Stifel's Price Target Reduction Casts Shadow On Lucid (LCID) Investment Prospects

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Stifel's Price Target Reduction Casts Shadow on Lucid (LCID) Investment Prospects

Lucid Group (LCID) stock took a hit recently after investment firm Stifel Nicolaus slashed its price target, raising concerns among investors about the electric vehicle (EV) maker's future. The move underscores the ongoing challenges faced by Lucid, despite its promising technology and ambitious goals. This article delves into the details of Stifel's downgrade, its implications for LCID investors, and what the future might hold for the company.

Stifel's Rationale: A Deeper Dive

Stifel Nicolaus, a prominent financial services firm, reduced its price target for Lucid stock from $16 to $11, reflecting a significant decrease in its valuation. The analysts cited several factors contributing to this bearish outlook. These included:

-

Increased Competition: The EV market is becoming increasingly crowded, with established automakers and new entrants vying for market share. Lucid faces stiff competition from Tesla, Rivian, and other players, making it harder to achieve its ambitious sales targets. This heightened competitive landscape is a significant headwind for Lucid's growth trajectory.

-

Production Challenges: Lucid has experienced production hurdles, impacting its ability to meet its delivery goals. While the company has made strides in ramping up production, consistent and substantial increases remain crucial for its long-term success. Any further production delays could further dampen investor sentiment.

-

Macroeconomic Headwinds: The broader economic climate also plays a role. Rising interest rates and inflation are impacting consumer spending, potentially reducing demand for luxury EVs like those produced by Lucid. This macroeconomic uncertainty adds another layer of complexity to the investment outlook for LCID.

Implications for LCID Investors

Stifel's price target reduction sent ripples through the market, causing a noticeable dip in LCID's stock price. For current investors, this news is undoubtedly concerning. It raises questions about the company's ability to meet its financial projections and achieve profitability in the near term. Investors are now grappling with the potential for further price declines and the need to reassess their investment strategy.

What's Next for Lucid?

Despite the challenges, Lucid possesses significant strengths. Its cutting-edge technology, particularly its impressive battery range and luxurious vehicle design, remain compelling selling points. The company's long-term vision and commitment to innovation continue to attract attention. However, successfully navigating the competitive landscape and overcoming production challenges are paramount for future growth. Lucid needs to demonstrate consistent execution and deliver on its promises to regain investor confidence.

Analyzing the Long-Term Outlook: Factors to Consider

Several factors will influence Lucid's future performance, including:

- Successful Production Ramp-up: Consistent and significant increases in production capacity are crucial for meeting demand and achieving economies of scale.

- Expansion into New Markets: Geographical expansion can diversify revenue streams and reduce reliance on specific markets.

- Strategic Partnerships: Collaborations with other companies can provide access to new technologies, resources, and distribution channels.

- Innovation and Technological Advancement: Continuing to invest in research and development to maintain a competitive edge in the rapidly evolving EV market is vital.

Conclusion: A Cautious Approach

Stifel's price target reduction serves as a stark reminder of the risks associated with investing in Lucid. While the company's potential is undeniable, investors should adopt a cautious approach, carefully considering the challenges ahead before making any investment decisions. Further analysis of financial statements and upcoming announcements will be crucial in assessing the long-term viability of LCID. Conduct thorough research and consult with a financial advisor before investing in any stock, particularly in a volatile market like the current EV sector. Stay updated on the latest news and developments to make informed choices.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Stifel's Price Target Reduction Casts Shadow On Lucid (LCID) Investment Prospects. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Analysis How Us Tariffs Negated Usmca Gains For Mazda Exports

