Stock Market Update: Analysis Of S&P 500 And Nasdaq Drops Following Fed Announcement And Iran News

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Stock Market Update: S&P 500 and Nasdaq Plunge After Fed Announcement and Iran Tensions

The US stock market experienced a significant downturn Wednesday, with the S&P 500 and Nasdaq Composite suffering notable losses following the Federal Reserve's interest rate announcement and escalating tensions in Iran. Investors reacted negatively to the combination of persistent inflation concerns and geopolitical uncertainty, leading to a sell-off across major indices. This article delves into the specifics of the market's reaction and analyzes the contributing factors.

Fed Raises Rates, Hints at Further Hikes

The Federal Reserve's decision to raise interest rates by 0.25% was largely expected by market analysts. However, Chair Jerome Powell's comments suggesting that further rate hikes may be necessary to combat inflation dampened investor optimism. This signals a continued commitment to tackling inflation, even at the risk of slowing economic growth. The market interpreted this as a less dovish stance than some had anticipated, leading to immediate selling pressure. The implication of higher borrowing costs for businesses and consumers weighed heavily on investor sentiment. Learn more about the Fed's recent monetary policy decisions . (This would link to the official Federal Reserve website).

Iran Tensions Add to Market Volatility

Adding to the market's woes were escalating tensions in Iran. Reports of injected further uncertainty into an already jittery market. Geopolitical risks are often a significant driver of market volatility, as investors seek safer assets during periods of international instability. The oil market also reacted, with crude prices experiencing a noticeable spike, further impacting investor confidence. This uncertainty creates a ripple effect, impacting various sectors, including energy and technology.

S&P 500 and Nasdaq Bear the Brunt

The S&P 500 closed down [insert percentage]% on Wednesday, while the Nasdaq Composite experienced an even steeper decline of [insert percentage]%. This sell-off reflects a broad-based concern among investors about the economic outlook. Tech stocks, particularly sensitive to interest rate hikes, were among the hardest hit. The drop highlights the market's vulnerability to both economic policy and global events.

Sector-Specific Analysis:

- Technology: Tech stocks, often considered growth stocks, are particularly sensitive to rising interest rates, leading to significant losses in this sector.

- Energy: Oil prices increased due to the geopolitical uncertainty surrounding Iran, benefiting energy companies but overall adding to market instability.

- Financials: The financial sector generally benefits from higher interest rates, but the overall market downturn negated any significant gains.

What's Next for the Market?

The short-term outlook for the market remains uncertain. Further rate hikes by the Federal Reserve, coupled with ongoing geopolitical risks, could continue to exert downward pressure on stock prices. However, some analysts believe that the market may find support at certain levels, potentially leading to a rebound in the coming weeks. It is crucial to monitor economic data releases and geopolitical developments closely.

Disclaimer: This article provides general information and analysis and does not constitute financial advice. Investors should conduct their own thorough research and consult with a financial advisor before making any investment decisions.

Keywords: S&P 500, Nasdaq, Stock Market, Stock Market Crash, Federal Reserve, Interest Rates, Inflation, Iran, Geopolitical Risk, Market Volatility, Investment, Economic Outlook, Stock Market Analysis, Market Update, Tech Stocks.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Stock Market Update: Analysis Of S&P 500 And Nasdaq Drops Following Fed Announcement And Iran News. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Analisis El Desafio De La Jaula Bahamondes Y El Significado De Su Combate En Ufc

Jun 21, 2025

Analisis El Desafio De La Jaula Bahamondes Y El Significado De Su Combate En Ufc

Jun 21, 2025 -

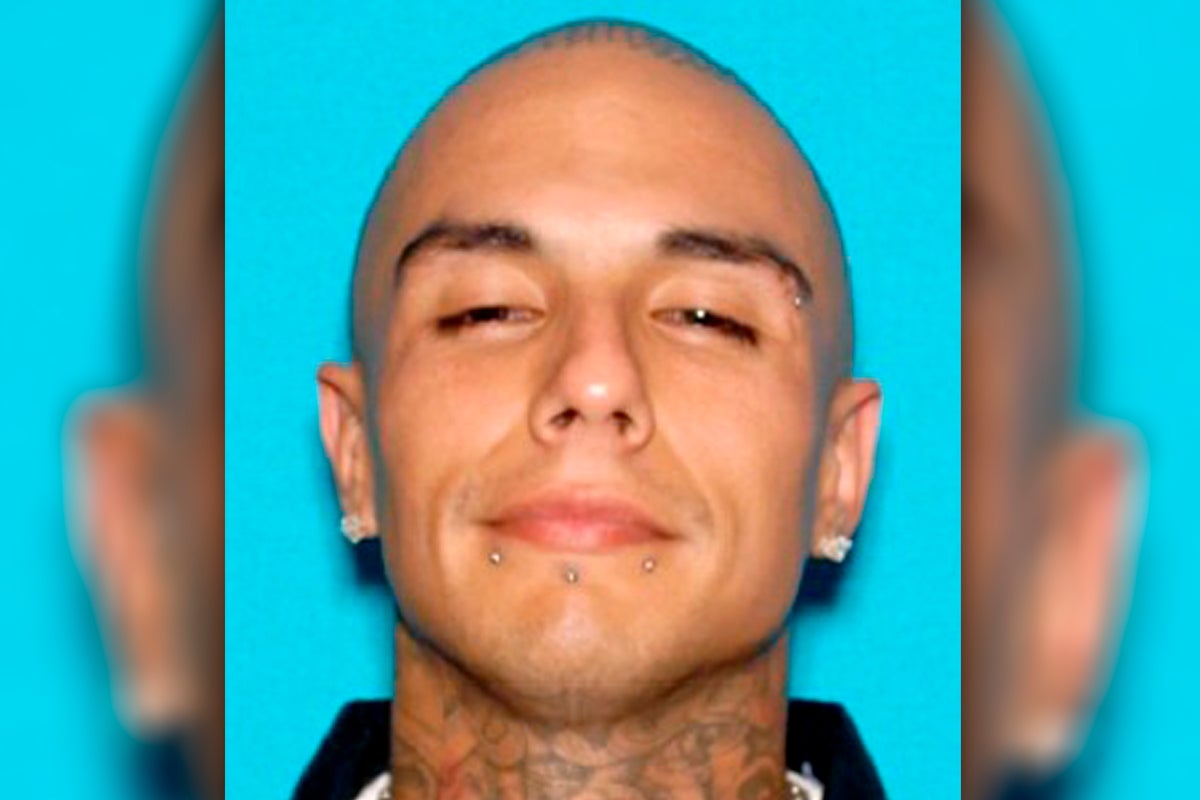

Swifty Blue Murder 19 Mexican Mafia Members Face Conspiracy Charges

Jun 21, 2025

Swifty Blue Murder 19 Mexican Mafia Members Face Conspiracy Charges

Jun 21, 2025 -

Major Bust 19 Arrested In Mexican Mafias Rapper Assassination Attempt

Jun 21, 2025

Major Bust 19 Arrested In Mexican Mafias Rapper Assassination Attempt

Jun 21, 2025 -

Keshas New Single Attention A Deep Dive Into The Lyrics And Music Video

Jun 21, 2025

Keshas New Single Attention A Deep Dive Into The Lyrics And Music Video

Jun 21, 2025 -

Is Tulsi Gabbard Losing Influence Within Trumps Circle

Jun 21, 2025

Is Tulsi Gabbard Losing Influence Within Trumps Circle

Jun 21, 2025