Six-Day Winning Streak: S&P 500 Leads Stock Market Rally After Moody's Downgrade

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Six-Day Winning Streak: S&P 500 Leads Stock Market Rally After Moody's Downgrade – A Surprise Turnaround?

The stock market defied expectations this week, staging a remarkable six-day winning streak culminating in a significant rally led by the S&P 500. This surge comes on the heels of Moody's downgrade of several small and mid-sized US banking institutions, an event that many analysts predicted would trigger a market downturn. The unexpected positive movement raises questions about the resilience of the market and the factors driving this surprising turnaround.

Moody's Downgrade and Market Reaction:

Moody's recent downgrade of 10 small and mid-sized banks, citing concerns about credit quality and rising interest rates, sent shockwaves through the financial sector. Many investors braced for a significant market correction, fearing a domino effect similar to the banking crisis earlier this year. However, the market's response has been decidedly different. Instead of a crash, we've witnessed a robust rally.

The S&P 500's Strong Performance:

The S&P 500 index, a benchmark for US large-cap stocks, has been the driving force behind this unexpected rally. Its six-day winning streak reflects a significant surge in investor confidence, defying initial predictions of a bearish market. This counter-intuitive response suggests underlying factors are at play, overshadowing the negative impact of the Moody's downgrade.

Factors Contributing to the Rally:

Several factors might be contributing to this surprising market performance:

- Resilience of the Banking Sector: While the Moody's downgrade impacted some smaller institutions, the larger banks appear to be weathering the storm, indicating a degree of resilience within the broader financial system. This stability could be reassuring investors.

- Strong Corporate Earnings: Positive corporate earnings reports from several key companies have likely boosted investor sentiment, reinforcing confidence in the overall economic outlook. Strong earnings often outweigh short-term negative news.

- Federal Reserve's Actions: The Federal Reserve's recent pause in interest rate hikes has likely provided a degree of stability, reducing uncertainty in the market. While further rate hikes are anticipated, the pause itself is a positive signal for investors.

- Bargain Hunting: Some analysts suggest that the initial dip following the Moody's downgrade presented a buying opportunity for investors seeking undervalued assets. This bargain hunting could have fueled the subsequent rally.

Analyzing the Long-Term Implications:

While the current six-day winning streak is impressive, it's crucial to avoid drawing premature conclusions about the long-term implications. The market remains volatile, and several factors could still impact its performance in the coming weeks and months. The ongoing impact of inflation, geopolitical tensions, and further interest rate hikes remain significant uncertainties.

Looking Ahead:

The unexpected rally following the Moody's downgrade highlights the complexity and unpredictability of the stock market. While the current positive trend is encouraging, investors should remain cautious and continue to monitor key economic indicators and geopolitical events. Further analysis is needed to determine whether this rally represents a sustainable trend or a temporary reprieve. Consult with a financial advisor before making any investment decisions.

Keywords: S&P 500, Stock Market Rally, Moody's Downgrade, Six-Day Winning Streak, Stock Market, Market Volatility, Banking Sector, Federal Reserve, Interest Rates, Investment, Economic Outlook, Corporate Earnings.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Six-Day Winning Streak: S&P 500 Leads Stock Market Rally After Moody's Downgrade. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

