Stock Market Slump: S&P 500 And Nasdaq Drop On Fed Rate Hike Fears And Iran Tensions

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Stock Market Slump: S&P 500 and Nasdaq Drop on Fed Rate Hike Fears and Iran Tensions

The US stock market experienced a significant downturn on Tuesday, with the S&P 500 and Nasdaq Composite indices suffering notable declines. This sharp fall can be attributed to a confluence of factors, primarily fueled by escalating anxieties surrounding potential Federal Reserve interest rate hikes and rising geopolitical tensions in the Middle East, particularly concerning Iran.

Investors are nervously anticipating the Federal Reserve's upcoming monetary policy decisions. The persistent threat of further interest rate increases aims to curb inflation, but this strategy carries the risk of slowing economic growth and potentially triggering a recession. Higher interest rates make borrowing more expensive for businesses, impacting investment and potentially leading to job losses. This uncertainty is driving investors towards safer assets, leading to a sell-off in the stock market. The fear is that aggressive rate hikes could stifle economic growth, leading to a significant market correction.

The Impact of Geopolitical Instability:

Adding to the market's woes are the escalating tensions between the US and Iran. Recent events in the region have heightened concerns about potential conflict, injecting significant uncertainty into the global economic outlook. The possibility of further disruptions to oil supplies, already strained by the ongoing war in Ukraine, is a major contributor to investor anxiety. Energy prices are highly sensitive to geopolitical events, and any significant escalation in the Middle East could lead to a sharp increase in oil prices, further fueling inflation and negatively impacting global economic growth. This uncertainty is driving investors to seek safer havens, contributing to the stock market slump.

S&P 500 and Nasdaq Take a Hit:

The S&P 500, a broad measure of the US stock market, experienced a significant drop, closing down [Insert Percentage Here]% on Tuesday. The tech-heavy Nasdaq Composite fared even worse, falling by [Insert Percentage Here]%, reflecting the sector's sensitivity to interest rate increases. Technology companies often rely on borrowed money for expansion and innovation; higher interest rates increase their borrowing costs and potentially impact their profitability.

What This Means for Investors:

This market slump underscores the interconnectedness of global economics and geopolitics. The current situation highlights the importance of diversified investment strategies and a long-term perspective. Investors should carefully consider their risk tolerance and consult with financial advisors before making any significant investment decisions.

Looking Ahead:

The coming weeks will be crucial in determining the market's trajectory. The Federal Reserve's upcoming announcements on interest rates, along with further developments in the Middle East, will significantly influence investor sentiment and market performance. Analysts are closely monitoring these factors and offering varied predictions, ranging from a short-term correction to a more sustained downturn. Keeping abreast of economic news and geopolitical developments is essential for navigating the current market volatility.

Key Takeaways:

- Interest rate hikes: The primary driver of the market slump is the anticipation of further interest rate increases by the Federal Reserve.

- Geopolitical tensions: Escalating tensions between the US and Iran are adding to market uncertainty.

- Impact on tech stocks: The tech-heavy Nasdaq has been particularly hard hit, reflecting the sector's sensitivity to interest rates.

- Investor caution: Investors are advised to exercise caution and consider diversifying their portfolios.

- Ongoing monitoring: Closely following economic and geopolitical news is crucial for informed investment decisions.

This market downturn serves as a reminder of the inherent risks associated with stock market investments. Staying informed and adapting your investment strategy based on current events is crucial for navigating these challenging times. For more in-depth analysis, consider consulting a financial professional. [Optional: Link to a relevant financial news website or resource].

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Stock Market Slump: S&P 500 And Nasdaq Drop On Fed Rate Hike Fears And Iran Tensions. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

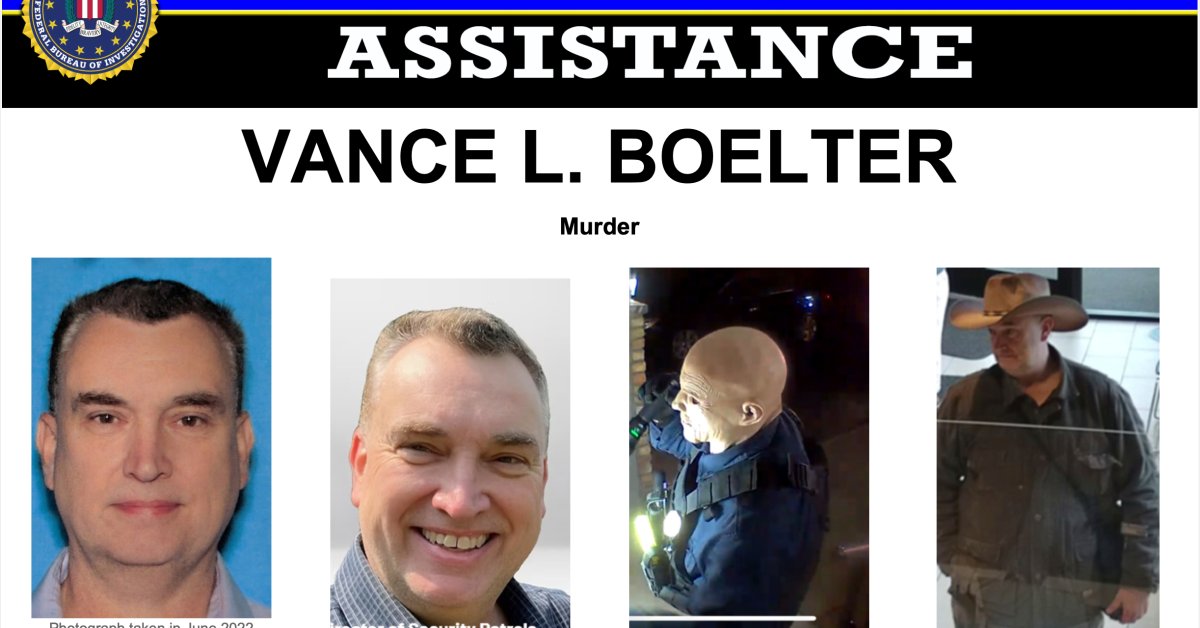

Minnesota Legislature Shooting Vance L Boelters Arrest And The Ongoing Investigation

Jun 20, 2025

Minnesota Legislature Shooting Vance L Boelters Arrest And The Ongoing Investigation

Jun 20, 2025 -

Increased Tensions North Koreas Multiple Rocket Launches Condemned By South Korea

Jun 20, 2025

Increased Tensions North Koreas Multiple Rocket Launches Condemned By South Korea

Jun 20, 2025 -

Economic Impact Virginias Strategic Energy Investments Pay Off

Jun 20, 2025

Economic Impact Virginias Strategic Energy Investments Pay Off

Jun 20, 2025 -

Second Arrest For Barry Morphew In Wife Suzannes Murder Investigation

Jun 20, 2025

Second Arrest For Barry Morphew In Wife Suzannes Murder Investigation

Jun 20, 2025 -

Market Update S And P 500 Nasdaq Fall As Investors React To Fed Rate Uncertainty And Iran Concerns

Jun 20, 2025

Market Update S And P 500 Nasdaq Fall As Investors React To Fed Rate Uncertainty And Iran Concerns

Jun 20, 2025