Slowdown In Rate Cuts: U.S. Treasury Yields React To Fed's 2025 Forecast

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Slowdown in Rate Cuts: US Treasury Yields React to Fed's 2025 Forecast

The Federal Reserve's surprisingly hawkish projection for interest rates in 2025 sent shockwaves through the financial markets, leading to a noticeable increase in US Treasury yields. This unexpected shift marks a departure from previous expectations of more aggressive rate cuts and highlights the central bank's ongoing battle against persistent inflation. The market reaction underscores the delicate balancing act the Fed faces between cooling inflation and avoiding a recession.

Fed's 2025 Rate Projections: A Hawkish Surprise

The Federal Open Market Committee (FOMC) projected interest rates remaining elevated well into 2025. This forecast deviated significantly from market predictions, which anticipated a more rapid decline in interest rates. This divergence prompted immediate market reactions, with investors reassessing their expectations for future monetary policy. The unexpected hawkish stance suggests the Fed is prioritizing inflation control, even at the risk of slower economic growth. This could potentially signal a longer period of higher borrowing costs for consumers and businesses.

Impact on US Treasury Yields:

The immediate consequence of the Fed's announcement was a rise in US Treasury yields. Yields on 2-year and 10-year Treasury notes increased significantly, reflecting investor concerns about a prolonged period of tighter monetary policy. This rise in yields indicates a shift in investor sentiment, with a reduced expectation of near-term rate cuts. The increased yields reflect a higher perceived risk associated with holding US Treasury bonds in an environment of potentially higher interest rates for an extended period.

Market Volatility and Investor Sentiment:

The market's reaction was swift and pronounced. Stock prices experienced a decline as investors adjusted their portfolios to account for the altered interest rate outlook. The increased uncertainty surrounding future monetary policy contributed to heightened market volatility. Analysts are closely monitoring the situation, analyzing the potential ripple effects across various asset classes and economic sectors. The uncertainty surrounding the Fed's future actions leaves investors with a significant degree of risk.

Analyzing the Fed's Rationale:

The Fed's decision to maintain a hawkish stance despite recent economic slowdown signals a continued focus on achieving its 2% inflation target. While acknowledging the risks of a recession, the central bank appears unwilling to compromise on its inflation goals. This approach suggests that the Fed believes that tackling inflation aggressively now, even if it means sacrificing some economic growth in the short term, is the best course of action to avoid a more prolonged period of high inflation. This strategy is crucial to maintaining the credibility of the Fed's monetary policy.

What this Means for the Future:

The Fed's revised 2025 forecast represents a significant shift in the economic outlook. It highlights the ongoing challenges in managing inflation and the complexities involved in balancing inflation control with economic growth. The market's response underscores the sensitivity of financial markets to changes in central bank policy. Further volatility is expected as investors continue to digest the implications of the Fed’s announcement and await future economic data releases. The coming months will be crucial in determining the actual trajectory of interest rates and their impact on the broader economy.

Keywords: US Treasury yields, Federal Reserve, interest rates, inflation, monetary policy, FOMC, 2025 forecast, economic outlook, market volatility, recession, bond yields, investment strategy.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Slowdown In Rate Cuts: U.S. Treasury Yields React To Fed's 2025 Forecast. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

