Slight Drop In U.S. Treasury Yields Follows Fed's Projection Of One 2025 Rate Cut

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Slight Drop in U.S. Treasury Yields Follows Fed's Projection of One 2025 Rate Cut

U.S. Treasury yields experienced a modest decline following the Federal Reserve's latest projections, which hinted at a potential interest rate cut in 2025. The move, although subtle, signals a shift in market sentiment regarding the future trajectory of interest rates and the overall economic outlook. This article delves into the details of this shift and explores its potential implications for investors and the broader economy.

The Federal Open Market Committee (FOMC) concluded its two-day meeting on Wednesday, [Insert Date], with a decision to hold interest rates steady. However, the accompanying economic projections revealed a notable change: a single quarter-point rate cut is now anticipated by some Fed officials in 2025. This is a departure from previous forecasts, which had largely excluded any rate cuts in the near future.

What Drove the Yield Dip?

The projected rate cut, albeit distant, injected a dose of dovishness into the market. Investors interpreted this as a potential softening of the Fed's hawkish stance on inflation, leading to reduced demand for higher-yielding Treasury bonds. Consequently, yields on these bonds experienced a slight dip. The benchmark 10-year Treasury yield fell [Insert Percentage] to [Insert Yield Percentage], while the 2-year yield dropped by [Insert Percentage] to [Insert Yield Percentage].

This reaction highlights the sensitivity of the bond market to even subtle changes in the Fed's outlook. Any hint of future easing can influence investor behavior and trigger adjustments in bond prices and yields.

Analyzing the Fed's Projections:

The Fed's projections are not unanimous, and the predicted rate cut isn't a certainty. The median projection of FOMC participants still anticipates the federal funds rate remaining above 5% through the end of 2024. However, the inclusion of a single rate cut in 2025 reflects a growing recognition among some officials that inflation might cool more quickly than previously anticipated.

Several factors might contribute to this shift in thinking:

- Cooling Inflation: Inflation data has shown signs of moderating in recent months. While still above the Fed's 2% target, the trend suggests progress in curbing price increases.

- Economic Slowdown Concerns: Concerns remain about the possibility of a significant economic slowdown, or even a recession, potentially dampening inflationary pressures.

- Labor Market Dynamics: Although the labor market remains relatively strong, there are indications of a potential slowdown in job growth, which could contribute to easing inflationary pressures.

Implications for Investors:

The slight drop in Treasury yields might signal a shift in the investment landscape. Investors who anticipated continued rate hikes may now reassess their portfolios, potentially favoring assets that perform well in a lower interest rate environment. This could impact various asset classes, including stocks, corporate bonds, and real estate.

Looking Ahead:

While the single projected rate cut in 2025 is a notable development, it's crucial to remember that the economic outlook remains uncertain. The Fed's decisions will continue to be data-dependent, meaning that future economic indicators will play a significant role in shaping monetary policy. Investors should closely monitor inflation data, employment figures, and other key economic releases for insights into the future trajectory of interest rates. Staying informed through reliable financial news sources is essential for making well-informed investment decisions.

Disclaimer: This article provides general information and should not be considered investment advice. Consult a qualified financial advisor before making any investment decisions.

Keywords: US Treasury Yields, Federal Reserve, Interest Rates, Rate Cut, Bond Market, Economic Outlook, Inflation, FOMC, 10-year Treasury Yield, 2-year Treasury Yield, Investment Strategy, Monetary Policy.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Slight Drop In U.S. Treasury Yields Follows Fed's Projection Of One 2025 Rate Cut. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Information Blackout Jon Jones Blasts Ufcs Handling Of Aspinall Injury

