Stock Market Slumps: S&P 500 And Nasdaq Drop On Fed Rate Hikes And Iran Concerns

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Stock Market Slumps: S&P 500 and Nasdaq Drop on Fed Rate Hikes and Iran Concerns

Wall Street experienced a significant downturn today, with the S&P 500 and Nasdaq Composite indices suffering substantial losses. The declines were primarily attributed to escalating concerns about further Federal Reserve interest rate hikes and rising geopolitical tensions stemming from the situation in Iran. This follows a period of relative market stability, leaving investors reeling.

This sharp reversal underscores the fragility of the current market climate and highlights the interconnectedness of global economic factors. The dual pressures of monetary policy tightening and geopolitical uncertainty are creating a volatile environment for investors.

Fed Rate Hikes Fuel Market Anxiety

The Federal Reserve's ongoing efforts to combat inflation through interest rate increases continue to weigh heavily on market sentiment. Higher interest rates increase borrowing costs for businesses and consumers, potentially slowing economic growth and impacting corporate profits. This week's economic data, showing persistent inflation, fueled speculation about further aggressive rate hikes in the coming months, prompting a sell-off across various sectors. Analysts are closely monitoring the upcoming Federal Open Market Committee (FOMC) meeting for further clues about the central bank's future monetary policy direction. Understanding the Fed's actions and their impact on the stock market is crucial for any serious investor. [Link to article on understanding Fed policy]

Iran Tensions Add to Market Volatility

Adding to the already tense situation is the escalating crisis in Iran. Recent developments have increased concerns about regional stability and the potential for wider geopolitical ramifications. This uncertainty is prompting investors to seek safer havens, leading to capital flight away from riskier assets like stocks. The potential for disruptions to global oil supplies further exacerbates the situation, adding another layer of complexity to the current market downturn. This highlights the impact of geopolitical risk on financial markets.

Sector-Specific Impacts

The decline wasn't uniform across all sectors. Technology stocks, which are particularly sensitive to interest rate changes, bore the brunt of the sell-off, with the Nasdaq Composite experiencing a more pronounced drop than the broader S&P 500. Energy stocks, however, saw some gains due to the ongoing concerns about oil supply disruptions linked to the Iranian situation. This underscores the importance of portfolio diversification in navigating turbulent market conditions.

What this means for investors

The current market slump presents a challenging environment for investors. Experts recommend a cautious approach, suggesting a thorough review of individual portfolios and a focus on long-term investment strategies. Consider the following:

- Diversification: Spread your investments across different asset classes to mitigate risk.

- Risk Tolerance: Evaluate your personal risk tolerance and adjust your portfolio accordingly.

- Long-Term Perspective: Avoid making impulsive decisions based on short-term market fluctuations.

- Professional Advice: Consult with a financial advisor for personalized guidance.

The coming weeks will be crucial in determining the trajectory of the market. Close monitoring of economic indicators, Federal Reserve announcements, and geopolitical developments is essential for navigating this period of uncertainty. Staying informed is key to making informed investment decisions. [Link to resource on investment strategies]

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Consult with a qualified financial advisor before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Stock Market Slumps: S&P 500 And Nasdaq Drop On Fed Rate Hikes And Iran Concerns. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Harris Campaigns Alleged Request For Mark Cubans Vetting Papers Sparks Debate

Jun 21, 2025

Harris Campaigns Alleged Request For Mark Cubans Vetting Papers Sparks Debate

Jun 21, 2025 -

Hong Kong Intensifies Crackdown On Democracy As U S Focus Shifts

Jun 21, 2025

Hong Kong Intensifies Crackdown On Democracy As U S Focus Shifts

Jun 21, 2025 -

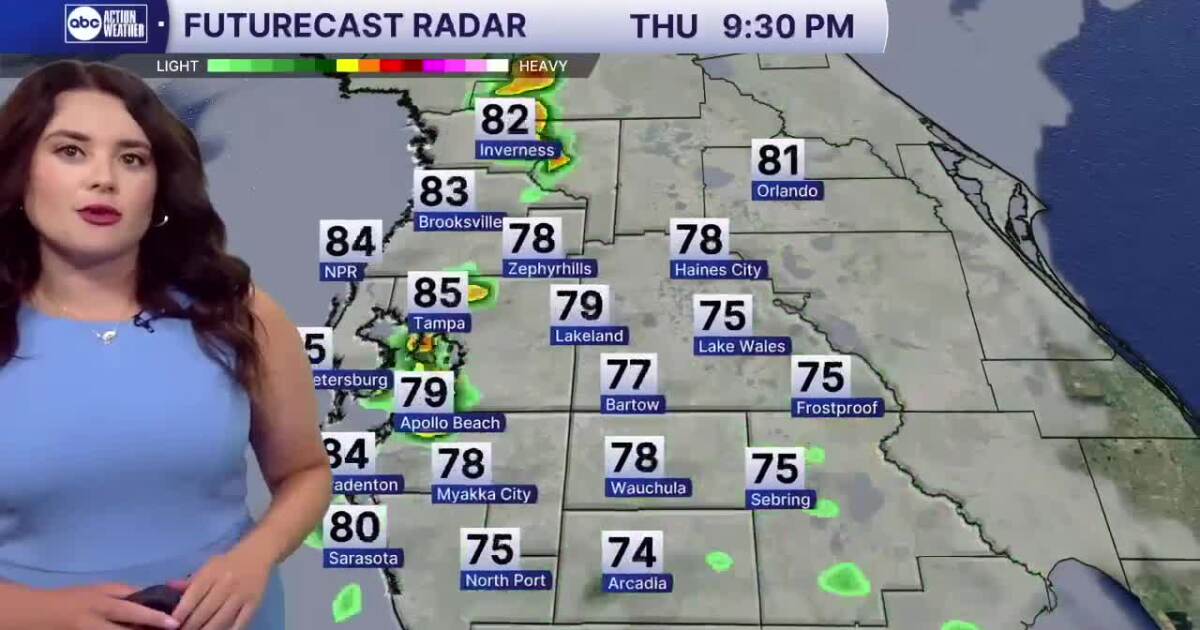

Afternoon Showers And High Humidity Todays Complete Weather Forecast

Jun 21, 2025

Afternoon Showers And High Humidity Todays Complete Weather Forecast

Jun 21, 2025 -

Frequent Nocturnal Thunderstorms In Tampa Bay A Meteorological Explanation

Jun 21, 2025

Frequent Nocturnal Thunderstorms In Tampa Bay A Meteorological Explanation

Jun 21, 2025 -

Analysis Tulsi Gabbards Absence From Trumps Iran And Israel Policy Highlights Growing Divisions

Jun 21, 2025

Analysis Tulsi Gabbards Absence From Trumps Iran And Israel Policy Highlights Growing Divisions

Jun 21, 2025