Stock Market Today: Six-Day Win For S&P 500 Amidst Moody's Downgrade

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Stock Market Today: Six-Day Win for S&P 500 Despite Moody's Downgrade – A Surprising Rally?

The S&P 500 closed higher for a sixth consecutive day on Thursday, defying expectations following Moody's downgrade of several US banking institutions. This unexpected rally has left market analysts scrambling to understand the driving forces behind this seemingly contradictory trend. While the Moody's downgrade sent ripples through the financial sector, the broader market displayed remarkable resilience, prompting questions about the long-term implications.

Moody's Downgrade: A Catalyst for Uncertainty?

Moody's decision to downgrade the credit ratings of 10 small and mid-sized US banks, citing concerns about asset quality and profitability, initially sparked concerns about a wider banking crisis. The downgrade highlighted the ongoing pressures faced by the banking sector, particularly in the wake of recent interest rate hikes by the Federal Reserve. This news, typically a significant market mover, seemed to have a surprisingly muted impact on the overall market sentiment.

Why the S&P 500 is defying expectations:

Several factors might contribute to the S&P 500's resilience despite the negative news:

-

Strong Corporate Earnings: The current earnings season has generally exceeded expectations, boosting investor confidence in the underlying strength of the US economy. Many companies are reporting robust profits, defying fears of a recession.

-

Resilient Consumer Spending: Despite inflation, consumer spending remains relatively strong, suggesting that the economy is faring better than some analysts had predicted. This continued spending supports corporate earnings and contributes to a positive market outlook.

-

Market Overreaction to Negative News: Some analysts argue that the initial market reaction to negative news, like the Moody's downgrade, is often exaggerated. As investors process the information and assess the actual impact, the market may adjust accordingly, leading to a rebound.

-

Federal Reserve's Pause on Rate Hikes (Potential): Although not confirmed, speculation of a potential pause or slowdown in future Federal Reserve interest rate hikes has injected some optimism into the market. This reduces concerns about further economic slowdown.

Looking Ahead: Navigating Market Volatility

While the six-day winning streak for the S&P 500 is encouraging, it's crucial to approach the market with caution. The current situation highlights the inherent volatility of the stock market and the difficulty in predicting its future direction. Several factors could still impact the market in the coming weeks and months, including:

- Inflationary pressures: Persistent inflation could force the Federal Reserve to continue raising interest rates, potentially dampening economic growth.

- Geopolitical instability: Ongoing geopolitical tensions could introduce further uncertainty into the market.

- Unexpected economic data: Negative surprises in key economic indicators could trigger a market correction.

What this means for investors:

The recent market performance underscores the importance of a well-diversified investment portfolio and a long-term investment strategy. Investors should consult with financial advisors to determine the best course of action based on their individual risk tolerance and financial goals. Staying informed about market trends and economic news is crucial for making informed investment decisions.

Keywords: S&P 500, Stock Market, Moody's, Downgrade, US Banks, Stock Market Today, Market Rally, Economic News, Investment Strategy, Stock Market Volatility, Federal Reserve, Interest Rates, Corporate Earnings, Consumer Spending.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Investing in the stock market involves risk, and you could lose money. Consult with a qualified financial advisor before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Stock Market Today: Six-Day Win For S&P 500 Amidst Moody's Downgrade. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

