Sirius XM Vs. Top-Performing Stocks: A Millionaire-Maker Comparison

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Sirius XM vs. Top-Performing Stocks: A Millionaire-Maker Comparison

Is SiriusXM the next big investment, or are other stocks poised to deliver greater returns? We delve into a head-to-head comparison, examining SiriusXM's performance against top-performing stocks and exploring whether it truly holds millionaire-maker potential. Investing wisely requires careful consideration, and this analysis provides valuable insights for discerning investors.

The allure of striking it rich is powerful, and many investors dream of finding the next stock that catapults them to millionaire status. While no investment guarantees riches, understanding market trends and comparing potential investments is crucial. Today, we're pitting SiriusXM, the satellite radio giant, against some of the top-performing stocks of recent years to determine if it's truly a contender for your portfolio.

SiriusXM: A Closer Look at the Satellite Radio Giant

SiriusXM Holdings Inc. (SIRI) offers satellite radio services, providing a vast library of music, sports, news, and talk radio to subscribers across North America. Its established market position and consistent subscriber growth have attracted investors. However, the company faces challenges, including competition from streaming services and evolving listening habits.

Key Strengths:

- Established Brand Recognition: SiriusXM boasts a well-known brand and a loyal subscriber base.

- Diverse Content Offering: Its broad content library caters to a wide range of listener preferences.

- Recurring Revenue Model: The subscription-based model provides a predictable revenue stream.

Key Weaknesses:

- Competition from Streaming Services: Spotify, Apple Music, and other streaming platforms offer compelling alternatives.

- Dependence on Subscription Fees: The business model is vulnerable to subscriber churn.

- Technological Advancements: The company must adapt to evolving listening technologies and consumer preferences.

Top-Performing Stocks: A Benchmark for Comparison

Comparing SiriusXM to top-performing stocks requires identifying a suitable benchmark. Over the past decade, several sectors have significantly outperformed the market. These include:

- Technology Stocks: Companies like Apple (AAPL), Microsoft (MSFT), and Amazon (AMZN) have experienced remarkable growth.

- Growth Stocks: High-growth companies in sectors such as renewable energy and biotechnology have delivered substantial returns.

- Index Funds: Diversified index funds like the S&P 500 have provided consistent, long-term growth.

Analyzing the historical performance of these stocks against SiriusXM reveals significant differences in growth trajectories and risk profiles. While SiriusXM has shown moderate growth, the top performers have often delivered significantly higher returns. However, it's crucial to remember that past performance doesn't guarantee future results.

Millionaire-Maker Potential: A Realistic Assessment

While SiriusXM offers a relatively stable investment with a predictable revenue stream, its potential to deliver millionaire-making returns compared to top-performing stocks appears limited in the short term. The competitive landscape and evolving media consumption habits present challenges to significant growth.

Diversification is Key: Rather than focusing solely on SiriusXM, a diversified portfolio including a mix of established and high-growth stocks, along with potentially bonds and other asset classes, is a more prudent approach to wealth building.

Long-Term Perspective: Building wealth takes time and patience. While some stocks may experience rapid growth, a long-term investment strategy, focusing on consistent growth and diversification, is often more effective.

Conclusion: Informed Decisions for Informed Investors

Investing in SiriusXM can be part of a diversified portfolio, offering a stable element. However, expecting it to be a sole millionaire-maker stock is unrealistic. Thorough research and a well-defined investment strategy are crucial for achieving long-term financial success. Consult with a financial advisor to create a personalized investment plan that aligns with your risk tolerance and financial goals. Remember to always conduct your own thorough due diligence before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Sirius XM Vs. Top-Performing Stocks: A Millionaire-Maker Comparison. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Death Stranding 2 Subtletys Demise In Kojimas Latest

Jul 01, 2025

Death Stranding 2 Subtletys Demise In Kojimas Latest

Jul 01, 2025 -

Jason Day Favored 2025 John Deere Classic Betting Odds Preview

Jul 01, 2025

Jason Day Favored 2025 John Deere Classic Betting Odds Preview

Jul 01, 2025 -

American Idol Winner Faces Backlash Turns Down Key To Hometown

Jul 01, 2025

American Idol Winner Faces Backlash Turns Down Key To Hometown

Jul 01, 2025 -

Ufcs Merab Dvalishvili The Unexpectedly Low Ranking And Fan Response

Jul 01, 2025

Ufcs Merab Dvalishvili The Unexpectedly Low Ranking And Fan Response

Jul 01, 2025 -

Hideo Kojima Discusses The Technical Hurdles Of Representing Asian Features In Games