Sep 03, 2025

Analysis How Us Tariffs Negated Usmca Gains For Mazda Exports

Sep 03, 2025 -

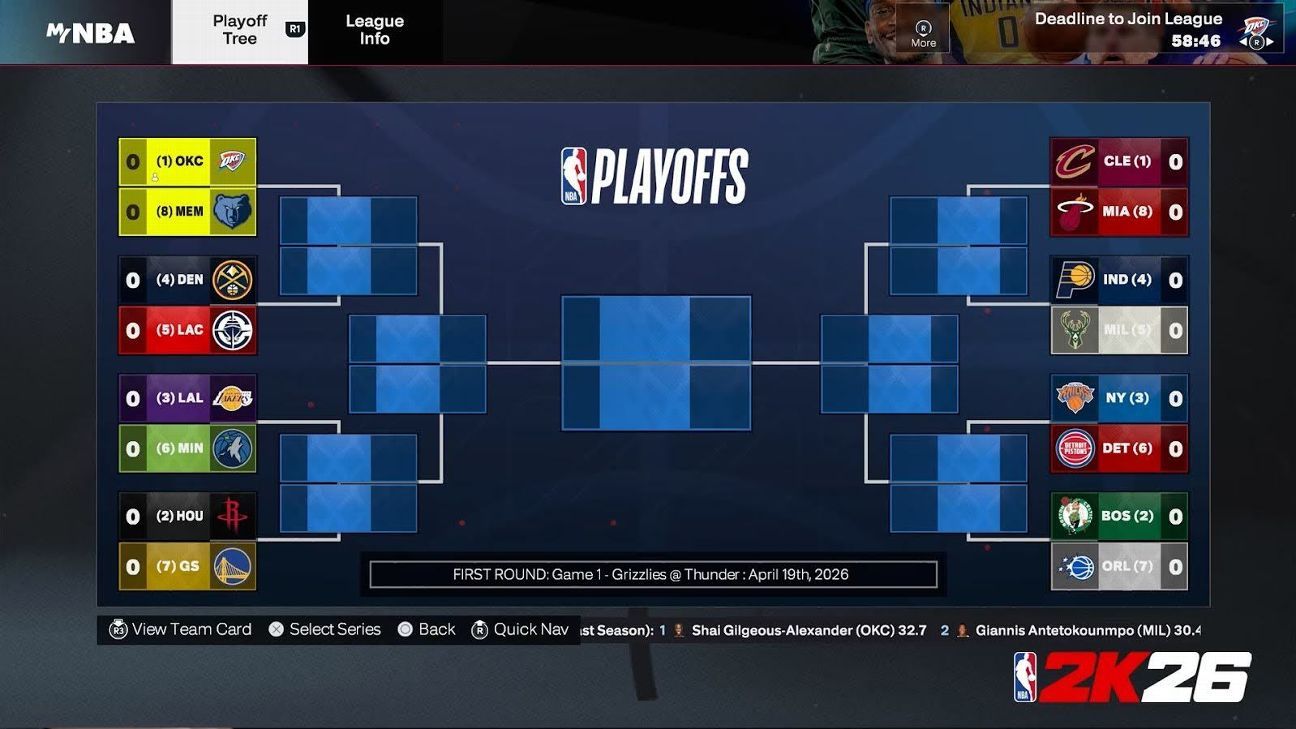

Nba 2 K26 Significant My Nba And My Gm Changes Announced

Sep 03, 2025

Nba 2 K26 Significant My Nba And My Gm Changes Announced

Sep 03, 2025 -

28 Years After The Bone Temple Trailer And Ralph Fiennes Return To The Undead

Sep 03, 2025

28 Years After The Bone Temple Trailer And Ralph Fiennes Return To The Undead

Sep 03, 2025 -

Trump Tariffs Deemed Illegal A Court Ruling And Its Implications

Sep 03, 2025

Trump Tariffs Deemed Illegal A Court Ruling And Its Implications

Sep 03, 2025 -

Reshaping Global Order China Russia Partnership Deepens At Sco Summit

Sep 03, 2025

Reshaping Global Order China Russia Partnership Deepens At Sco Summit

Sep 03, 2025

Latest Posts

-

Bryan Kohberger And Arfid Exploring The Connection

Sep 05, 2025

Bryan Kohberger And Arfid Exploring The Connection

Sep 05, 2025 -

Great Lakes Water Contamination Expands Affecting 1 Million Residents

Sep 05, 2025

Great Lakes Water Contamination Expands Affecting 1 Million Residents

Sep 05, 2025 -

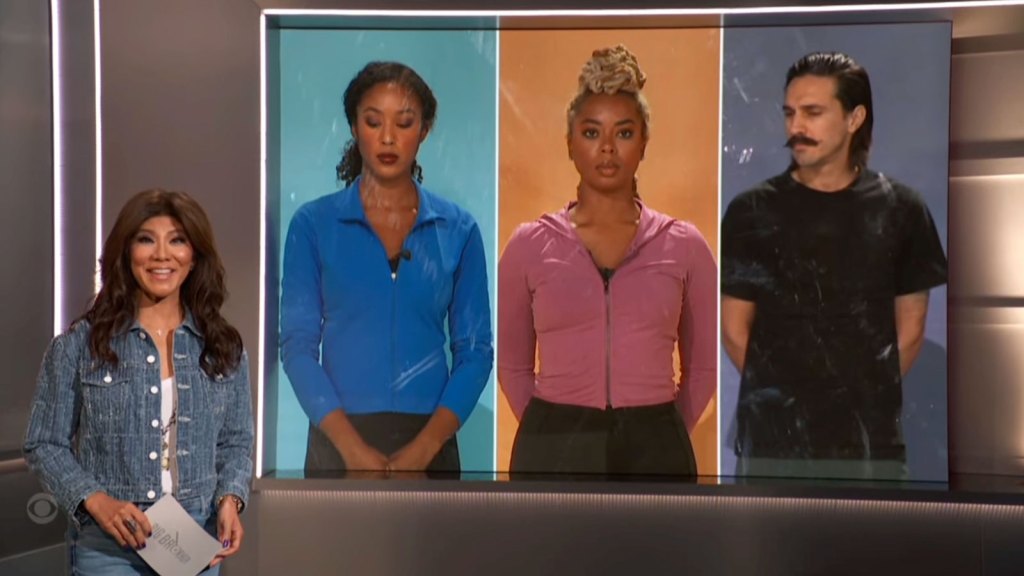

Big Brother Season 27 Week 8 Who Went Home Before Jury

Sep 05, 2025

Big Brother Season 27 Week 8 Who Went Home Before Jury

Sep 05, 2025 -

From Fan To Troll The Untold Story Of A Belichick Prank

Sep 05, 2025

From Fan To Troll The Untold Story Of A Belichick Prank

Sep 05, 2025 -

Jailing Of Nhs Surgeon Highlights Fraud And Unusual Circumstances

Sep 05, 2025

Jailing Of Nhs Surgeon Highlights Fraud And Unusual Circumstances

Sep 05, 2025