Stock Market Dips: S&P 500 And Nasdaq Decline On Fed Rate Hike Speculation And Iran Concerns

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Stock Market Dips: S&P 500 and Nasdaq Decline on Fed Rate Hike Speculation and Iran Concerns

Wall Street experienced a downturn today, with the S&P 500 and Nasdaq falling amidst growing concerns about potential Federal Reserve interest rate hikes and escalating tensions in Iran. The declines mark a significant shift from recent market optimism and highlight the fragility of investor confidence in the face of geopolitical and economic uncertainty.

The market's reaction underscores the delicate balance between economic growth and inflation control. Investors are grappling with the implications of persistent inflation and the Federal Reserve's ongoing efforts to curb it. Speculation of further interest rate increases, aimed at cooling down the economy, has fueled anxieties about a potential recession. This fear, coupled with the escalating situation in Iran, sent ripples of uncertainty throughout the market.

H2: Fed Rate Hike Speculation: A Major Catalyst for the Decline

The Federal Reserve's monetary policy remains a key driver of market volatility. Recent economic data, showing persistent inflation despite previous rate hikes, has led many analysts to predict further increases in interest rates. This expectation has put pressure on stocks, as higher interest rates typically lead to higher borrowing costs for businesses, potentially slowing economic growth and reducing corporate profits. The uncertainty surrounding the future path of interest rates is leaving investors hesitant and contributing significantly to the market's downward trend. This uncertainty is further amplified by conflicting signals from the Fed itself, making it difficult for investors to gauge their next move. Many are turning to [link to reputable financial news source analyzing Fed policy] for deeper insight into the ongoing debate.

H2: Iran Tensions Add to Market Instability

Adding to the economic anxieties is the escalating geopolitical situation in Iran. Recent developments have increased concerns about regional stability and potential disruptions to global energy markets. Any significant escalation in the region could have severe consequences for the global economy, further impacting investor confidence. The oil market, particularly sensitive to geopolitical events, is already reacting to the news, adding to inflationary pressures. This interconnectedness between geopolitical instability and market performance highlights the complex factors influencing current market trends. You can find more detailed analysis of the Iran situation and its market implications from sources like [link to reputable international news source covering Iran].

H3: Impact on Specific Sectors

The decline wasn't uniform across all sectors. Technology stocks, particularly those in the Nasdaq, were hit particularly hard, reflecting their sensitivity to interest rate changes. This is because tech companies often rely on borrowing to fund growth, making them vulnerable to higher interest rate environments. Other growth-oriented sectors also experienced significant drops. Conversely, some defensive sectors, like utilities, saw relatively less impact.

H2: What's Next for the Market?

The market's direction in the coming days and weeks will depend heavily on several factors: the Federal Reserve's next move regarding interest rates, the evolution of the situation in Iran, and the release of further economic data. Analysts are closely monitoring these developments and providing diverse predictions, ranging from a continued downturn to a potential rebound. It's crucial for investors to remain informed and consider diversifying their portfolios to mitigate risk. Staying updated through reputable financial news sources and consulting with financial advisors is essential during times of market volatility.

H2: Investor Actions and Mitigation Strategies

In the face of such market uncertainty, investors may consider several actions:

- Diversification: Spread investments across different asset classes to reduce risk.

- Risk Assessment: Evaluate your risk tolerance and adjust your portfolio accordingly.

- Long-Term Perspective: Avoid panic selling and maintain a long-term investment strategy.

- Professional Advice: Consult with a financial advisor for personalized guidance.

The current market dip underscores the importance of informed decision-making and a well-defined investment strategy. While short-term fluctuations are inevitable, a long-term perspective and a carefully managed portfolio can help investors navigate periods of uncertainty. Remember to always conduct thorough research before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Stock Market Dips: S&P 500 And Nasdaq Decline On Fed Rate Hike Speculation And Iran Concerns. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Brewers Success Story Isaac Collins Key Contributions

Jun 20, 2025

Brewers Success Story Isaac Collins Key Contributions

Jun 20, 2025 -

James Woods Two Run Blast Homer No 19 Decides Close Game For Team Name

Jun 20, 2025

James Woods Two Run Blast Homer No 19 Decides Close Game For Team Name

Jun 20, 2025 -

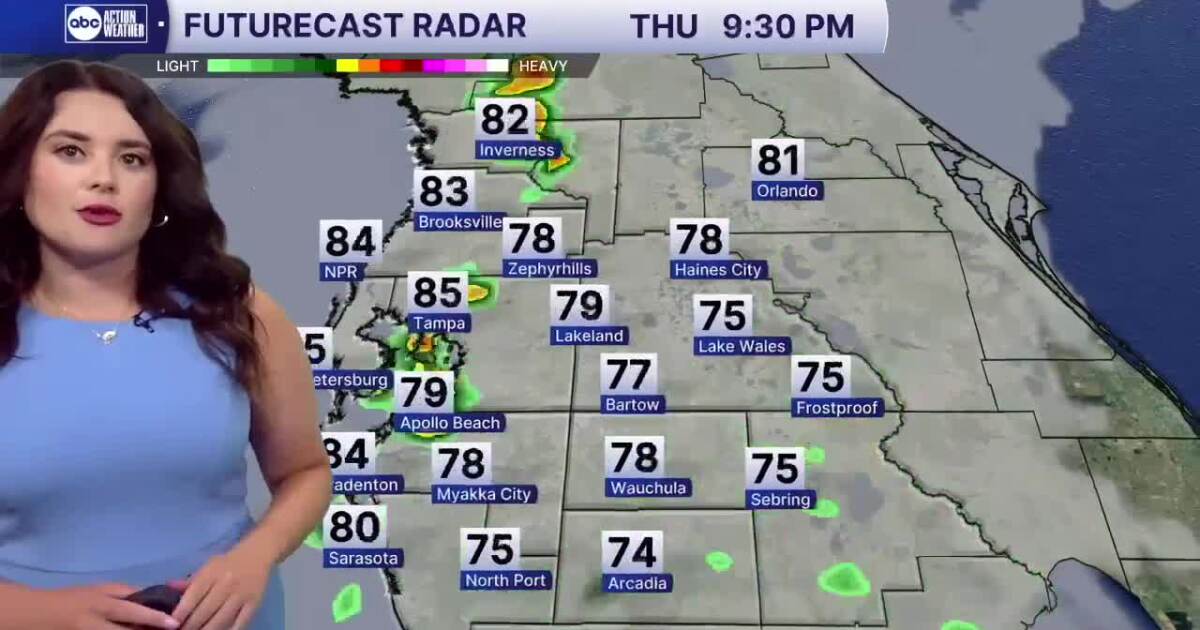

Late Day Showers Expected Muggy Conditions Forecast

Jun 20, 2025

Late Day Showers Expected Muggy Conditions Forecast

Jun 20, 2025 -

Urgent Safety Recall Fords Mach E Evs Face Occupant Lockout Risk

Jun 20, 2025

Urgent Safety Recall Fords Mach E Evs Face Occupant Lockout Risk

Jun 20, 2025 -

Governor Mc Masters Energy Bill A Comprehensive Overview Of The Laws Impact

Jun 20, 2025

Governor Mc Masters Energy Bill A Comprehensive Overview Of The Laws Impact

Jun 20, 2025