Stock Market Soars: S&P 500's 6-Day Rally, Dow & Nasdaq Gains Defy Moody's Downgrade

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Stock Market Soars: S&P 500's 6-Day Rally Defies Moody's Downgrade

The US stock market defied expectations this week, staging a remarkable six-day rally that saw significant gains across major indices, including the S&P 500, Dow Jones Industrial Average, and Nasdaq. This surge comes surprisingly after Moody's Investors Service downgraded 10 small and midsize US banking companies, and issued a negative outlook on the broader US banking system. The unexpected strength is leaving analysts scrambling to understand the driving forces behind this bullish turn.

A Six-Day Winning Streak: Unlikely but Welcome

The S&P 500, a key benchmark of US stock market performance, closed significantly higher after six consecutive days of gains. This impressive rally has erased some recent losses and injected a much-needed dose of optimism into the market. The Dow Jones Industrial Average also experienced substantial growth, mirroring the positive trend seen in the broader S&P 500. Even the tech-heavy Nasdaq, which has been more volatile recently, participated in the upward movement.

This rally is particularly noteworthy given the recent downgrade from Moody's. The agency cited concerns about the creditworthiness of smaller banks and the potential for further strain on the financial system. This news typically triggers a negative market reaction; however, the market appears to have shrugged off these concerns, at least for now.

What Fueled This Unexpected Rally?

Several factors could be contributing to this unexpected surge:

- Resilient Economic Data: Recent economic data, while mixed, has shown some signs of resilience. Stronger-than-expected consumer spending and a robust jobs market might be bolstering investor confidence. [Link to relevant economic data source]

- Bargain Hunting: Some analysts believe that the recent dip in stock prices presented attractive buying opportunities for investors, leading to increased demand and pushing prices higher. This suggests that many see the current market correction as a temporary setback rather than a sign of a larger downturn.

- Easing Inflation Concerns: Although inflation remains a concern, recent data hints at a potential cooling trend, which could be contributing to a more positive outlook among investors. [Link to inflation data source]

- Strong Corporate Earnings: Upcoming corporate earnings reports could also be playing a role. Positive expectations for strong earnings from major companies could be driving investors to anticipate further market growth.

Looking Ahead: Uncertainty Remains

While the recent rally is undoubtedly positive news, it's crucial to approach the situation with caution. The impact of Moody's downgrade, rising interest rates, and persistent inflation concerns remain significant uncertainties. This unexpected surge could be a temporary reprieve, and investors should remain vigilant and diversify their portfolios to mitigate potential risks.

What this means for investors:

The current market situation highlights the unpredictable nature of the stock market. While this recent rally is encouraging, it’s vital to maintain a long-term perspective and make informed investment decisions based on thorough research and risk tolerance. Consulting with a financial advisor is always recommended, especially during periods of market volatility.

Keywords: Stock Market, S&P 500, Dow Jones, Nasdaq, Moody's Downgrade, Stock Market Rally, Six-Day Rally, Market Volatility, Investment Strategy, Economic Data, Inflation, Corporate Earnings.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Stock Market Soars: S&P 500's 6-Day Rally, Dow & Nasdaq Gains Defy Moody's Downgrade. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Bali Tourism Overhaul Stricter Guidelines To Combat Irresponsible Behavior

