Social Security At 90: The Future Of Retirement Benefits

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Social Security at 90: The Future of Retirement Benefits

A cornerstone of American retirement security, Social Security celebrates its 90th anniversary in 2025. But as the program ages, so does its population, raising critical questions about its long-term solvency and the future of retirement benefits for millions.

This year marks a significant milestone for Social Security. Established in 1935 amidst the Great Depression, the Social Security Act revolutionized retirement security in the United States, providing a safety net for millions of Americans. But ninety years later, the program faces unprecedented challenges. Understanding these challenges and exploring potential solutions is crucial for ensuring the program's continued success and the financial well-being of future retirees.

The Looming Challenges: Funding and Demographics

The primary challenge facing Social Security is the changing demographics of the United States. The ratio of workers to retirees is shrinking, meaning fewer people are contributing to the system to support a growing number of beneficiaries. This imbalance, coupled with increasing life expectancies, is putting immense strain on the Social Security Trust Funds. The latest projections from the Social Security Administration (SSA) indicate that the trust funds will be depleted within the next decade or two, potentially leading to benefit cuts unless significant changes are made.

- Declining Birth Rates: Lower birth rates contribute directly to a smaller workforce supporting a larger retired population.

- Increased Life Expectancy: People are living longer, resulting in more years receiving benefits and increased strain on the system.

- Rising Healthcare Costs: The escalating cost of healthcare in later life impacts individual retirement savings and increases the demand for Social Security benefits.

Potential Solutions: A Multi-Pronged Approach

Addressing Social Security's long-term financial stability requires a multifaceted approach. There is no single, easy solution, and any changes will likely involve a combination of strategies. Some of the most frequently discussed options include:

- Raising the Full Retirement Age: Gradually increasing the age at which individuals can receive full retirement benefits could help to align the system with increasing life expectancies.

- Increasing the Social Security Tax Rate: A modest increase in the Social Security tax rate for both employers and employees could generate additional revenue.

- Increasing the Taxable Earnings Base: Expanding the amount of earnings subject to Social Security taxes could broaden the revenue base.

- Benefit Reductions: This is a politically sensitive option, but it remains a potential tool for addressing the funding gap.

- Benefit Formula Adjustments: Modifying the formula used to calculate benefits could help to ensure the system's long-term sustainability.

The Future of Retirement: Planning for Uncertainty

The future of Social Security remains uncertain. While the program is unlikely to disappear entirely, significant changes are almost inevitable. Individuals planning for retirement should consider this uncertainty and diversify their retirement strategies. This may involve:

- Increasing personal savings: Supplementing Social Security benefits with personal retirement accounts (like 401(k)s and IRAs) is crucial.

- Exploring alternative retirement income sources: Consider annuities, part-time work, or downsizing your home to create additional income streams.

- Staying informed: Keep abreast of legislative developments and potential changes to Social Security benefits.

Conclusion:

Social Security's 90th anniversary provides an opportunity to reflect on its past successes and address the challenges that lie ahead. Securing the future of Social Security requires a thoughtful and collaborative effort involving policymakers, stakeholders, and individuals. Proactive planning and a commitment to finding sustainable solutions are essential to preserving this vital safety net for generations to come. Learn more about planning your retirement by visiting the official .

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Social Security At 90: The Future Of Retirement Benefits. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

