Social Security's 90th Anniversary: Potential Changes To Retirement Income

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Social Security at 90: A Look at Potential Changes to Retirement Income

Social Security, the cornerstone of retirement security for millions of Americans, celebrates its 90th anniversary this year. While the program has provided a crucial safety net for decades, its future faces considerable challenges. As the population ages and the workforce participation rate shifts, discussions surrounding potential changes to retirement income through Social Security are more vital than ever. This article explores the current state of Social Security, the looming challenges, and the potential reforms under consideration.

The Current State of Social Security: A Balancing Act

Established in 1935 amidst the Great Depression, Social Security initially provided a modest but essential income stream for retirees. Today, it serves as a lifeline for over 65 million Americans, including retirees, disabled workers, and their families. The system operates on a "pay-as-you-go" model, where current workers' contributions fund current beneficiaries' benefits. This model's sustainability hinges on a healthy balance between contributors and recipients.

However, demographic shifts are creating a significant strain. The aging baby boomer generation is entering retirement, leading to a higher proportion of beneficiaries compared to contributors. This imbalance is further exacerbated by increasing life expectancies and declining birth rates. The Social Security Administration (SSA) regularly publishes reports detailing the program's financial projections, which consistently highlight the need for long-term solutions to ensure its solvency. You can find these crucial reports directly on the .

Challenges Facing Social Security's Future

Several key challenges threaten Social Security's long-term viability:

- Declining Birth Rates: Fewer workers entering the workforce mean fewer contributions to support the growing number of retirees.

- Increasing Life Expectancies: People are living longer, drawing benefits for an extended period, increasing the overall financial burden.

- Rising Healthcare Costs: Healthcare expenses in retirement significantly impact retirees' financial well-being and put additional pressure on Social Security's resources.

- Economic Volatility: Recessions and economic downturns reduce tax revenues, impacting Social Security's funding.

Potential Changes and Reforms

Discussions regarding Social Security reform have been ongoing for years. Several proposals aim to address the looming financial challenges while ensuring the program's continued viability for future generations. These potential changes include:

- Raising the Full Retirement Age: Gradually increasing the age at which individuals can receive full retirement benefits could reduce the payout period and ease the financial strain.

- Adjusting Benefit Calculations: Re-evaluating the formula used to calculate benefit amounts could help manage costs without drastically reducing payments for individual retirees.

- Increasing the Taxable Earnings Base: Expanding the amount of earnings subject to Social Security taxes could generate additional revenue.

- Investing Social Security Trust Funds: Exploring opportunities to invest a portion of the Social Security trust funds in a diversified portfolio could generate higher returns.

The Road Ahead: Ensuring a Secure Retirement

The future of Social Security is a complex issue demanding careful consideration and bipartisan cooperation. While the program faces significant challenges, proactive measures can help ensure its long-term sustainability. Staying informed about these ongoing discussions and advocating for responsible solutions are crucial steps in safeguarding retirement security for all Americans. We encourage you to to share your concerns and perspectives. Understanding the complexities of Social Security and engaging in the conversation is essential to building a more secure retirement for future generations.

Disclaimer: This article provides general information and does not constitute financial or legal advice. For personalized guidance, consult with a qualified professional.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Social Security's 90th Anniversary: Potential Changes To Retirement Income. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Robinhoods Rto Policy Ceos Perspective And Employee Sentiment

Aug 16, 2025

Robinhoods Rto Policy Ceos Perspective And Employee Sentiment

Aug 16, 2025 -

How Robinhoods Ceo Is Using Rto To Drive Innovation Among Managers

Aug 16, 2025

How Robinhoods Ceo Is Using Rto To Drive Innovation Among Managers

Aug 16, 2025 -

25 Killed In Gaza Following Israeli Gunfire Netanyahus Evacuation Proposal Sparks Debate

Aug 16, 2025

25 Killed In Gaza Following Israeli Gunfire Netanyahus Evacuation Proposal Sparks Debate

Aug 16, 2025 -

A Deeper Dive Examining The Impact Of Weapons On Child Characters In Horror Movies