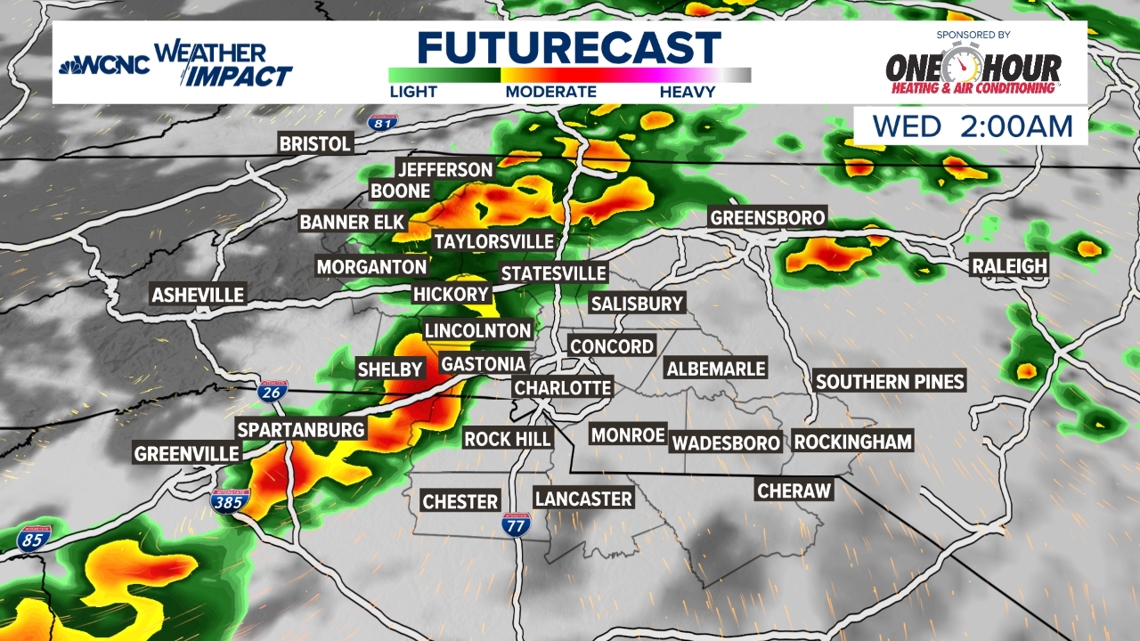

Few Strong Storms Expected Late Tuesday Very Isolated Threat

May 21, 2025

Few Strong Storms Expected Late Tuesday Very Isolated Threat

May 21, 2025 -

From Game To Screen Exploring The Key Differences In Joel And Ellies Relationship In The Last Of Us Season 2

May 21, 2025

From Game To Screen Exploring The Key Differences In Joel And Ellies Relationship In The Last Of Us Season 2

May 21, 2025 -

The Last Of Us Season 2 A Deeper Dive Into The Reimagined Joel Ellie Relationship

May 21, 2025

The Last Of Us Season 2 A Deeper Dive Into The Reimagined Joel Ellie Relationship

May 21, 2025 -

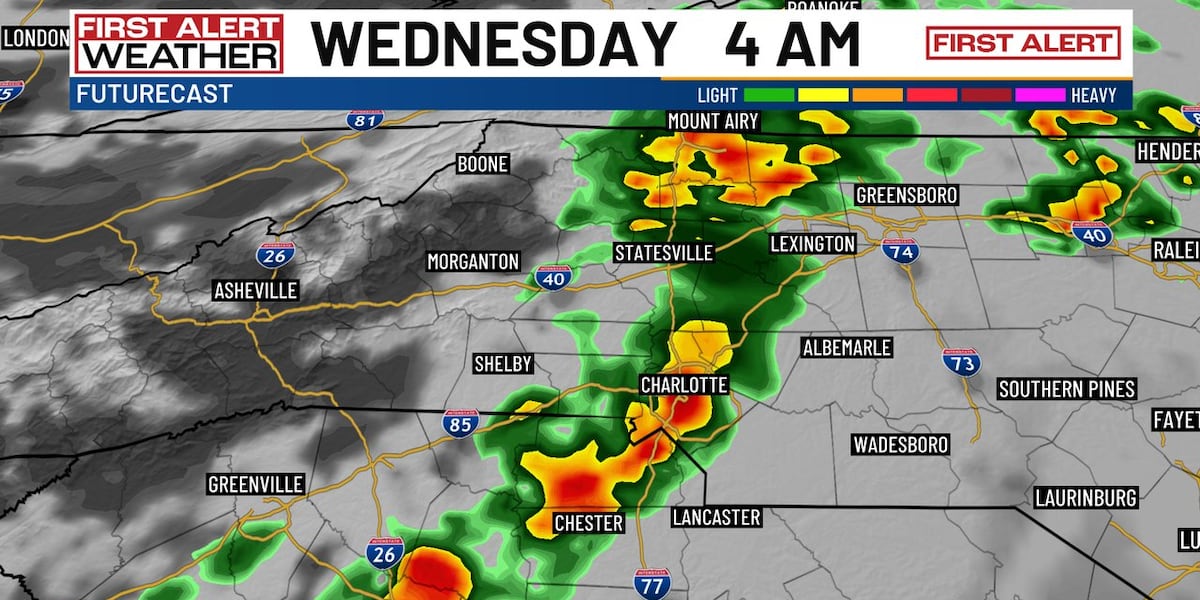

Severe Weather Possible Overnight Storms To Hit Charlotte Before Cooldown

May 21, 2025

Severe Weather Possible Overnight Storms To Hit Charlotte Before Cooldown

May 21, 2025 -

Trumps Diplomatic Efforts Negotiating A Cease Fire In Ukraine Amidst Renewed Russian Strikes

May 21, 2025

Trumps Diplomatic Efforts Negotiating A Cease Fire In Ukraine Amidst Renewed Russian Strikes

May 21, 2025