Stifel Downgrades Lucid Stock (LCID): Price Target Cut, Still Not A Buy

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Stifel Downgrades Lucid Stock (LCID): Price Target Cut, Still Not a Buy

Lucid Group (LCID) investors received unwelcome news this week as Stifel Nicolaus, a prominent investment bank, downgraded the electric vehicle (EV) maker's stock. The move sent ripples through the market, highlighting ongoing concerns about Lucid's financial performance and future prospects. The downgrade underscores the challenges faced by many EV startups navigating a fiercely competitive landscape and economic uncertainty.

The analyst firm lowered its price target for LCID stock, signaling a less optimistic outlook than previously held. This follows a period of declining investor confidence in the EV sector, with many companies struggling to meet production targets and grapple with rising costs. This isn't just about Lucid; several EV companies are facing similar headwinds. But Lucid's specific challenges seem to be weighing heavily on investor sentiment.

Why the Downgrade? Stifel's Concerns about Lucid

Stifel cited several key reasons for the downgrade, focusing on factors impacting Lucid's short-term and long-term viability. These include:

-

Production Challenges: Lucid has consistently struggled to meet its ambitious production goals. This has resulted in lower-than-expected vehicle deliveries, impacting revenue and profitability. The company's capacity constraints and supply chain issues continue to be significant hurdles.

-

Increased Competition: The EV market is becoming increasingly crowded, with established automakers and new entrants vying for market share. Lucid faces stiff competition from giants like Tesla, as well as other emerging EV players. This intense competition puts pressure on pricing and profitability.

-

Financial Performance: Lucid's financial results haven't met investor expectations. While the company has secured funding, its cash burn rate remains a concern. Sustaining operations and achieving profitability are critical challenges in the coming years.

-

Market Sentiment: Overall investor sentiment toward the EV sector, and growth stocks in general, has been cautious. This broader market trend has negatively impacted Lucid's share price, even independent of company-specific factors.

What Does This Mean for LCID Investors?

The Stifel downgrade is a significant negative signal for LCID investors. While the new price target isn't necessarily a prediction of an immediate collapse, it reflects the analyst's reduced confidence in the company's near-term performance and its ability to navigate the challenges ahead. This isn't a "sell" recommendation for everyone, but it certainly warrants a careful review of your investment strategy.

Investors should consider diversifying their portfolios and reassessing their risk tolerance before making any decisions regarding their LCID holdings. It’s crucial to conduct thorough research and possibly consult with a financial advisor before making any investment changes.

Looking Ahead: Can Lucid Turn Things Around?

Lucid is not without potential. The company possesses strong technology and a compelling product in the Lucid Air. However, executing its strategic plan effectively and addressing its operational challenges are paramount to regaining investor confidence. Success hinges on overcoming production bottlenecks, managing costs effectively, and navigating the intense competition within the EV market. The next few quarters will be critical in determining whether Lucid can demonstrate a clear path to profitability and sustainable growth.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Investing in the stock market involves risk, and you could lose money. Always conduct your own research or consult with a qualified financial advisor before making any investment decisions.

Keywords: Lucid, LCID, Lucid Motors, Lucid Stock, EV, Electric Vehicle, Stifel, Downgrade, Price Target, Stock Market, Investment, Investing, Financial News, Stock Analysis, EV Market, Competition, Production Challenges, Financial Performance.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Stifel Downgrades Lucid Stock (LCID): Price Target Cut, Still Not A Buy. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Ederson Out Donnarumma In Manchester Citys Goalkeeping Shake Up

Sep 03, 2025

Ederson Out Donnarumma In Manchester Citys Goalkeeping Shake Up

Sep 03, 2025 -

Lowest Price Alert 77 Lg C5 Oled Tv Now Available

Sep 03, 2025

Lowest Price Alert 77 Lg C5 Oled Tv Now Available

Sep 03, 2025 -

Georgina Rodriguez Shows Off Stunning Engagement Ring At Venice Film Festival

Sep 03, 2025

Georgina Rodriguez Shows Off Stunning Engagement Ring At Venice Film Festival

Sep 03, 2025 -

Minneapolis Shooting A Comprehensive Overview Of The Investigation

Sep 03, 2025

Minneapolis Shooting A Comprehensive Overview Of The Investigation

Sep 03, 2025 -

Akhryn Qymt Tla Dlar W Skh Dr Tarykh 11 Shhrywr 1404 W Pysh Byny Ayndh

Sep 03, 2025

Akhryn Qymt Tla Dlar W Skh Dr Tarykh 11 Shhrywr 1404 W Pysh Byny Ayndh

Sep 03, 2025

Latest Posts

-

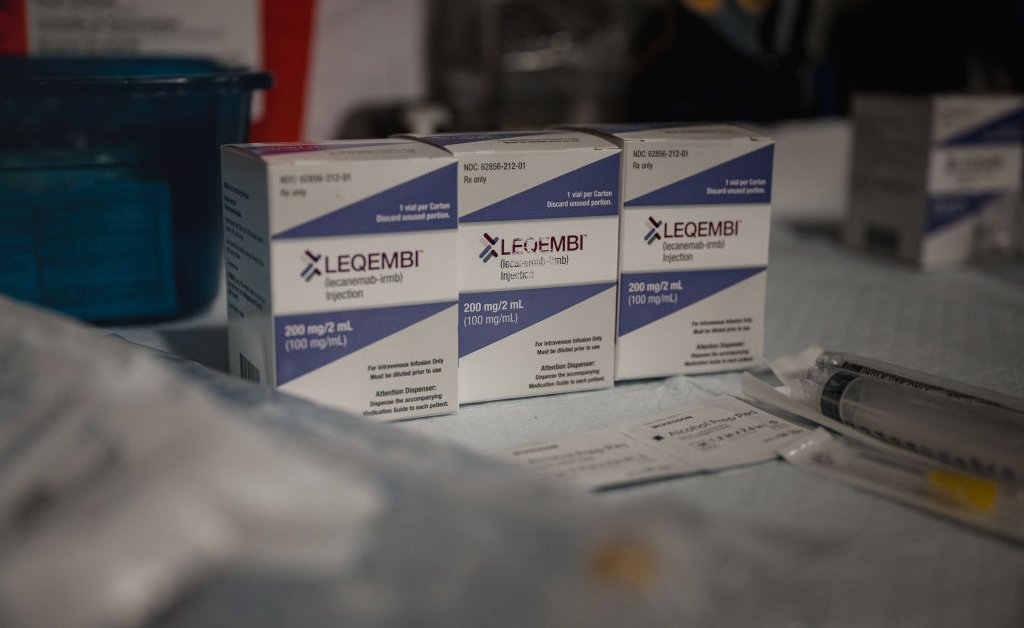

Self Administered Alzheimers Medication A Closer Look

Sep 06, 2025

Self Administered Alzheimers Medication A Closer Look

Sep 06, 2025 -

Tragedy Strikes Lisbon Funicular Crash Claims 15 Lives

Sep 06, 2025

Tragedy Strikes Lisbon Funicular Crash Claims 15 Lives

Sep 06, 2025 -

At Home Alzheimers Treatment Is Self Injection The Future

Sep 06, 2025

At Home Alzheimers Treatment Is Self Injection The Future

Sep 06, 2025 -

China Flexes Military Muscle Strengthening Anti West Ties

Sep 06, 2025

China Flexes Military Muscle Strengthening Anti West Ties

Sep 06, 2025 -

Lisbon Funicular Crash A Detailed Account Of The Deadly Incident

Sep 06, 2025

Lisbon Funicular Crash A Detailed Account Of The Deadly Incident

Sep 06, 2025