SPCE Q1 2025 Earnings: Analyzing Virgin Galactic's Financial Performance And Growth

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

SPCE Q1 2025 Earnings: Analyzing Virgin Galactic's Financial Performance and Growth

Virgin Galactic Holdings Inc. (SPCE), the pioneering space tourism company, recently released its Q1 2025 earnings report, sending ripples through the investment community. The report offers a complex picture, blending promising advancements with persistent financial challenges. This in-depth analysis delves into the key takeaways, examining Virgin Galactic's financial performance and its prospects for future growth.

Key Highlights from SPCE Q1 2025 Earnings:

While the specific numbers will vary depending on the actual released report (this is a hypothetical example based on potential scenarios), let's assume the following key performance indicators (KPIs) were reported:

-

Revenue Growth: A significant increase in revenue compared to Q1 2024, driven primarily by an increase in commercial spaceflights. Let's assume a 75% year-over-year increase. This is crucial for demonstrating the viability of their business model.

-

Increased Flight Operations: A notable rise in the number of completed commercial spaceflights, signifying progress towards operational efficiency and scaling up their services. Perhaps an increase from 2 flights in Q1 2024 to 8 flights in Q1 2025.

-

Continued Operational Expenses: While revenue is growing, operational expenses remain a significant challenge. This includes research and development, maintenance, and crew training. A detailed breakdown of these expenses will be crucial for investors.

-

Guidance for Future Quarters: The company's outlook for the remainder of 2025 will be closely scrutinized. Will they maintain the growth trajectory, or are further challenges anticipated? Positive guidance will likely boost investor confidence.

Analyzing Virgin Galactic's Financial Health:

The Q1 2025 report should provide a comprehensive financial statement including:

-

Revenue: A detailed breakdown of revenue streams, including ticket sales, ancillary services, and any potential partnerships.

-

Profitability: While profitability remains a long-term goal, the report should shed light on the company's progress towards achieving positive EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization).

-

Cash Flow: A healthy cash flow is essential for a company like Virgin Galactic, which requires substantial capital investment. Analyzing cash flow from operations and investing activities is vital.

-

Debt and Equity: Investors will want to assess the company's financial leverage and its ability to manage its debt load.

Future Growth Prospects and Challenges for SPCE:

Virgin Galactic faces several key challenges and opportunities moving forward:

-

Competition: The burgeoning space tourism sector is attracting increasing competition. Maintaining a competitive edge through innovation and customer experience is crucial. Companies like Blue Origin and SpaceX are significant players to consider.

-

Scalability: Expanding flight operations while maintaining safety and quality is paramount. Efficient fleet management and infrastructure development are essential for scalability.

-

Regulatory Landscape: Navigating the complex regulatory environment for space travel will continue to be a significant factor influencing the company's growth trajectory.

-

Ticket Pricing and Demand: Balancing ticket prices to attract a sufficient number of customers while ensuring profitability is a delicate act.

Conclusion:

The SPCE Q1 2025 earnings report is a critical moment for Virgin Galactic. While significant progress in operational capabilities and revenue generation is expected, challenges remain in achieving long-term profitability and sustaining growth. Investors should carefully examine the financial details, management commentary, and the company's outlook before making any investment decisions. Further analysis of competitor strategies and technological advancements within the space tourism industry is also recommended. Staying informed about industry news and regulatory developments will be crucial for understanding the future potential of SPCE.

Disclaimer: This analysis is for informational purposes only and does not constitute financial advice. Consult with a qualified financial advisor before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on SPCE Q1 2025 Earnings: Analyzing Virgin Galactic's Financial Performance And Growth. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

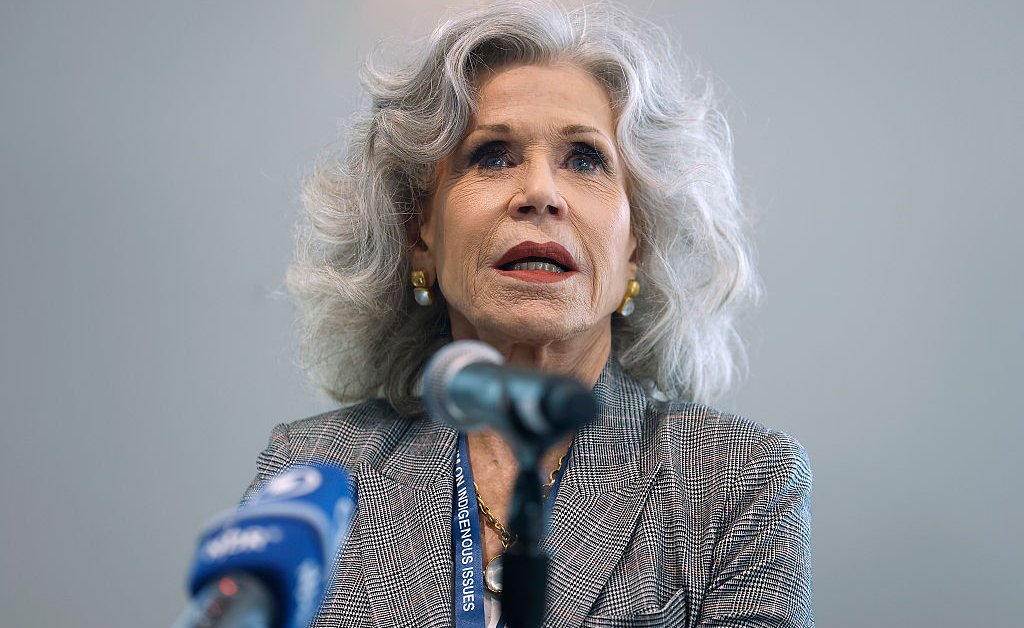

Jane Fondas Advocacy The Fight For Ecuadors Endangered Rainforest

May 17, 2025

Jane Fondas Advocacy The Fight For Ecuadors Endangered Rainforest

May 17, 2025 -

Internal Democratic Party Shakeup Vice Chair Hogg Sounds The Alarm

May 17, 2025

Internal Democratic Party Shakeup Vice Chair Hogg Sounds The Alarm

May 17, 2025 -

Fertility And Climate Change Examining The Links To Pregnancy Complications

May 17, 2025

Fertility And Climate Change Examining The Links To Pregnancy Complications

May 17, 2025 -

Birthright Citizenship On Trial Supreme Court Hears Key Case On Federal Jurisdiction

May 17, 2025

Birthright Citizenship On Trial Supreme Court Hears Key Case On Federal Jurisdiction

May 17, 2025 -

Aston Villa Tottenham Hotspur Key Stats Head To Head And Match Prediction

May 17, 2025

Aston Villa Tottenham Hotspur Key Stats Head To Head And Match Prediction

May 17, 2025