May 21, 2025

Information Blackout Jon Jones Blasts Ufcs Handling Of Aspinall Injury

May 21, 2025 -

Letitia James Trump Lawsuits And Doj Real Estate Probe Clash

May 21, 2025

Letitia James Trump Lawsuits And Doj Real Estate Probe Clash

May 21, 2025 -

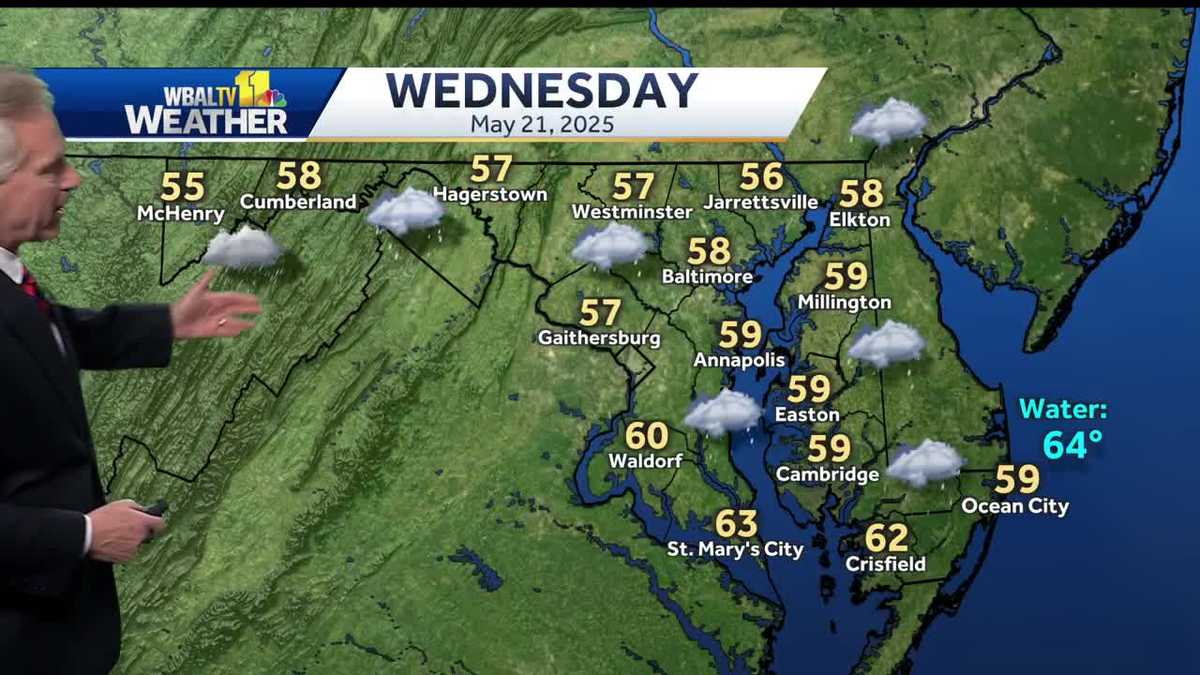

Wednesday Weather Rain And Cold Temperatures Expected

May 21, 2025

Wednesday Weather Rain And Cold Temperatures Expected

May 21, 2025 -

Church Vandalism Two Boys Charged After Bathroom Incident

May 21, 2025

Church Vandalism Two Boys Charged After Bathroom Incident

May 21, 2025 -

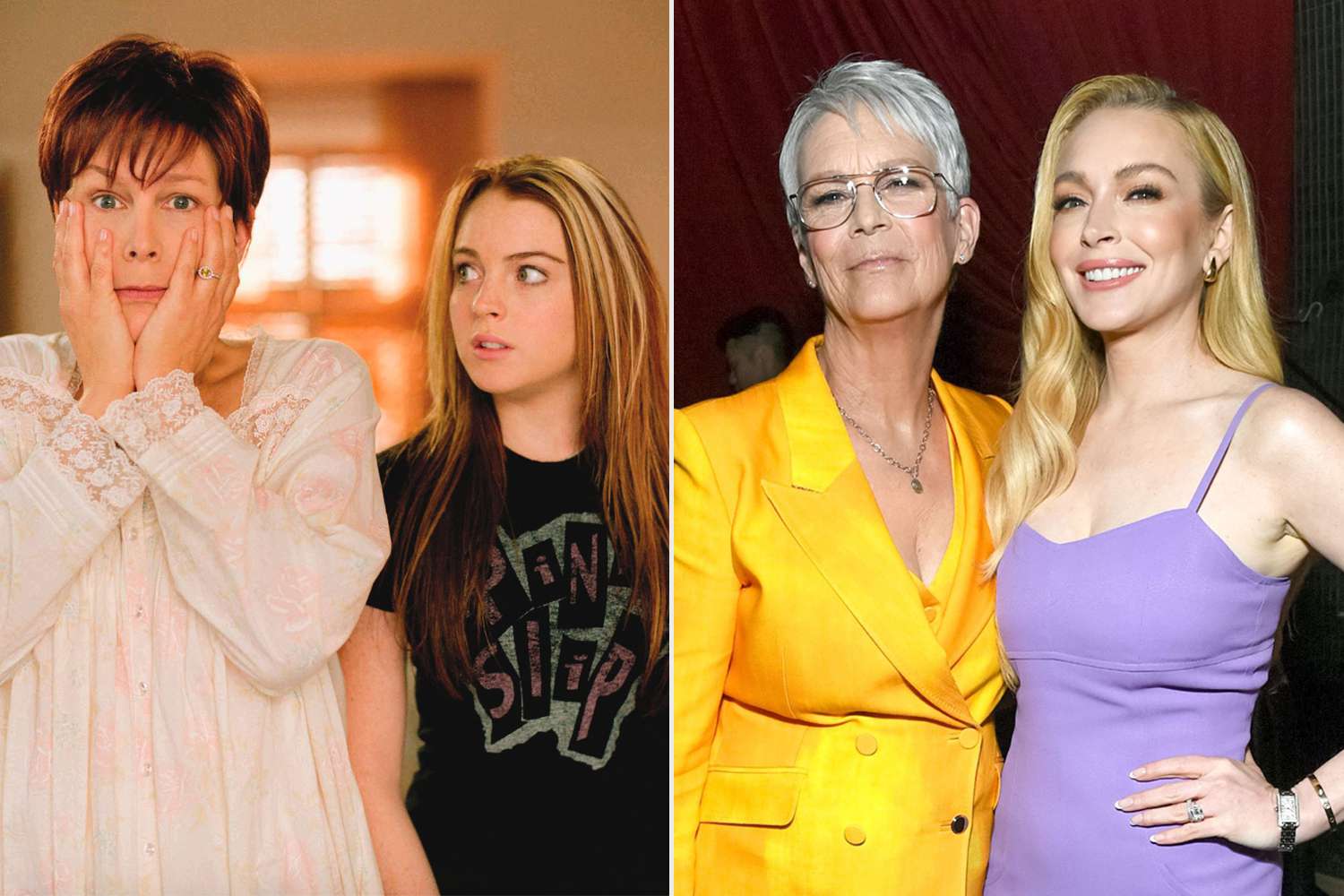

The Freaky Friday Legacy Jamie Lee Curtis Discusses Her Ongoing Friendship With Lindsay Lohan

May 21, 2025

The Freaky Friday Legacy Jamie Lee Curtis Discusses Her Ongoing Friendship With Lindsay Lohan

May 21, 2025