Jul 01, 2025

Hideo Kojima Discusses The Technical Hurdles Of Representing Asian Features In Games

Jul 01, 2025

Latest Posts

-

Illinois Womens Golf Celebrates Five Wgca All American Scholars

Jul 01, 2025

Illinois Womens Golf Celebrates Five Wgca All American Scholars

Jul 01, 2025 -

Topuria Vs Makhachev Cormiers Bold Prediction Shakes Up The Ufc Lightweight Division

Jul 01, 2025

Topuria Vs Makhachev Cormiers Bold Prediction Shakes Up The Ufc Lightweight Division

Jul 01, 2025 -

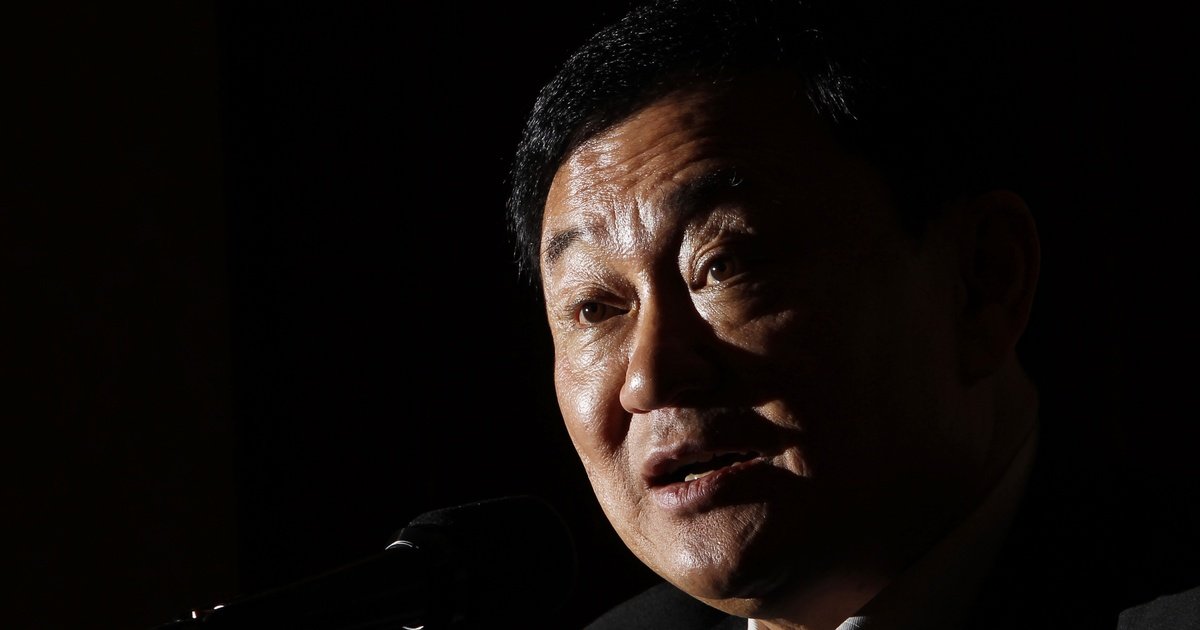

Understanding The Demise Of Thailands Powerful Shinawatra Family

Jul 01, 2025

Understanding The Demise Of Thailands Powerful Shinawatra Family

Jul 01, 2025 -

Ilia Topuria Rising Star Or Makhachevs Next Victim Cormier Offers Insight

Jul 01, 2025

Ilia Topuria Rising Star Or Makhachevs Next Victim Cormier Offers Insight

Jul 01, 2025 -

Jamal Roberts American Idol Winner Refuses Key To City Amidst Controversy

Jul 01, 2025

Jamal Roberts American Idol Winner Refuses Key To City Amidst Controversy

Jul 01, 2025