Slight Dip In U.S. Treasury Yields Following Fed's Rate Cut Projection

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Slight Dip in U.S. Treasury Yields After Fed Hints at Rate Cut

U.S. Treasury yields experienced a modest decline following the Federal Reserve's recent projection of a potential interest rate cut later this year. This move, although subtle, sent ripples through the financial markets, prompting analysts to scrutinize the central bank's evolving stance on monetary policy. The shift suggests a growing concern among policymakers regarding the potential for an economic slowdown, a development closely watched by investors worldwide.

The Fed's announcement, made during its [insert date] meeting, indicated a belief that inflation is cooling more quickly than initially anticipated. While the current inflation rate remains above the Fed's target of 2%, the projected easing of monetary policy suggests a shift towards prioritizing economic growth over further aggressive inflation-fighting measures. This strategic pivot is a significant departure from the more hawkish stance observed earlier in the year.

Understanding the Impact on Treasury Yields

U.S. Treasury yields move inversely to bond prices. When investors anticipate lower interest rates, the demand for existing bonds with higher yields increases, pushing their prices up and consequently causing yields to fall. This is precisely what happened following the Fed's statement. The expectation of future rate cuts reduced the attractiveness of newly issued bonds, leading to a decrease in demand and a corresponding dip in yields.

This subtle yet significant market reaction highlights the delicate balancing act the Fed faces. The central bank is attempting to navigate the complex interplay between combating inflation and preventing a potential recession. A premature or overly aggressive rate hike could stifle economic growth, while insufficient tightening could allow inflation to become entrenched.

What Does This Mean for Investors?

The slight dip in Treasury yields presents both opportunities and challenges for investors. For those seeking income, the reduced yields may necessitate a reassessment of their investment strategies. However, the potential for future rate cuts could also offer opportunities for those willing to take on more risk in anticipation of rising bond prices.

Key considerations for investors include:

- Diversification: Maintaining a well-diversified portfolio across various asset classes remains crucial in navigating fluctuating market conditions.

- Risk Tolerance: Investors should carefully assess their own risk tolerance before making any significant investment decisions based on the Fed's projections.

- Long-Term Perspective: Maintaining a long-term investment perspective is essential to weathering short-term market volatility.

The Road Ahead: Uncertainty Remains

While the Fed's projection of a potential rate cut offers some clarity, significant uncertainty remains. The future trajectory of inflation, economic growth, and geopolitical events will all play a role in shaping the Fed's future monetary policy decisions.

Analysts are closely monitoring several key economic indicators, including inflation data, employment figures, and consumer spending, to gauge the effectiveness of the Fed's current approach. Any unexpected shifts in these indicators could trigger further volatility in Treasury yields and broader financial markets.

For more in-depth analysis on this topic, you might find the following resources helpful: [Link to a reputable financial news source]. Stay tuned for further updates as the situation evolves. Understanding these market shifts is key to making informed financial decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Slight Dip In U.S. Treasury Yields Following Fed's Rate Cut Projection. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Trumps Tariff Standoff With Walmart Will Consumers Feel The Pinch