May 20, 2025

Bali Tourism Overhaul Stricter Guidelines To Combat Irresponsible Behavior

May 20, 2025 -

Bidens Cancer Diagnosis Political Figures Offer Messages Of Hope

May 20, 2025

Bidens Cancer Diagnosis Political Figures Offer Messages Of Hope

May 20, 2025 -

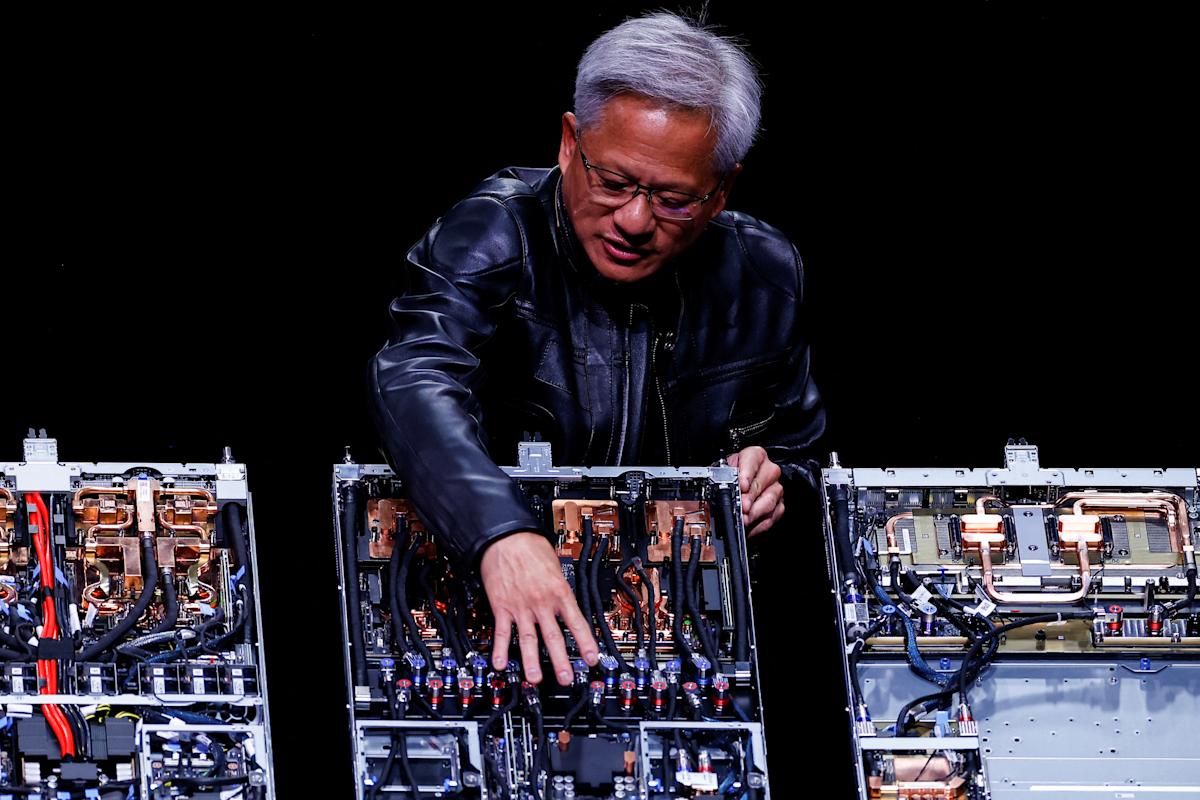

Market Movers Tracking Nvidia Alibaba Novavax Ryanair And Diageo Stock Performance

May 20, 2025

Market Movers Tracking Nvidia Alibaba Novavax Ryanair And Diageo Stock Performance

May 20, 2025 -

One Rate Cut Predicted For 2025 Impact On U S Treasury Yields

May 20, 2025

One Rate Cut Predicted For 2025 Impact On U S Treasury Yields

May 20, 2025 -

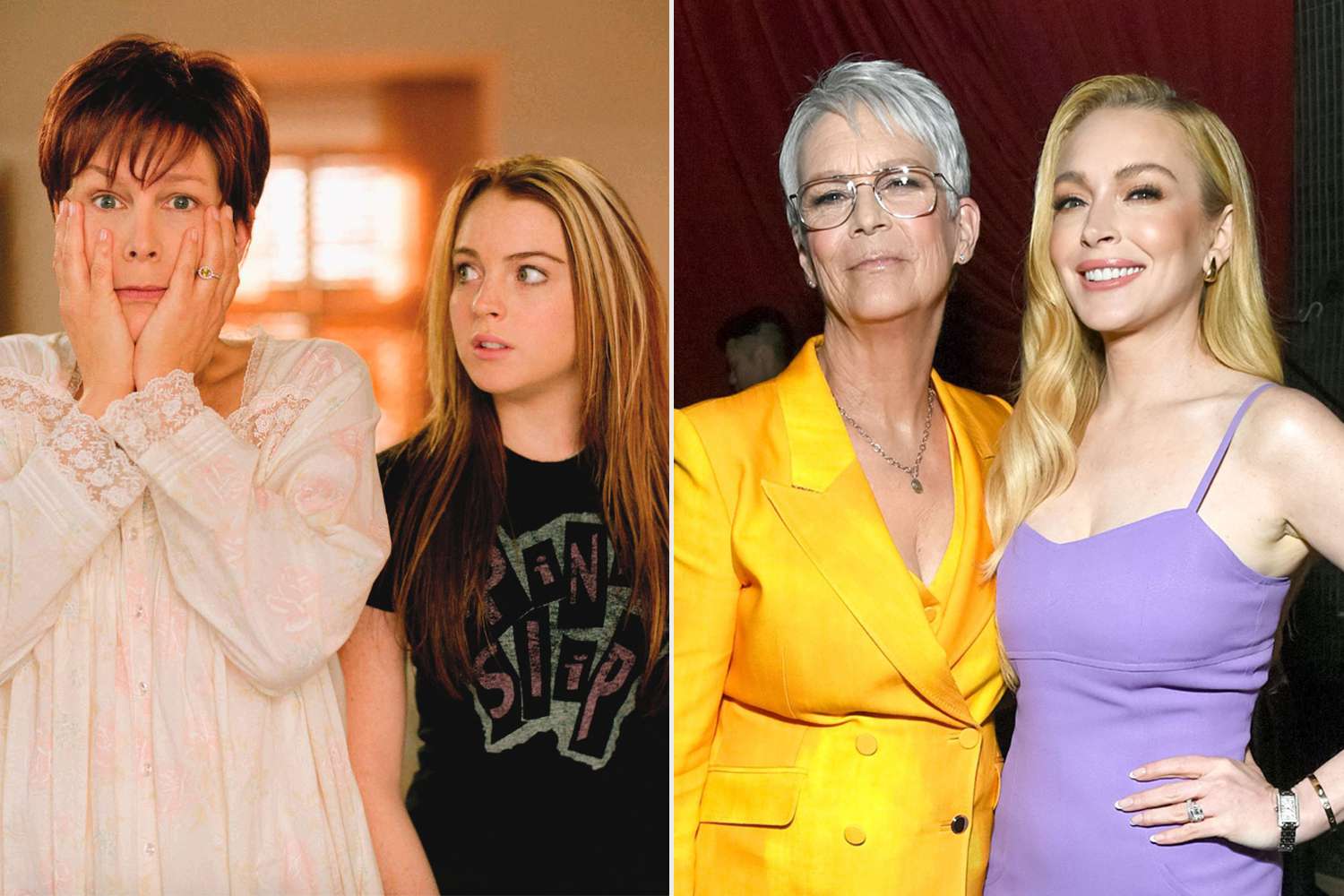

Beyond Freaky Friday Jamie Lee Curtis Shares Insights Into Her Friendship With Lindsay Lohan

May 20, 2025

Beyond Freaky Friday Jamie Lee Curtis Shares Insights Into Her Friendship With Lindsay Lohan

May 20, 2025