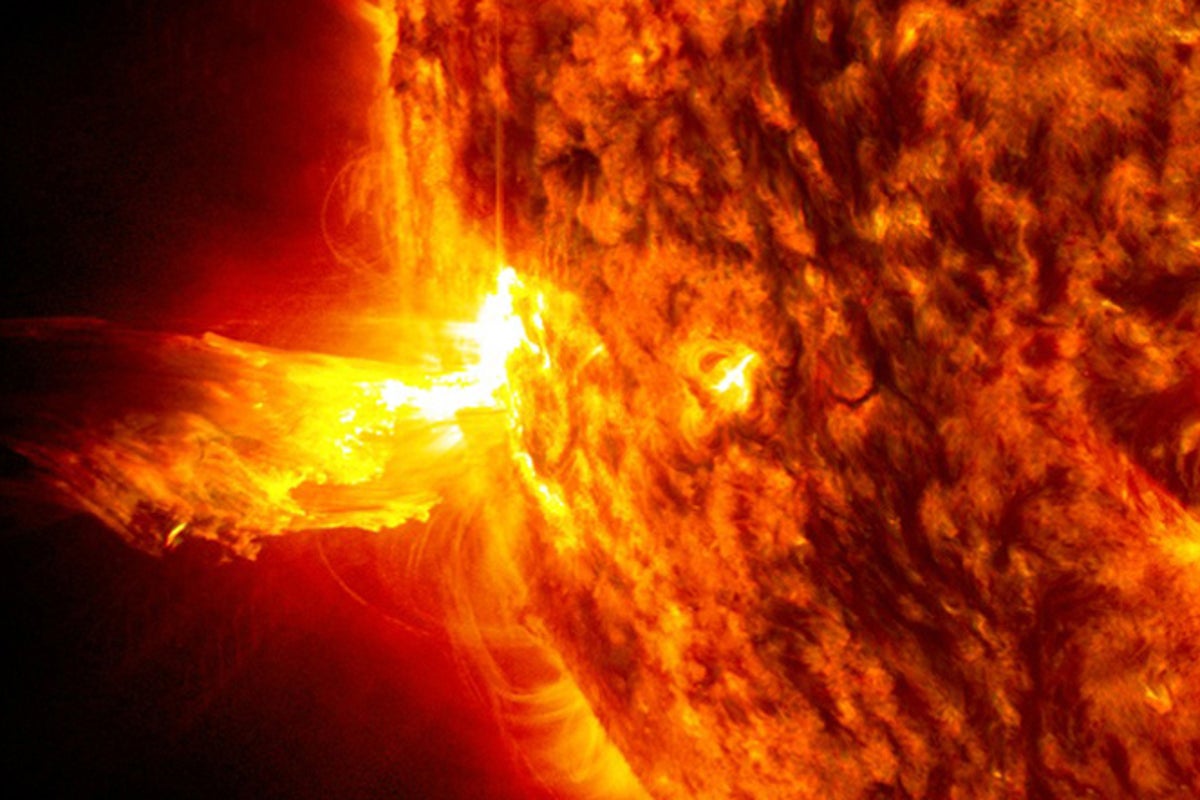

Solar Storm Warning Nasa Forecasts Widespread Blackouts

May 20, 2025

Solar Storm Warning Nasa Forecasts Widespread Blackouts

May 20, 2025 -

Jon Jones Ufc Future Uncertain I M Done Hint Sparks Fan Fury

May 20, 2025

Jon Jones Ufc Future Uncertain I M Done Hint Sparks Fan Fury

May 20, 2025 -

Helldivers 2 Warbond Event Masters Of Ceremony Skins Arrive May 15th

May 20, 2025

Helldivers 2 Warbond Event Masters Of Ceremony Skins Arrive May 15th

May 20, 2025 -

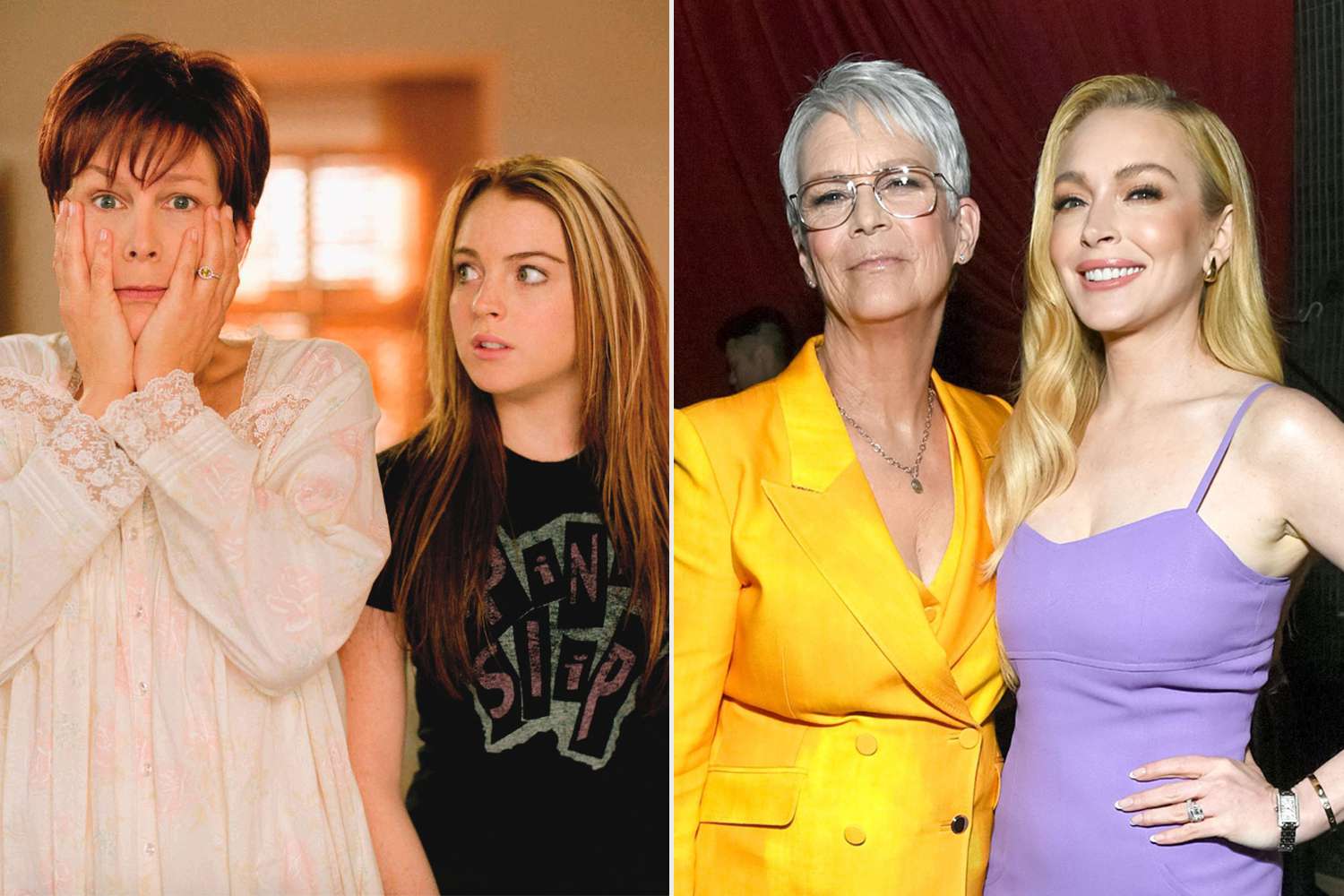

Beyond Freaky Friday Jamie Lee Curtis Shares Insights Into Her Friendship With Lindsay Lohan

May 20, 2025

Beyond Freaky Friday Jamie Lee Curtis Shares Insights Into Her Friendship With Lindsay Lohan

May 20, 2025 -

Lizzo Addresses Frequent Cancellation Her Careers Controversies Explained

May 20, 2025

Lizzo Addresses Frequent Cancellation Her Careers Controversies Explained

May 20, 2025