Stock Market Nosedive: PCE Inflation And Nvidia's Performance Drag Dow, S&P 500, And Nasdaq Lower

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Stock Market Nosedive: PCE Inflation and Nvidia's Performance Drag Dow, S&P 500, and Nasdaq Lower

The US stock market experienced a significant downturn on [Date], with major indices like the Dow Jones Industrial Average, S&P 500, and Nasdaq Composite all closing sharply lower. This market nosedive was largely attributed to a combination of factors, primarily the hotter-than-expected Personal Consumption Expenditures (PCE) inflation data and a less-than-stellar performance from tech giant Nvidia following its earnings report.

This unexpected market volatility has sent ripples through investor confidence, raising concerns about the Federal Reserve's future monetary policy decisions and the overall health of the economy. Let's delve deeper into the contributing factors:

Higher-Than-Expected PCE Inflation Fuels Fears

The Bureau of Economic Analysis released its PCE inflation report, revealing a [Insert Percentage]% increase in core PCE, exceeding analysts' expectations. This data point reignited concerns about persistent inflation, suggesting that the Federal Reserve might need to maintain a more hawkish monetary policy stance for longer than previously anticipated. This could mean continued interest rate hikes, impacting borrowing costs for businesses and consumers alike, ultimately hindering economic growth. The impact on the bond market was immediate, with Treasury yields rising sharply.

- Key Takeaway: Persistent inflation continues to be a major headwind for the stock market, driving uncertainty and prompting investors to reassess their positions.

Nvidia's Earnings Report Fails to Impress

Tech giant Nvidia, a key bellwether for the tech sector and a significant component of major indices, reported earnings that, while positive, fell short of some analysts' overly optimistic projections. This underperformance, coupled with cautious guidance for the next quarter, sent shockwaves through the technology sector and contributed significantly to the broader market sell-off. Concerns about slowing demand for semiconductors and the potential impact of geopolitical tensions also played a role.

- Key Takeaway: Nvidia's influence on the market is undeniable. Its performance, or lack thereof, significantly impacts investor sentiment towards the tech sector and the broader market.

What This Means for Investors

The current market downturn highlights the inherent volatility of the stock market and the importance of diversification. Investors should carefully consider their risk tolerance and investment strategies in light of these recent developments. While short-term fluctuations are normal, the persistent inflationary pressures and potential for further interest rate hikes necessitate a cautious approach.

Strategies to Consider:

- Diversification: Spreading investments across different asset classes can help mitigate risk.

- Long-Term Perspective: Maintaining a long-term investment horizon can help weather short-term market fluctuations.

- Professional Advice: Consulting with a qualified financial advisor can provide personalized guidance based on individual circumstances.

Looking Ahead: Uncertainty Remains

The market's future trajectory remains uncertain. The Federal Reserve's upcoming decisions regarding interest rates will play a crucial role in determining the market's direction. Furthermore, ongoing geopolitical events and potential economic slowdowns in key regions will continue to impact investor sentiment. Keeping abreast of economic data releases and analyzing market trends will be vital for investors navigating this period of uncertainty. Stay tuned for further updates and analysis.

[Call to action - subtly integrated]: Want to stay informed on market trends and receive insightful analysis? Subscribe to our newsletter for regular updates delivered straight to your inbox.

Related Articles:

- [Link to an article about PCE inflation]

- [Link to an article about Nvidia's business]

- [Link to an article about Federal Reserve policy]

This article aims to provide accurate and up-to-date information. However, it should not be considered financial advice. Consult with a financial professional before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Stock Market Nosedive: PCE Inflation And Nvidia's Performance Drag Dow, S&P 500, And Nasdaq Lower. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Bay Area Athlete Sets New Standard In Farallon Islands Golden Gate Bridge Swim