May 20, 2025

Trumps Tariff Standoff With Walmart Will Consumers Feel The Pinch

May 20, 2025 -

Trumps Venezuela Tps Victory Supreme Court Clears Path For Deportations

May 20, 2025

Trumps Venezuela Tps Victory Supreme Court Clears Path For Deportations

May 20, 2025 -

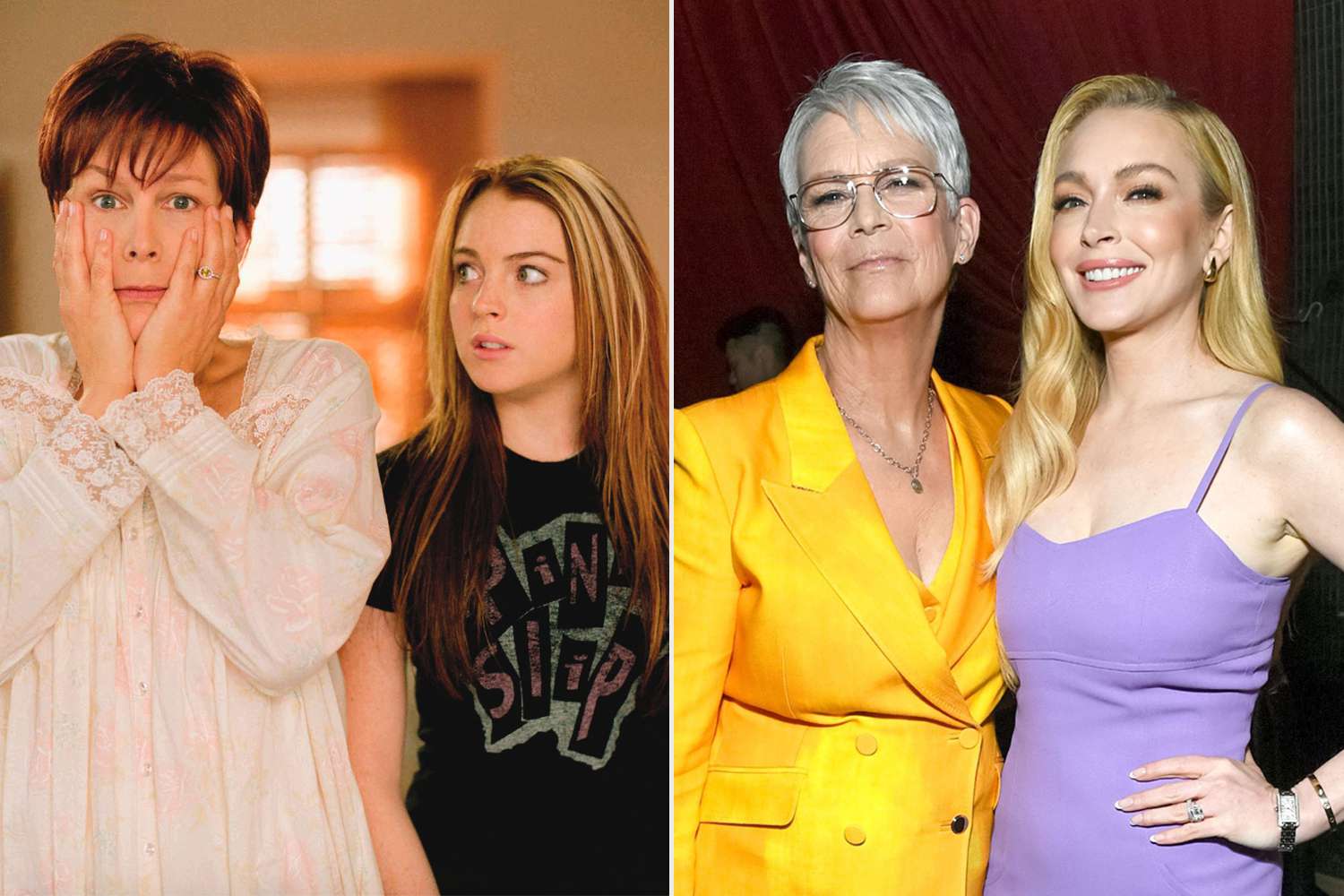

Exclusive Interview Jamie Lee Curtis On Her Relationship With Lindsay Lohan Following Freaky Friday

May 20, 2025

Exclusive Interview Jamie Lee Curtis On Her Relationship With Lindsay Lohan Following Freaky Friday

May 20, 2025 -

From Debut Novel To Bestseller Decoding Taylor Jenkins Reids Publishing Success

May 20, 2025

From Debut Novel To Bestseller Decoding Taylor Jenkins Reids Publishing Success

May 20, 2025 -

My 600 Lb Lifes Latonya Pottain Passes Away At 40 A Tragic Loss

May 20, 2025

My 600 Lb Lifes Latonya Pottain Passes Away At 40 A Tragic Loss

May 20, 2025