Slight Decrease In US Treasury Yields Following Fed's Rate Cut Indication

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Slight Decrease in US Treasury Yields After Fed Hints at Rate Cut

US Treasury yields experienced a modest dip following the Federal Reserve's latest indication of a potential interest rate cut. This shift, though subtle, signals a growing expectation among investors that the Fed may soon ease its monetary policy stance to combat slowing economic growth. The move comes amid increasing concerns about potential recessionary pressures and the ongoing impact of banking sector instability.

The benchmark 10-year Treasury yield fell slightly to [insert current yield percentage] on [date], down from [previous yield percentage] on [previous date]. Similarly, the 2-year Treasury yield, a more sensitive indicator of short-term interest rate expectations, also saw a minor decline. This downward trend reflects a shift in investor sentiment, with many now anticipating a less aggressive approach from the Federal Reserve in its fight against inflation.

What Drove the Yield Decrease?

Several factors contributed to this subtle yet significant decrease in Treasury yields. The primary driver is the market's interpretation of the Fed's recent communication. While the Fed hasn't explicitly committed to a rate cut, recent statements from Federal Reserve officials have hinted at a potential pause or even a reduction in interest rates in the coming months. This comes in response to:

- Slowing Economic Growth: Recent economic data has pointed to a slowdown in various key sectors, raising concerns about a potential recession. Indicators like weakening consumer spending and a cooling housing market have fueled speculation of a rate cut.

- Banking Sector Concerns: The recent turmoil in the banking sector, particularly the collapse of Silicon Valley Bank and Signature Bank, has increased uncertainty in the financial markets. The Fed’s actions to shore up the banking system have also contributed to the expectation of a more dovish monetary policy.

- Inflation Easing (Slightly): While inflation remains stubbornly high, there are signs that it may be beginning to ease slightly. This, coupled with the other factors, has led some investors to believe that the Fed might have more room to maneuver on interest rates.

What This Means for Investors

The decrease in Treasury yields carries implications for various aspects of the financial market. Lower yields generally translate to:

- Lower borrowing costs: Companies and individuals may find it cheaper to borrow money.

- Increased demand for bonds: Lower yields can make bonds more attractive to income-seeking investors.

- Potential impact on the stock market: Lower yields can potentially boost the stock market, as investors may shift their allocations from bonds to equities.

However, it's crucial to remember that the situation remains fluid. The Fed's future actions will heavily depend on incoming economic data and the evolving inflation picture. A premature rate cut could risk reigniting inflationary pressures, while delaying a cut might exacerbate economic slowdown.

Looking Ahead: Uncertainty Remains

While the slight decrease in Treasury yields offers a glimpse into potential future monetary policy, considerable uncertainty remains. Investors should carefully monitor upcoming economic data releases, including inflation reports and employment figures, to gauge the Fed's likely next move. Furthermore, the ongoing situation in the banking sector continues to be a key factor influencing market sentiment and interest rate expectations. The coming weeks and months will be crucial in determining the trajectory of US Treasury yields and the overall economic outlook.

Disclaimer: This article provides general information and should not be considered financial advice. Consult with a qualified financial advisor before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Slight Decrease In US Treasury Yields Following Fed's Rate Cut Indication. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

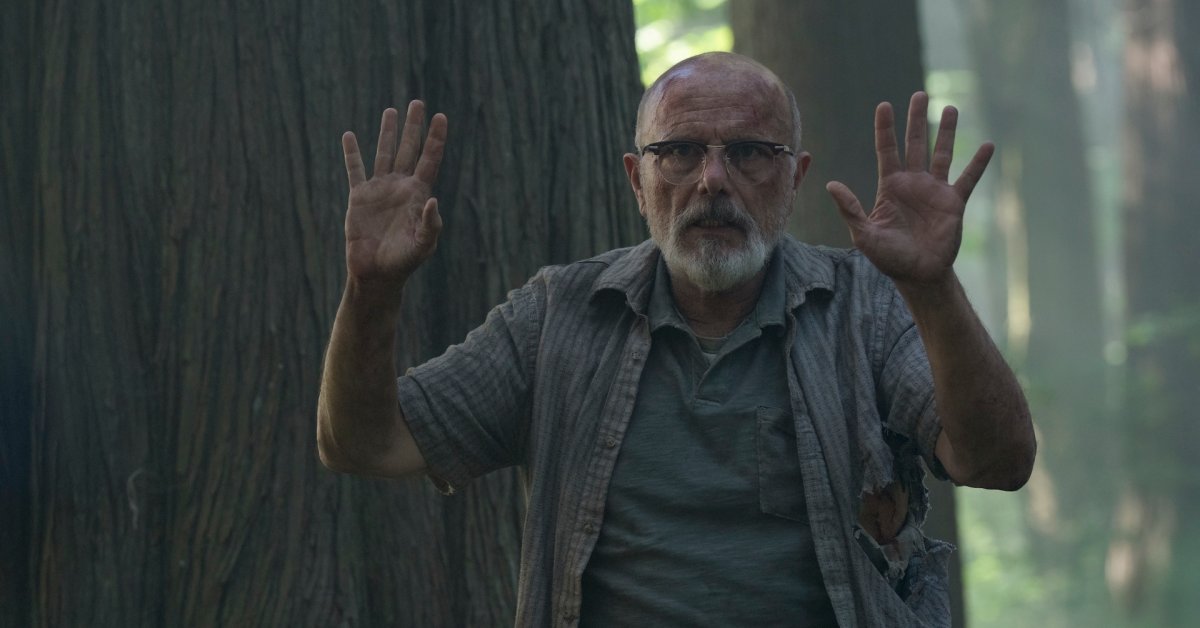

Joel And Ellies Evolving Dynamic Analyzing The Last Of Us Season 2s Departures From The Game

May 20, 2025

Joel And Ellies Evolving Dynamic Analyzing The Last Of Us Season 2s Departures From The Game

May 20, 2025 -

Is A Dhs Backed Citizenship Competition Reality Show On The Horizon

May 20, 2025

Is A Dhs Backed Citizenship Competition Reality Show On The Horizon

May 20, 2025 -

Revealed The Truth Behind Jamie Lee Curtis And Lindsay Lohans Friendship

May 20, 2025

Revealed The Truth Behind Jamie Lee Curtis And Lindsay Lohans Friendship

May 20, 2025 -

Potential Global Blackouts Nasa Forecasts Powerful Solar Flares

May 20, 2025

Potential Global Blackouts Nasa Forecasts Powerful Solar Flares

May 20, 2025 -

Jon Jones And Tom Aspinall Fan Fury Over Controversial Strip The Duck Comment

May 20, 2025

Jon Jones And Tom Aspinall Fan Fury Over Controversial Strip The Duck Comment

May 20, 2025