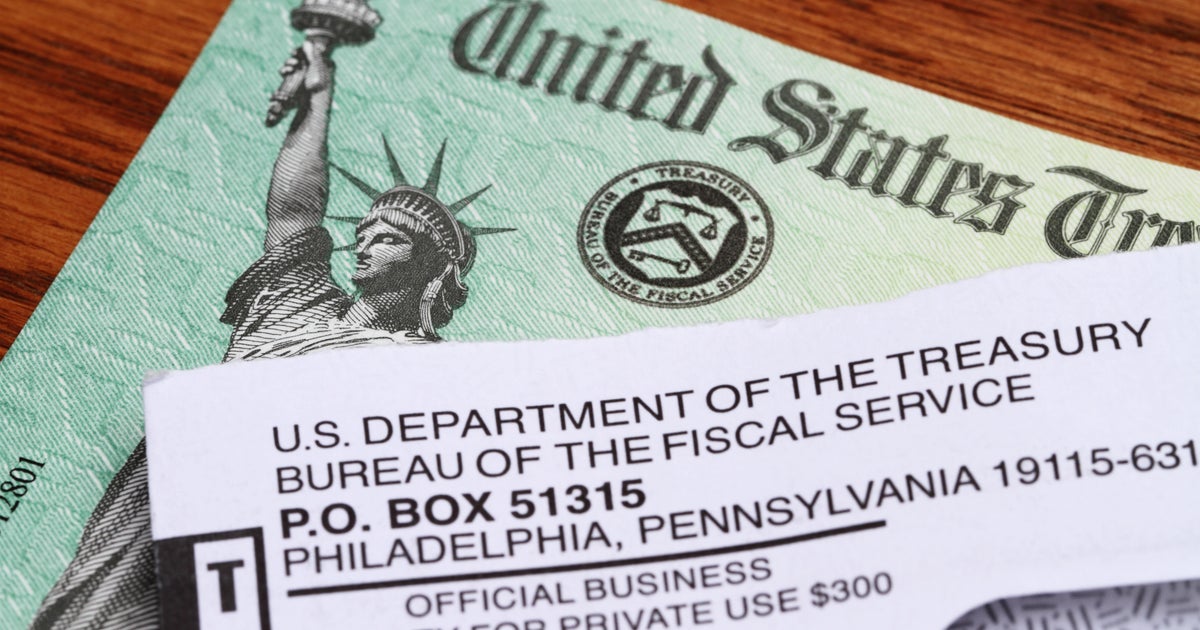

Social Security Taxes And The Inflation Reduction Act: What You Need To Know

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Social Security Taxes and the Inflation Reduction Act: What You Need to Know

The Inflation Reduction Act (IRA), signed into law in August 2022, made significant changes to various aspects of the US economy, including – though subtly – Social Security. While it didn't directly alter Social Security benefits or eligibility, it indirectly impacts taxpayers through its provisions on Medicare and overall economic policy. Understanding these indirect effects is crucial for anyone concerned about their Social Security taxes and future benefits.

This article will clarify the relationship between the IRA and Social Security taxes, addressing common questions and misconceptions.

What the Inflation Reduction Act Didn't Do to Social Security Taxes:

It's crucial to address the elephant in the room: the IRA did not raise Social Security taxes. The Social Security tax rate remains unchanged at 6.2% for employees and 6.2% for employers, with a combined 12.4% for self-employed individuals. The earnings base subject to Social Security tax also remains the same (this amount is adjusted annually for inflation). Rumors and misinformation regarding tax increases related to Social Security under the IRA are inaccurate.

How the IRA Indirectly Impacts Social Security:

The IRA's impact on Social Security is primarily indirect, stemming from its broader economic goals:

-

Reduced Deficit: A primary aim of the IRA is to reduce the national deficit. A healthier national economy, fueled by responsible fiscal policies, can positively influence Social Security's long-term solvency. While the IRA doesn't directly fund Social Security, a stronger economy generally translates into higher tax revenues, which can indirectly benefit the Social Security trust fund.