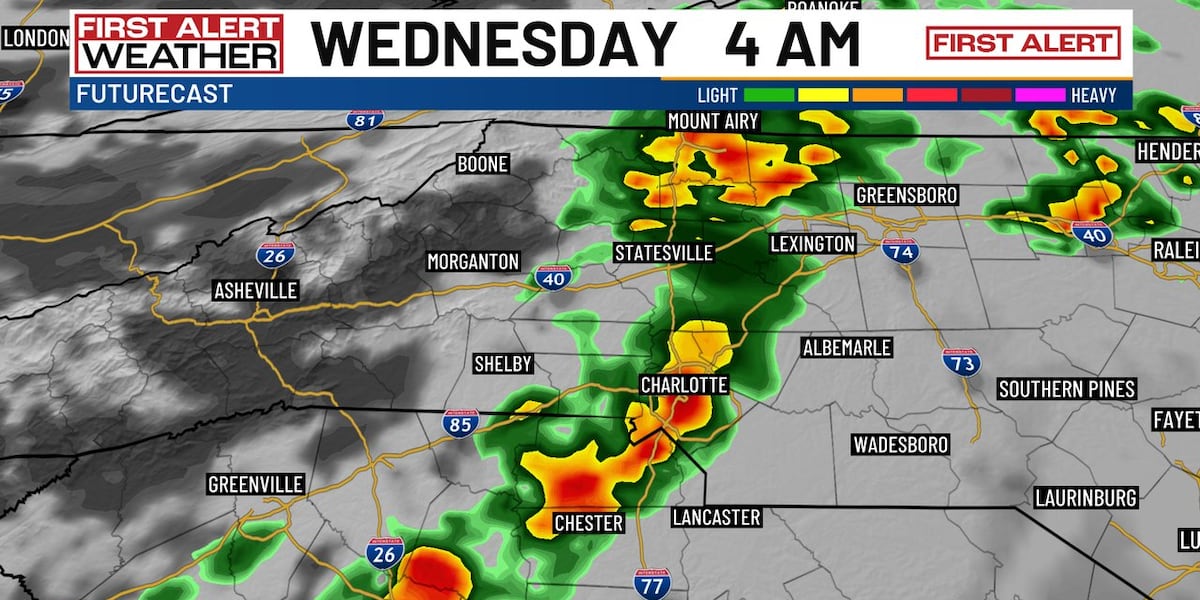

Overnight Storm System To Bring Heavy Rain And Cooler Temperatures To Charlotte

May 21, 2025

Overnight Storm System To Bring Heavy Rain And Cooler Temperatures To Charlotte

May 21, 2025 -

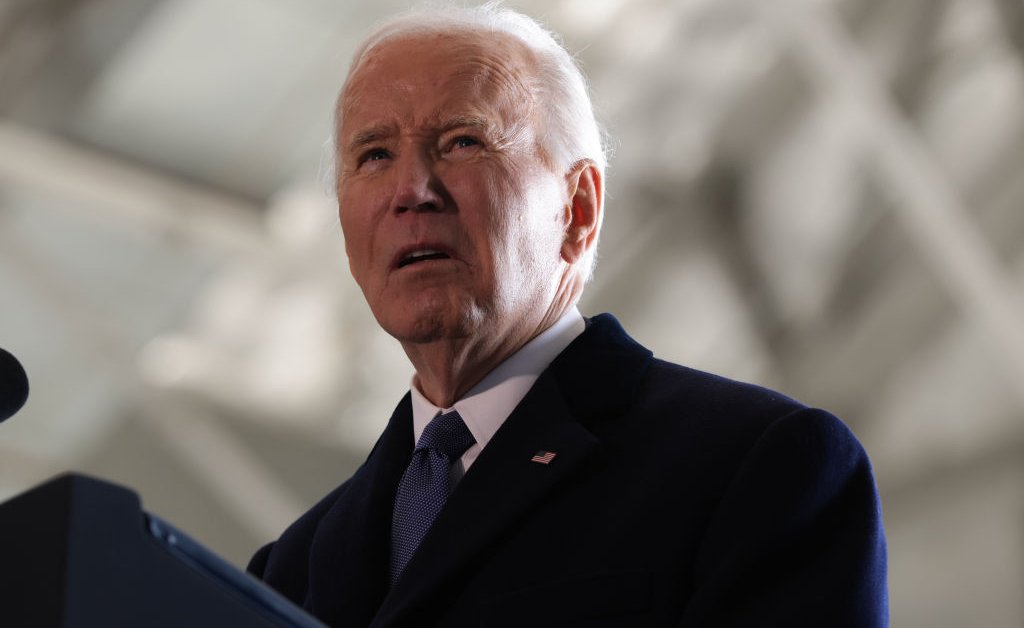

Is Biden Capable Vance Questions Presidents Fitness After Health News

May 21, 2025

Is Biden Capable Vance Questions Presidents Fitness After Health News

May 21, 2025 -

Medical And Scientific Research A Cornerstone Of American Strength And Prosperity

May 21, 2025

Medical And Scientific Research A Cornerstone Of American Strength And Prosperity