Aug 31, 2025

Bay Area Athlete Sets New Standard In Farallon Islands Golden Gate Bridge Swim

Aug 31, 2025 -

Willem Dafoes Early Investment In Late Fame Kent Jones On Casting

Aug 31, 2025

Willem Dafoes Early Investment In Late Fame Kent Jones On Casting

Aug 31, 2025 -

X Ais Expansion In Memphis Concerns And Community Response

Aug 31, 2025

X Ais Expansion In Memphis Concerns And Community Response

Aug 31, 2025 -

Labor Day Weekend What To Expect And How To Make The Most Of It

Aug 31, 2025

Labor Day Weekend What To Expect And How To Make The Most Of It

Aug 31, 2025 -

Marsha Blackburn On Trumps Commitment To Rural Tennesseans

Aug 31, 2025

Marsha Blackburn On Trumps Commitment To Rural Tennesseans

Aug 31, 2025

Latest Posts

-

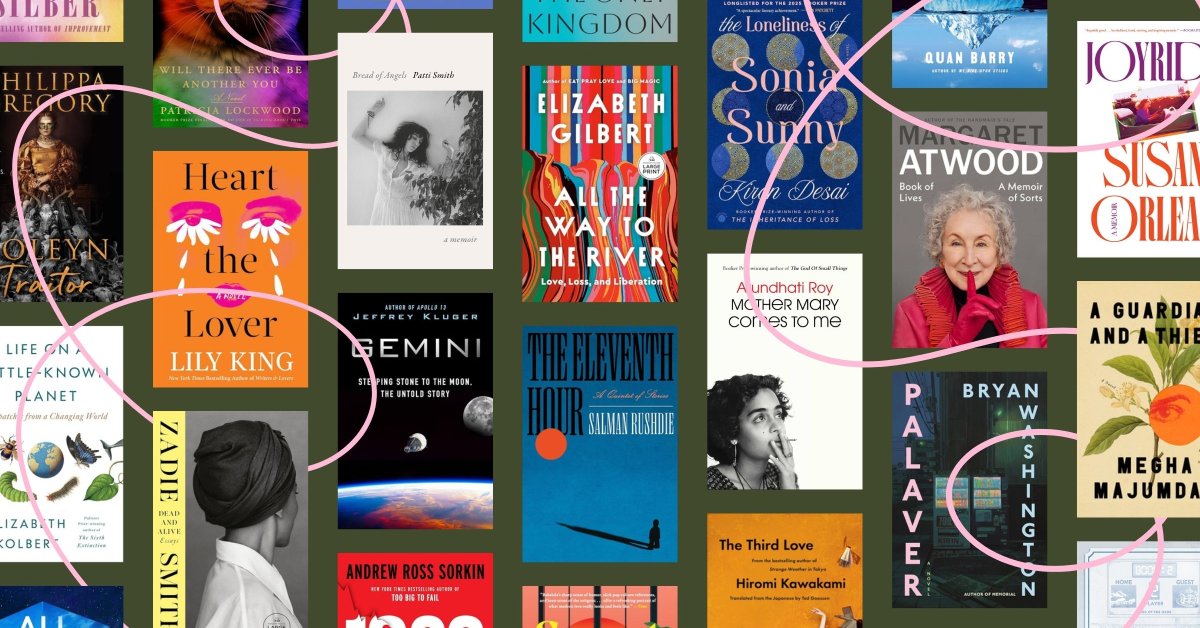

24 Notable Books Hitting Shelves Fall 2025

Sep 04, 2025

24 Notable Books Hitting Shelves Fall 2025

Sep 04, 2025 -

New Lady Gaga Song The Dead Dance Debuts At Wednesday Graveyard Gala

Sep 04, 2025

New Lady Gaga Song The Dead Dance Debuts At Wednesday Graveyard Gala

Sep 04, 2025 -

Lady Gagas Bloody Mary Removed A Wednesday Soundtrack Update

Sep 04, 2025

Lady Gagas Bloody Mary Removed A Wednesday Soundtrack Update

Sep 04, 2025 -

Nyt Spelling Bee Answers For Wednesday September 3rd

Sep 04, 2025

Nyt Spelling Bee Answers For Wednesday September 3rd

Sep 04, 2025 -

28 Years Later Ralph Fiennes Faces The Undead In Bone Temple Sequel Trailer

Sep 04, 2025

28 Years Later Ralph Fiennes Faces The Undead In Bone Temple Sequel Trailer

Sep 04, 2025