-

Medicare Cost Reduction: The IRA includes provisions to lower prescription drug costs for seniors on Medicare. This reduces government spending on healthcare, freeing up resources that could indirectly contribute to broader fiscal stability and, consequently, the financial health of Social Security. This is an important point, as Medicare and Social Security are linked in terms of overall national spending.

-

Increased Tax Revenue (Indirect): By aiming to lower inflation and stimulate sustainable economic growth, the IRA aims to generate more tax revenue overall. While the increased tax revenue doesn't specifically target Social Security, a robust economy generally translates to stronger Social Security tax collections.

What You Should Focus On Regarding Your Social Security Taxes:

Instead of focusing on the non-existent direct impacts of the IRA on your Social Security taxes, concentrate on these aspects:

-

Understanding Your Earnings: Ensure you understand how Social Security taxes are calculated based on your annual earnings and self-employment income. The Social Security Administration (SSA) website provides comprehensive resources.

-

Retirement Planning: Develop a sound retirement plan that considers various factors, including Social Security benefits, personal savings, and other retirement income sources. The SSA’s retirement estimator is a valuable tool.

-

Staying Informed: Keep yourself informed about changes in Social Security policy and economic trends through reputable sources like the SSA website and trusted financial news outlets.

In Conclusion:

The Inflation Reduction Act did not directly alter Social Security taxes. However, its indirect influence through broader economic policy and Medicare cost reduction may contribute positively to the long-term financial health of Social Security. Focus on understanding your own financial situation and planning for retirement rather than worrying about unsubstantiated claims of tax increases related to the IRA. Remember to consult financial advisors for personalized guidance on your retirement planning.

Keywords: Inflation Reduction Act, Social Security Taxes, Social Security benefits, Medicare, Retirement Planning, Social Security Administration, IRA, Taxes, Retirement, Economic Policy, Fiscal Policy, National Deficit.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Social Security Taxes And The Inflation Reduction Act: What You Need To Know. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Distracted Us Policy Enables Further Crackdown In Hong Kong

Jul 07, 2025

Distracted Us Policy Enables Further Crackdown In Hong Kong

Jul 07, 2025 -

Swiss Pharmaceutical Companies Strategies For Success In The Face Of U S Trade Barriers

Jul 07, 2025

Swiss Pharmaceutical Companies Strategies For Success In The Face Of U S Trade Barriers

Jul 07, 2025 -

Red Dead Online Strange Tales Dlc Brings Zombies Robots And More

Jul 07, 2025

Red Dead Online Strange Tales Dlc Brings Zombies Robots And More

Jul 07, 2025 -

Dc Studios Podcast The Unlikely Friendship That Fueled The Superman Lex Luthor Conflict

Jul 07, 2025

Dc Studios Podcast The Unlikely Friendship That Fueled The Superman Lex Luthor Conflict

Jul 07, 2025 -

Two Labor Markets Analyzing The Discrepancy Between Adp And Official Employment Numbers

Jul 07, 2025

Two Labor Markets Analyzing The Discrepancy Between Adp And Official Employment Numbers

Jul 07, 2025

Latest Posts

-

Trumps Tax Bill Increased Hunger Concerns For Iowa Food Pantries

Jul 07, 2025

Trumps Tax Bill Increased Hunger Concerns For Iowa Food Pantries

Jul 07, 2025 -

Dogecoin Price Holds Steady 0 16 Support Level Key For Bulls

Jul 07, 2025

Dogecoin Price Holds Steady 0 16 Support Level Key For Bulls

Jul 07, 2025 -

Israeli Air Force Targets Yemeni Ports And Galaxy Leader Vessel Idf Statement

Jul 07, 2025

Israeli Air Force Targets Yemeni Ports And Galaxy Leader Vessel Idf Statement

Jul 07, 2025 -

Cancer Free Jim Ross Confirmed For All In Wrestling Event In Texas

Jul 07, 2025

Cancer Free Jim Ross Confirmed For All In Wrestling Event In Texas

Jul 07, 2025 -

Wrestling News Jim Ross All In 2025 Commentary Role Announced

Jul 07, 2025

Wrestling News Jim Ross All In 2025 Commentary Role Announced

Jul 07, 2025