May 21, 2025 -

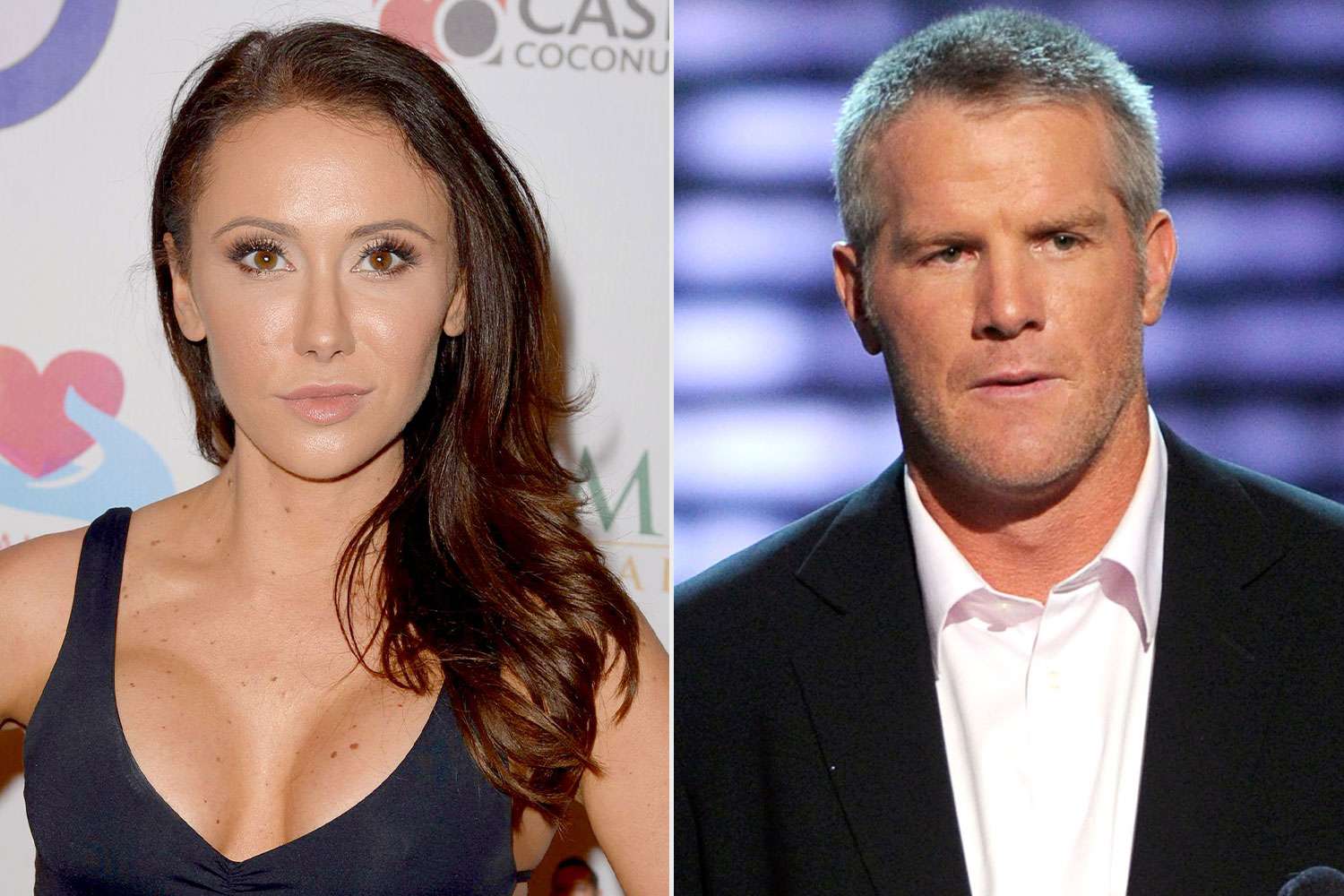

The Brett Favre Sexting Scandal Jenn Stergers Perspective On The Fallout

May 21, 2025

The Brett Favre Sexting Scandal Jenn Stergers Perspective On The Fallout

May 21, 2025 -

Critically Acclaimed Wwi Movie Featuring Daniel Craig Cillian Murphy And Tom Hardy Streaming Now

May 21, 2025

Critically Acclaimed Wwi Movie Featuring Daniel Craig Cillian Murphy And Tom Hardy Streaming Now

May 21, 2025