Aug 16, 2025

A Deeper Dive Examining The Impact Of Weapons On Child Characters In Horror Movies

Aug 16, 2025 -

Turkish Airlines Oman Air Partnership Unlock Miles On Flights

Aug 16, 2025

Turkish Airlines Oman Air Partnership Unlock Miles On Flights

Aug 16, 2025

Latest Posts

-

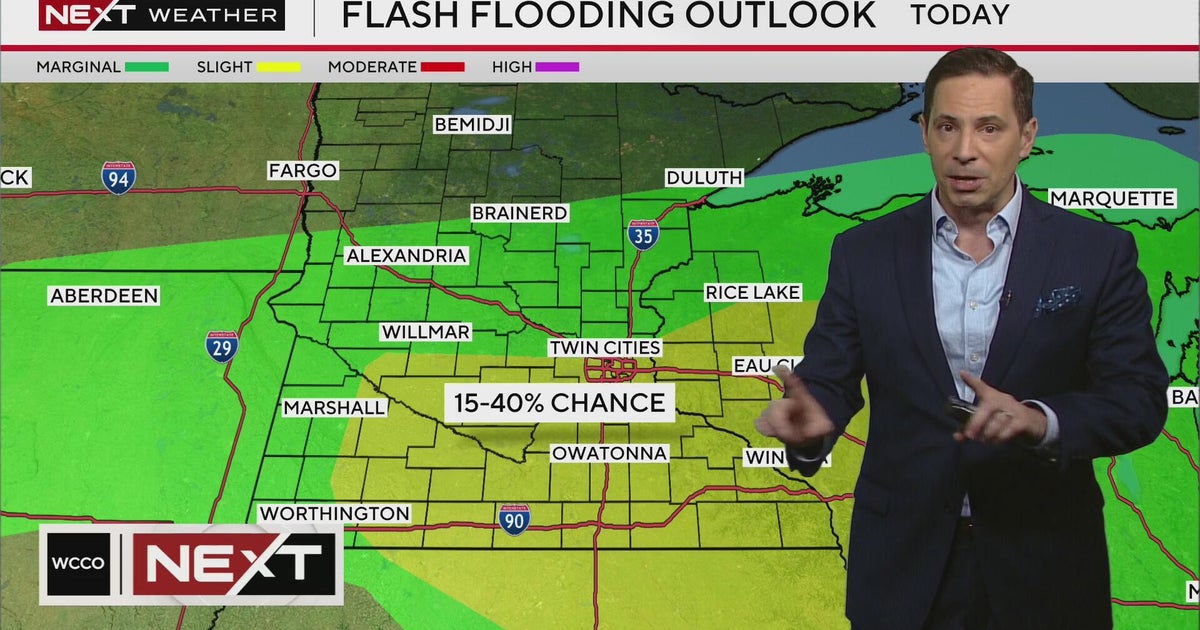

Next Weather 4 Pm Minnesota Forecast For August 15 2025

Aug 16, 2025

Next Weather 4 Pm Minnesota Forecast For August 15 2025

Aug 16, 2025 -

Unpacking The Perils A Critical Analysis Of The Trump Putin Meeting

Aug 16, 2025

Unpacking The Perils A Critical Analysis Of The Trump Putin Meeting

Aug 16, 2025 -

The Trump Putin Summit A Deeper Look At Potential Dangers

Aug 16, 2025

The Trump Putin Summit A Deeper Look At Potential Dangers

Aug 16, 2025 -

Advocacy Groups Israels New West Bank Settlements Will Lead To More Violence

Aug 16, 2025

Advocacy Groups Israels New West Bank Settlements Will Lead To More Violence

Aug 16, 2025 -

Expert Premier League Predictions Jones Knows Weekend Double

Aug 16, 2025

Expert Premier League Predictions Jones Knows Weekend Double

Aug 16, 2025