crucial insights into the health of the economy and corporate profitability.

- Geopolitical developments: The situation in Iran and other global hotspots will continue to influence investor sentiment.

Expert Opinions and Analysis:

[Include quotes from financial analysts or economists on the situation. Cite sources appropriately.] For example, "The current market volatility reflects a confluence of factors, with the Fed's actions and geopolitical risks playing significant roles," says [Analyst's Name], Chief Economist at [Institution]. "Investors should exercise caution and maintain a diversified portfolio."

Investment Strategies:

Given the current uncertainty, investors may consider adopting a more cautious approach. This could include:

- Diversification: Spreading investments across different asset classes can help mitigate risk.

- Risk assessment: Thoroughly evaluating the risk tolerance before making investment decisions.

- Long-term perspective: Maintaining a long-term investment strategy can help weather short-term market fluctuations.

Conclusion:

The recent market downturn highlights the interconnectedness of global events and their impact on financial markets. While the situation remains uncertain, careful monitoring of key economic indicators and geopolitical developments is crucial for informed investment decisions. Consult with a financial advisor for personalized guidance tailored to your individual circumstances. Remember, this information is for educational purposes and does not constitute financial advice.

Keywords: Stock Market, S&P 500, Nasdaq, Fed Rate Hike, Interest Rates, Iran, Geopolitical Risk, Recession, Inflation, Investment Strategy, Market Volatility, Economic Indicators.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Stock Market Update: Fed Rate Decision And Iran Situation Impact S&P 500, Nasdaq. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

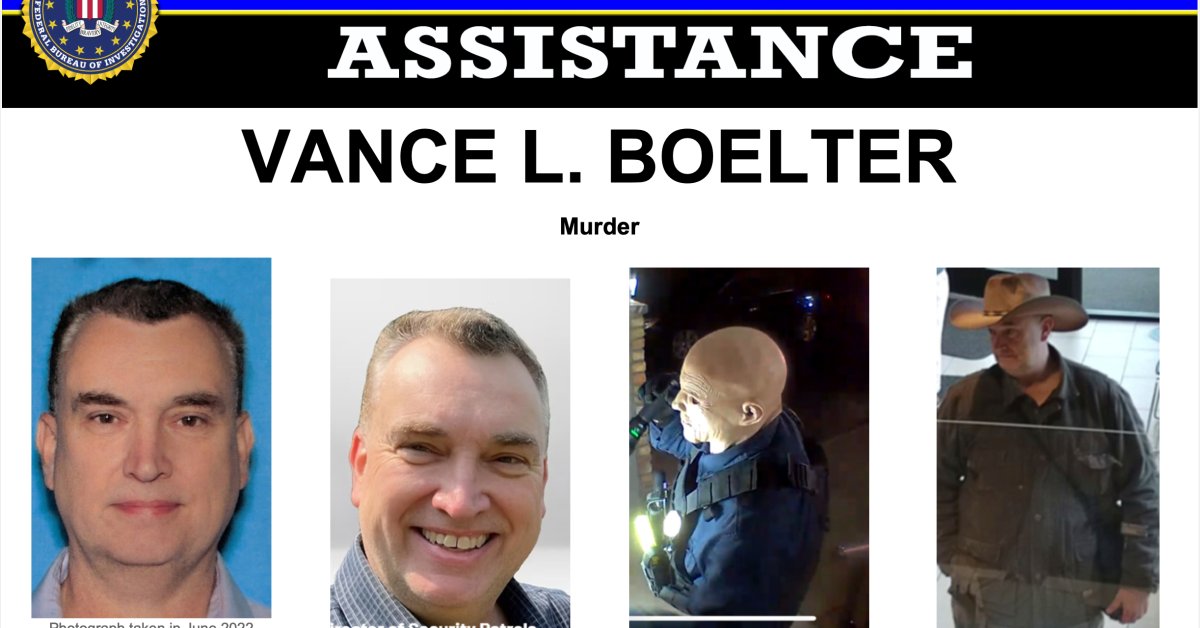

Vance L Boelter Details Emerge After Arrest In Minnesota Lawmaker Shooting Case

Jun 21, 2025

Vance L Boelter Details Emerge After Arrest In Minnesota Lawmaker Shooting Case

Jun 21, 2025 -

Kesha Drops New Song Attention Listen And Read The Lyrics Here

Jun 21, 2025

Kesha Drops New Song Attention Listen And Read The Lyrics Here

Jun 21, 2025 -

Widespread Airport Closures In Middle East Due To Israel Iran Conflict

Jun 21, 2025

Widespread Airport Closures In Middle East Due To Israel Iran Conflict

Jun 21, 2025 -

Bayern Munich Vs Boca Juniors Club World Cup Team News And Predicted Lineups

Jun 21, 2025

Bayern Munich Vs Boca Juniors Club World Cup Team News And Predicted Lineups

Jun 21, 2025 -

Is Tulsi Gabbard Losing Favor Within Trumps Inner Circle Cnn Investigates

Jun 21, 2025

Is Tulsi Gabbard Losing Favor Within Trumps Inner Circle Cnn Investigates

Jun 21, 2025