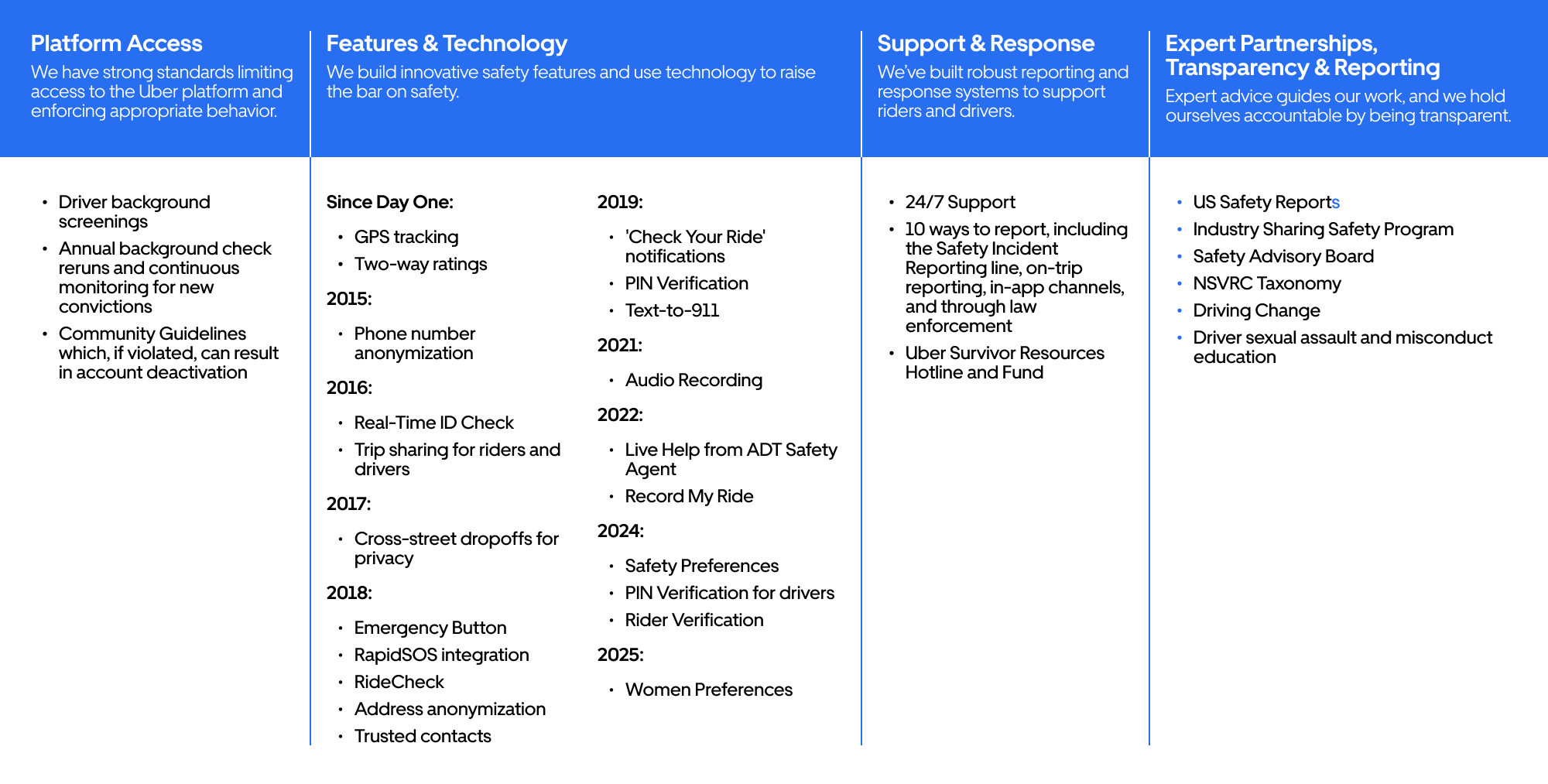

Assessing Ubers Commitment To Rider And Driver Safety

Aug 16, 2025

Assessing Ubers Commitment To Rider And Driver Safety

Aug 16, 2025 -

Fortnite Server Restoration A Full Report On The Recent Outage

Aug 16, 2025

Fortnite Server Restoration A Full Report On The Recent Outage

Aug 16, 2025 -

From Remote Work To 5 Day Office Robinhood Ceos U Turn On Rto

Aug 16, 2025

From Remote Work To 5 Day Office Robinhood Ceos U Turn On Rto

Aug 16, 2025 -

Fewer Tourists Fewer Tips Is The Las Vegas Economy In Decline

Aug 16, 2025

Fewer Tourists Fewer Tips Is The Las Vegas Economy In Decline

Aug 16, 2025 -

Earn Miles With Turkish Airlines And Oman Air Combined Frequent Flyer Program

Aug 16, 2025

Earn Miles With Turkish Airlines And Oman Air Combined Frequent Flyer Program

Aug 16, 2025

Latest Posts

-

Meet Nolan Mc Lean Ny Mets Top Pitching Prospect

Aug 16, 2025

Meet Nolan Mc Lean Ny Mets Top Pitching Prospect

Aug 16, 2025 -

General Hospitals Finola Hughes Reflects On Staying Alive And Early Career

Aug 16, 2025

General Hospitals Finola Hughes Reflects On Staying Alive And Early Career

Aug 16, 2025 -

Springboks Tactical Revolution Impact And Analysis

Aug 16, 2025

Springboks Tactical Revolution Impact And Analysis

Aug 16, 2025 -

Severe Weather Alert Strong Storms And Heavy Rain Overnight Into Saturday

Aug 16, 2025

Severe Weather Alert Strong Storms And Heavy Rain Overnight Into Saturday

Aug 16, 2025 -

Taylor Swifts The Life Of A Showgirl Everything We Know

Aug 16, 2025

Taylor Swifts The Life Of A Showgirl Everything We Know

Aug 16, 2025