Stock Market Update: Analysis Of S&P 500 And Nasdaq Losses Following Fed News And Iran Developments

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Stock Market Update: S&P 500 and Nasdaq Tumble Following Fed News and Iran Tensions

The stock market experienced a significant downturn on [Date], with both the S&P 500 and Nasdaq Composite suffering notable losses. This sharp decline followed closely on the heels of the Federal Reserve's latest interest rate announcement and escalating tensions in Iran. Investors are grappling with a confluence of factors that are impacting market sentiment and creating uncertainty for the coming weeks.

The Fed's Influence: Interest Rate Hikes and Market Volatility

The Federal Reserve's decision to [insert specific Fed action, e.g., raise interest rates by 0.25%] sent ripples through the financial markets. While the increase was [describe the increase as expected/unexpected/in line with predictions], the accompanying commentary regarding future rate hikes fueled concerns about a potential recession. Higher interest rates increase borrowing costs for businesses, potentially hindering investment and economic growth. This uncertainty is a major contributor to the current market volatility and the sell-off witnessed in the S&P 500 and Nasdaq. Analysts are closely examining the Fed's forward guidance for clues about the future trajectory of monetary policy. [Link to a reputable source discussing the Fed's announcement].

Geopolitical Headwinds: Iran Tensions and Global Uncertainty

Adding to the market's woes are the escalating tensions in Iran. [Clearly and concisely describe the recent developments in Iran, citing reputable news sources]. These developments have introduced a significant element of geopolitical risk, leading investors to seek safer assets and contributing to the sell-off in riskier equities. The uncertainty surrounding the situation in Iran adds another layer of complexity to the already challenging market environment. [Link to a reputable news source covering the Iran situation].

S&P 500 and Nasdaq Losses: A Deeper Dive

The S&P 500 experienced a [percentage]% drop, closing at [closing value], while the Nasdaq Composite fell by [percentage]%, closing at [closing value]. This decline reflects a broad-based sell-off, with several sectors experiencing significant losses. [Mention specific sectors most affected, e.g., technology, energy]. The tech-heavy Nasdaq was particularly hard hit, likely reflecting investor concerns about the impact of higher interest rates on growth stocks.

What to Watch For: Key Indicators and Market Predictions

Several key indicators will be closely watched in the coming days and weeks. These include:

- Inflation Data: Upcoming inflation reports will be crucial in shaping expectations for future Fed actions. Higher-than-expected inflation could lead to further interest rate hikes, while lower-than-expected inflation could provide some relief to the markets.

- Corporate Earnings: The upcoming earnings season will provide further insights into the financial health of corporations and their outlook for the future. Strong earnings could help to bolster investor confidence, while weak earnings could exacerbate the current market downturn.

- Geopolitical Developments: Any further escalation of tensions in Iran or other geopolitical hotspots could continue to negatively impact market sentiment.

Investor Sentiment and Next Steps

Market sentiment remains cautious, with many investors adopting a wait-and-see approach. It's crucial for investors to maintain a long-term perspective and to diversify their portfolios. Seeking advice from a qualified financial advisor is recommended, especially during periods of high market volatility. [Consider adding a subtle call to action, e.g., "Stay informed about market developments by subscribing to our newsletter."]

Disclaimer: This article provides general information and commentary and does not constitute financial advice. Investing in the stock market involves inherent risks, and past performance is not indicative of future results. Consult with a financial professional before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Stock Market Update: Analysis Of S&P 500 And Nasdaq Losses Following Fed News And Iran Developments. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Increased Ice Activity Trumps New Deportation Strategy In Democratic Areas

Jun 21, 2025

Increased Ice Activity Trumps New Deportation Strategy In Democratic Areas

Jun 21, 2025 -

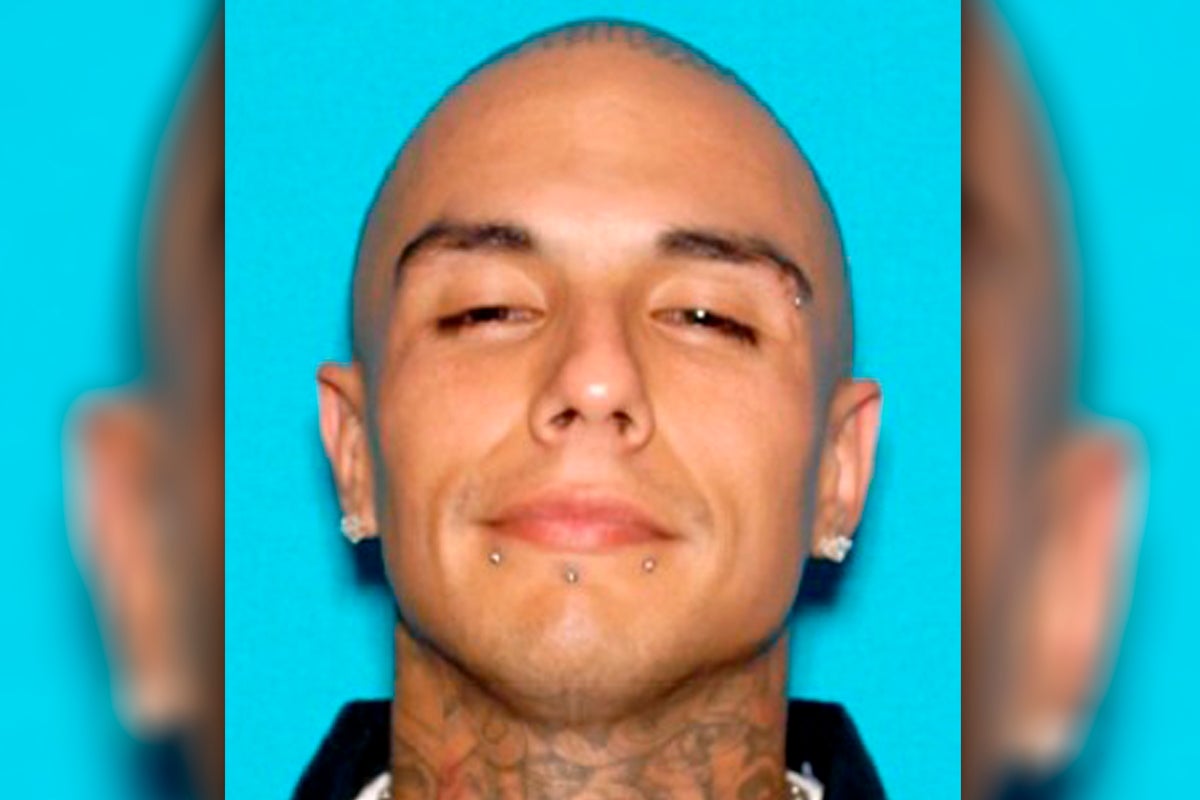

Alleged Mexican Mafia Hit On Rapper 19 Indicted

Jun 21, 2025

Alleged Mexican Mafia Hit On Rapper 19 Indicted

Jun 21, 2025 -

19 Mexican Mafia Members Charged In Plot To Kill La Rapper Swifty Blue

Jun 21, 2025

19 Mexican Mafia Members Charged In Plot To Kill La Rapper Swifty Blue

Jun 21, 2025 -

Attention Tour Dates Kesha Teams Up With Slayyyter And Rose Gray

Jun 21, 2025

Attention Tour Dates Kesha Teams Up With Slayyyter And Rose Gray

Jun 21, 2025 -

Barry Morphews Second Arrest New Developments In Suzanne Morphew Death

Jun 21, 2025

Barry Morphews Second Arrest New Developments In Suzanne Morphew Death

Jun 21, 2025